Since the global financial crisis and Great Recession, many critics have called for regulatory and legislative reforms to restore a system of “boring” banks constrained to traditional banking activities like deposit taking and lending. The narrative underlying this argument holds that the partial repeal of the Glass-Steagall Act in 1999 by the Gramm-Leach-Bliley Act enabled banks to expand into nontraditional activities such as securities trading and underwriting, thereby contributing to the financial crisis some ten years later. The implication is that if we could restore the Glass-Steagall Act, banks would become boring once again, and financial stability would be enhanced. The reality, however, may be more complex; an in-depth look “under the hood” of banks’ organizational structure over the past forty years shows that bank holding companies (BHCs) began expanding into those financial activities in the early 1980s and that this expansion was, in fact, nearly complete by 1999.

So how boring have banks been in the past few decades? Let’s look at some aggregate numbers based on a database I recently assembled on the organizational structure of BHCs. Between 1970, when the data begin, and 2016, more than 13,000 unique corporations have operated at some point with a BHC charter. Of those BHCs, more than a quarter expanded their business scope beyond traditional banking, collectively adding more than 60,000 subsidiaries. These units specialized in activities spanning the financial industry, such as specialty lending, loan brokerage, securities and commodities brokerage and dealing, wealth management, insurance, and much more.

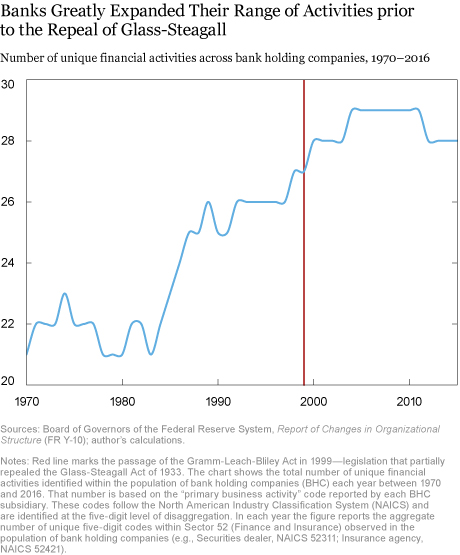

Was it the partial repeal of the Glass-Steagall Act in 1999 that spurred this expansion? The chart below shows the number of unique financial activities that BHCs collectively engaged in each year. The data indicate that the trend toward expanded activities in fact began in the early 1980s, and continued unmitigated throughout the 1990s. Judging from this evidence, the restrictions under Glass-Steagall did not prevent BHCs from expanding beyond traditional (“boring”) activities by BHCs, nor did its repeal accelerate that expansion.

Were Financial Holding Companies Expanding?

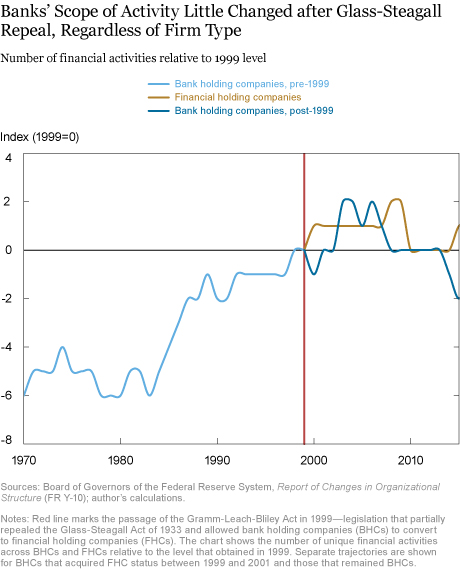

Perhaps instead of looking at BHCs as a whole, we should look specifically at BHCs that converted into financial holding companies (FHCs), the legal charter introduced by the Gramm-Leach-Bliley Act (GLBA) that allowed firms to expand more freely across a broader set of activities. FHCs may have be the ones that actually chose to expand, but their dynamics could be lost within those of the broader population. Out of 5,354 BHCs in existence at the end of 1999, 526 became FHCs between 2000 and 2001. The chart below shows how the scope of financial activities has fluctuated for those FHCs and for all other (non-converting) BHCs, relative to 1999. Somewhat contrary to expectations, it seems that FHCs and BHCs experienced virtually identical dynamics in the post-1999 years, with no upward trend detectable for either group.

New Activities or More of the Same?

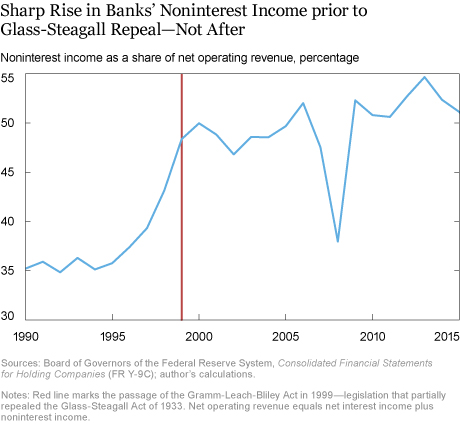

Perhaps the lack of expansion into entirely new activities since 1999 indicates that the passage of GLBA and the repeal of Glass-Steagall were more about lifting limits on activities that banks were already pursuing, since the scope of permissible activities had already been expanded for decades as interpretations of banking laws evolved (see Omarova, pages 1040–55). And so the removal of such limits may have freed banks to finally scale up those nontraditional activities significantly. If that were the case, we should see a marked change in the income-generation process of BHCs in the post-GLBA years: nontraditional activities are more typically associated with fee-based revenues for services rendered, rather than with interest from credit intermediation. Hence, an expansion in nontraditional activities should be reflected in a big increase in the noninterest component of BHCs’ total operating income after 1999. However, this is also not the case. As the chart below shows, BHCs’ noninterest income ratio steadily increased throughout the 1990s but had basically peaked by the time GLBA kicked in.

In sum, the repeal of Glass-Steagall in 1999 does not seem to have ignited a flurry of new activities. As I note in a recent New York Fed Staff Report (see page five), banking firms had already been widening their business scope for a long time, so it is not clear that that particular regulatory reform can be considered the catalyst of the Great Recession some ten years later, nor is it immediately obvious how reinstating restrictions per se would reduce the likelihood of a future crisis. But how is it that banks were already allowed to engage in less “traditional” activities, and what does that tell us about the nature of the banking business? To address those questions, we need to take a look at the history of banking regulation—something I will cover in a follow-up post.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

![]()

Nicola Cetorelli is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this blog post:

Nicola Cetorelli, “Were Banks ‘Boring’ before the Repeal of Glass-Steagall?” Federal Reserve Bank of New York Liberty Street Economics (blog), July 31, 2017, http://libertystreeteconomics.newyorkfed.org/2017/07/were-banks-boring-before-the-repeal-of-glass-steagall.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Mark: Thank you for your comment. Even though you are correct that the Krugman article does not explicitly mention Glass-Steagall, it was, as far as I am aware, the article that coined the concept of “boring banking.” In addition, to me, that article refers to Glass-Steagall implicitly when it refers to the evolution of banking following its Great Depression collapse, as in this excerpt: “… The banking industry that emerged from that collapse [The Great Depression] was tightly regulated, far less colorful than it had been before the Depression, and far less lucrative for those who ran it. Banking became boring … “ The Glass Steagall Act of 1933 was the main piece of legislation that imposed that tighter set of activity restrictions on banks. In my follow-up post, published on August 2, I actually suggest that banking really never “became boring”: tighter regulation was put in place and certain entities were restricted by it, but intermediation activities continued, undertaken by entities not subject to those restrictions. Link to follow-up post: http://libertystreeteconomics.newyorkfed.org/2017/08/were-banks-ever-boring.html

Strange choice of article to link in the first paragraph. Krugman never mentions Glass-Steagall in the linked piece, and in fact he dates the relevant period of deregulation (early 80s) to basically the same period you use to refute the “boring bank” hypothesis. There are lots of people who have repeatedly and explicitly advanced the “narrative underlying this [boring bank] argument,” but Krugman has never really been one of those. The reality of what *he* has argued has usually been more complex…(Glass-Steagall is not the only regulation that matters, and a significant portion of the risks to the modern system of banks and shadow banks would be out of scope of G-S in any case)

Nice post. Interested to read the follow-up. Calomiris and Haber also cover the history. https://www.amazon.com/Fragile-Design-Political-Princeton-Economic/dp/0691168350/ref=asap_bc?ie=UTF8