Editor’s note: A previous version of this post contained a table that incorrectly reported second off-the-run trading volumes of 0.0 for TIPS and FRNs. The table has been corrected to show that these figures are not separately calculated but are instead included in deep off-the-run volumes. (January 8, 2019, 3:00 p.m.)

Following an earlier joint FEDS Note and Liberty Street Economics blog post that examined aggregate trading volume in the Treasury cash market across venues, this post looks at volume across security type, seasoned-ness (time since issuance), and maturity. The analysis, which again relies on transactions recorded in the Financial Industry Regulatory Authority’s (FINRA) Trade Reporting and Compliance Engine (TRACE), sheds light on perceptions that some Treasury securities—in particular those that are off-the-run—may not trade very actively. We confirm that most trading volume is made up of on-the-run securities, especially in venues where the market has become more automated. However, we also find that daily average volume in off-the-run securities is still a meaningful $157 billion (27 percent of overall volume), and accounts for a large share (41 percent) of trading in the dealer-to-client venue of the market.

Trading Volume by Security Type

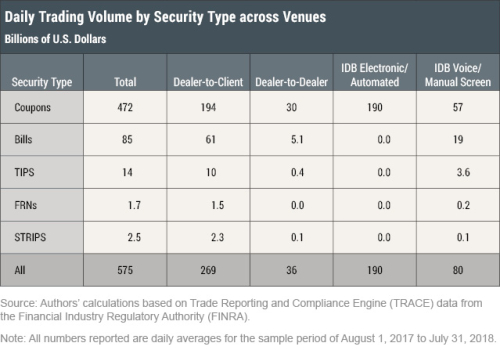

In the earlier post, we found overall daily trading volume in the Treasury cash market to average around $575 billion. In this post, we disaggregate this overall volume by type of marketable U.S. Treasury security: coupons (comprised of nominal notes and bonds), bills, Treasury Inflation-Protected Securities (TIPS), floating rate notes (FRNs), and Separate Trading of Registered Interest and Principal Securities (STRIPS). Treasury coupons account for the bulk of trading, with a daily average volume of $472 billion or 82 percent of overall volume (see the first column of the table below). Bills are a distant second with a daily average volume of $85 billion or 15 percent of total volume. Daily average volume in TIPS is around $14 billion, 2 percent of total volume, while daily average volumes in FRNs and STRIPS are $1.7 and $2.5 billion respectively, each less than 1 percent of total volume. The share of total daily volume for each security type is little changed over the time period used for this note—August 1, 2017 to July 31, 2018, the same timeframe assessed in the earlier post.

The remaining columns in the table above break down security type volumes further by venue, with the interdealer broker (IDB) venue split into electronic/automated and voice/manual screen subvenues. Overall, the concentration of trading in coupons is most pronounced in the IDB electronic/automated venue, where coupons make up 100 percent of volume. By contrast, bills make up 24 percent of volume in the IDB voice/manual venue and 23 percent of volume in the dealer-to-client (DTC) venue.

Trading Volumes for On-the-Run and Off-the-Run Securities

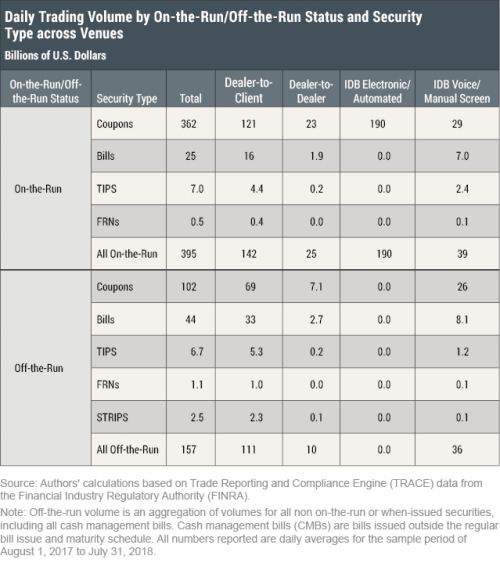

Next we report trading volumes for on-the-run and off-the-run securities. An on-the-run security is the most recently auctioned security of a given tenor, with off-the-runs being all the previously issued securities of that tenor (off-the-runs can be broken down further into first off-the-run, second off-the-run, and so forth). As shown in the first column in the table below, daily average trading volume in on-the-run securities is $395 billion, or 69 percent of the $575 billion total volume. Daily average volume for off-the-run securities is $157 billion or 27 percent of total volume.

Looking at these volumes by venue across the remaining columns, total off-the-run trading makes up a notable proportion of volume in both the DTC and IDB voice/manual screen venues, with 41 and 45 percent shares, respectively. The share of off-the-run activity is particularly large for bills in both of these venues. In the IDB electronic/automated venue, trading activity is limited not just to coupon securities, but entirely to on-the-run securities as well.

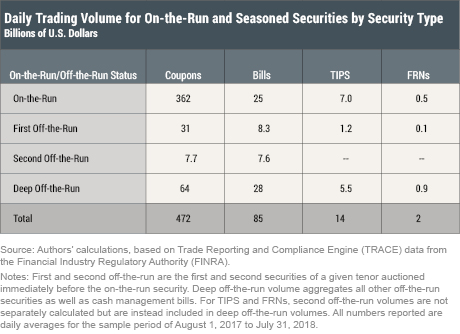

In the second, third, and fourth rows of the table below, we further divide seasoned (off-the-run) securities into first-off-the-run, second-off-the-run, and deep-off-the-run (all other off-the-runs), respectively. For coupons, average daily volume in deep-off-the runs as a group is $64 billion and 14 percent of total coupon volume, as shown in the first column. Deep off-the-run activity for coupons is most pronounced in the DTC and IDB voice/manual screen venues (not shown), accounting for 22 percent and 30 percent of all coupon volumes in those venues, respectively. Also notable is that deep off-the-run securities account for 33 percent of volume for bills and 40 percent of volume for TIPS.

Taken as a whole, these results suggest that trading volumes in off-the-run Treasury securities are economically meaningful and dispersed across a range of security types. The data also indicate that trading by primary dealers, other dealers, and buy-side participants (not shown) accounts for almost the entirety of daily activity in off-the-run securities, with essentially zero estimated off-the-run trading by principal trading firms (PTFs). This is consistent with the findings of our previous post, which showed that estimated PTF activity is dominant in the electronic/automated IDB venue—where there is no off-the-run trading—while dealers maintain a prominent role in the Treasury market overall.

Volume by Security Maturity

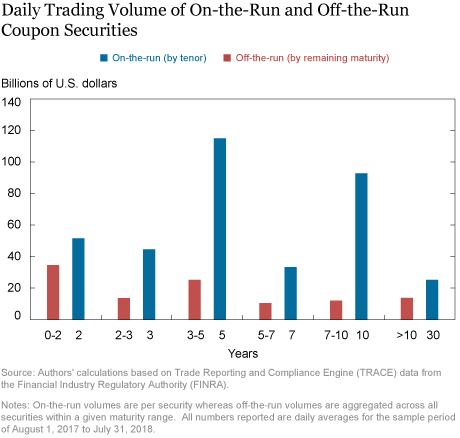

Security tenor or remaining maturity is the third and final dimension along which we break down trading volume. As shown by the blue bars in the figure below, the most traded on-the-run coupon tenor is the 5-year with an average daily volume of around $115 billion, followed by the 10-year and 2-year tenors with $93 and $52 billion in daily volume, respectively. For off-the-run coupons (the red bars), which fall into broader buckets of remaining maturity, volumes tend to be more evenly distributed across maturities.

For TIPS, on-the-run volumes are generally concentrated in the 5-year and 10-year tenors, both with an average daily volume of around $3 billion (not shown). For off-the-run TIPS, there are concentrations of volume around the 3- to 5-year and 7- to 10-year maturity buckets, with volumes of $1.1 billion and $1.6 billion respectively. There is also some concentration of volume in seasoned securities maturing within one year, with an average daily volume of around $1.5 billion. For on-the-run bills, average daily volumes for the 1-, 3- , and 6-month tenors are $9 billion, $8 billion, and $6 billion, respectively. One-year on-the-run average daily volume is somewhat lower at just $2 billion.

What More Do We Learn from the TRACE Data?

These insights from the TRACE data across security type, seasoned-ness, and maturity build on earlier findings, including Liberty Street Economics posts from 2013 and 2016 that leveraged FR 2004 data. The TRACE data allow for a more granular view of trading and in particular show that trading activity in off-the-run securities, including deep off-the-run securities, may not be as little as anecdotal commentary has sometimes suggested. This is especially true for the IDB voice/manual screen and DTC venues, into which the official sector and others had only limited visibility prior to the availability of the TRACE data. Future research will further investigate the liquidity characteristics of the various securities and venues studied here.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York, the Federal Reserve Board, or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Doug Brain is a markets analyst in the Federal Reserve Bank of New York’s Markets Group.

Doug Brain is a markets analyst in the Federal Reserve Bank of New York’s Markets Group.

Michiel De Pooter is chief of monetary and financial market analysis in the Division of Monetary Affairs at the Board of Governors of the Federal Reserve System.

Michiel De Pooter is chief of monetary and financial market analysis in the Division of Monetary Affairs at the Board of Governors of the Federal Reserve System.

Dobrislav Dobrev is a principal economist in the Division of Monetary Affairs at the Board of Governors.

Michael J. Fleming is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Michael J. Fleming is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Peter Johansson is a policy and market analysis associate in the Federal Reserve Bank of New York’s Markets Group.

Peter Johansson is a policy and market analysis associate in the Federal Reserve Bank of New York’s Markets Group.

Frank M. Keane is a senior policy advisor and a vice president in the Federal Reserve Bank of New York’s Markets Group.

Frank M. Keane is a senior policy advisor and a vice president in the Federal Reserve Bank of New York’s Markets Group.

Michael Puglia is a senior technology analyst in the Division of Monetary Affairs at the Board of Governors.

Michael Puglia is a senior technology analyst in the Division of Monetary Affairs at the Board of Governors.

Anthony P. Rodrigues is a senior associate for quantitative policy analysis in the Federal Reserve Bank of New York’s Markets Group.

Anthony P. Rodrigues is a senior associate for quantitative policy analysis in the Federal Reserve Bank of New York’s Markets Group.

Or Shachar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this blog post:

Doug Brain, Michiel De Pooter, Dobrislav Dobrev, Michael J. Fleming, Peter Johansson, Frank M. Keane, Michael Puglia, Anthony P. Rodrigues, and Or Shachar, “Breaking Down TRACE Volumes Further,” Federal Reserve Bank of New York Liberty Street Economics (blog), November 29, 2018, https://libertystreeteconomics.newyorkfed.org/2018/11/breaking-down-trace-volumes-further.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics