This post presents the latest update of the economic forecasts generated by the Federal Reserve Bank of New York’s (FRBNY) dynamic stochastic general equilibrium (DSGE) model. We introduced this model in a series of blog posts in September 2014 and have since published forecasts twice a year. Here we describe our current forecast and highlight how it has changed since May 2016.

As usual, we remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and the variables estimated, see our DSGE Model Q & A.

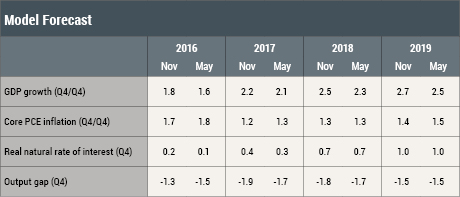

The latest model forecast is summarized in the table below and in the following figures. It uses quarterly macroeconomic data released through the third quarter of 2016 and financial data through the fourth quarter of 2016.

The chief changes from the May 2016 forecast are as follows:

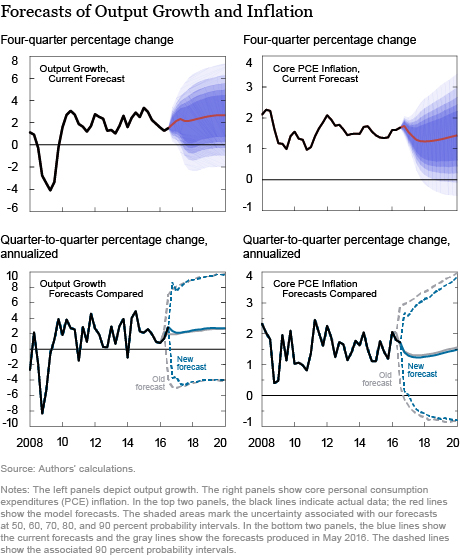

- The GDP growth forecast was revised up slightly for 2016 and through 2019. GDP is now expected to grow at 1.8 percent in 2016 and to accelerate somewhat in future years.

- Inflation, as measured by the growth rate in the personal consumption expenditure deflator excluding food and energy (core PCE), was down slightly from the May forecast. Going forward, core PCE inflation is expected to remain subdued, below the 2 percent inflation target.

We note, however, that the uncertainty around the output growth and inflation forecasts is substantial, as the next chart shows.

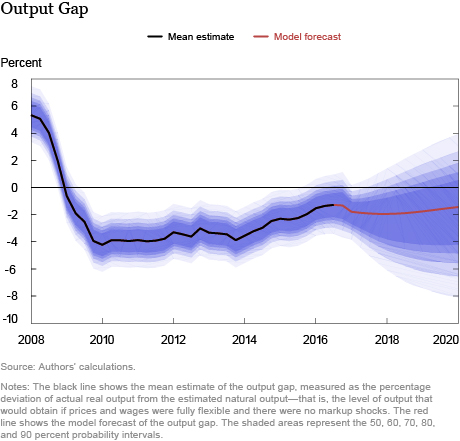

Contributing to November’s moderate inflation forecast is the fact that the level of real output is still predicted to remain below its potential over the next few years. As a result, the output gap is projected to remain negative. The uncertainty around the output gap forecasts is, however, very large (see the chart below):

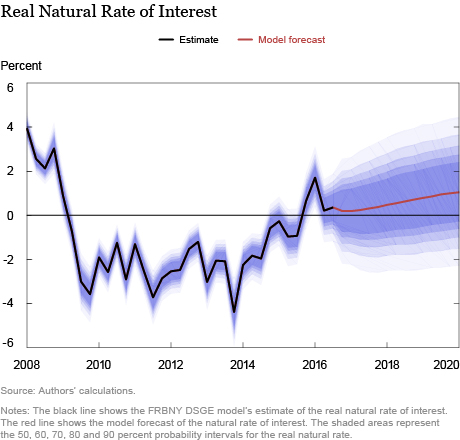

We conclude our post by showing the projections for the real natural rate of interest, that is, the real rate of interest that would prevail in the economy absent nominal rigidities and markup shocks (as described in this 2015 Liberty Street Economics blog post). This variable can be viewed as an estimate of where the real interest rate would be in the absence of monetary policy. In this sense, it summarizes the effects of factors other than monetary policy on interest rates. The estimate of the real natural rate of interest has risen significantly since 2014, with improving economic conditions. Going forward, the natural rate of interest is projected to increase very slowly:

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Marco Del Negro is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marc Giannoni is an assistant vice president in the Group.

Abhi Gupta is a research analyst in the Group.

Abhi Gupta is a research analyst in the Group.

Pearl Li is a research analyst in the Group.

Pearl Li is a research analyst in the Group.

Erica Moszkowski is a research analyst in the Group.

How to cite this blog post:

Marco del Negro, Marc Giannoni, Abhi Gupta, Pearl Li, and Erica Moszkowski, “The FRBNY DSGE Model Forecast—November 2016,” Federal Reserve Bank of New York Liberty Street Economics (blog), November 21, 2016, http://libertystreeteconomics.newyorkfed.org/2016/11/the-frbny-dsge-model-forecastnovember-2016.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Thank you for your very appropriate question! The forecasts were produced at the end of October so they do not embody any changes in fiscal policy.

Hi, I guess you made no assumptions on changes to fiscal policy, right? thanks