Household debt balances increased in the third quarter of 2018, a seventeenth consecutive increase. Total debt balances reached $13.51 trillion, a level more than 20 percent above the trough reached in 2013, according to the latest Quarterly Report on Household Debt and Credit from the New York Fed’s Center for Microeconomic Data. With today’s report we begin publishing a new set of charts that depict debt and repayment outcomes by the age of the borrower. The report and this analysis are based on the New York Fed Consumer Credit Panel (CCP), a 5 percent sample of anonymized Equifax credit reports. Here we’ll highlight three of the new charts.

Debt by Age

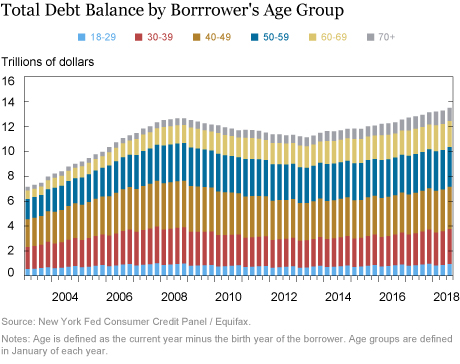

The chart below indicates that the pattern we found in our earlier Liberty Street Economics post, “The Graying of American Debt,” persists, with debt balances remaining more concentrated among older borrowers. The shift over the past decade is due to at least three major forces. First, demographics have changed with large cohorts of baby boomers entering into retirement. Second, demand for credit has shifted, along with changing preferences and borrowing needs following the Great Recession. Finally, the supply of credit has changed: mortgage lending has been tight, while auto loans and credit cards have been more widely available.

In a press briefing in April 2017 we presented evidence that these forces contributed to an overall increase in the share of debt balances held by individuals fifty years or older—by nearly 7 percentage points over the previous eight years—and that share has remained at about half of the total debt since then. In addition to an overall increase in the share of debt held by older borrowers, there has been a noticeable shift (shown in the new charts included in the Quarterly Report) in the composition of debt held by different age groups. Student and auto loan debt represent the majority of debt for borrowers under thirty, while housing-related debt makes up the vast majority of debt owned by borrowers over sixty.

Debt Performance by Age

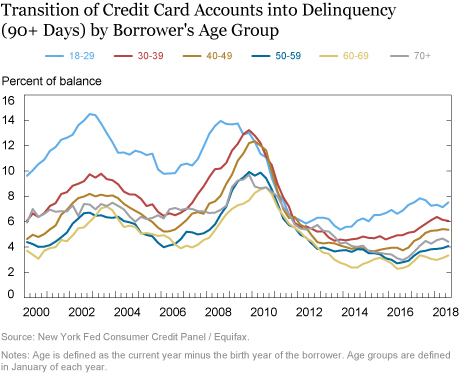

Also included in our new section is a set of charts on debt performance by product type and age. A close look at these charts reveals some interesting patterns. Below, you’ll find the transition into serious delinquency (90+ days past due) for credit card debt, by the age of the borrower. You can see first that generally, delinquency rates are highest among the youngest borrowers, and then decline for each subsequent older group. Although the gap in delinquency rates between each of the groups varies over time, it’s notable that the delinquency rate among the youngest borrowers was consistently much higher in the years before the Great Recession.

Following the Card Act of 2009, which made credit cards harder to get especially for the youngest borrowers, participation of younger borrowers in credit card markets decreased and their delinquency rate declined. In recent years, as overall credit card delinquencies have started to rise again, we see the gradual return of a divergence in delinquency rates across ages. A similar pattern exists in the analogous chart on auto loans—with an even more pronounced divergence between the delinquency rates among 18-29 year-olds and the older borrowers between 2014 and 2016.

Bankruptcy by Age

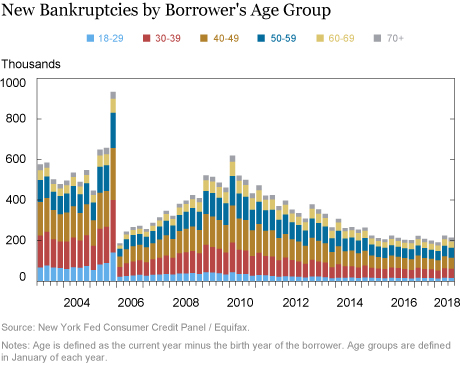

Finally, we’ll highlight another new chart in the Quarterly Report, new bankruptcy filings by age. Bankruptcy filings are reported on credit reports, where they are required to stick for seven to ten years, depending on the chapter filed. Our Quarterly Report has always included a chart of new bankruptcy filings, which follows very well the bankruptcy filing data published by the U.S. Courts (the CCP figures are comprehensive and actually a bit higher, due to multiple individuals being named on filings).

Broken out by age, bankruptcy filings echo the flow into delinquency—the oldest borrowers have historically had very low rates of bankruptcy filings. Borrowers between ages 30 and 49 make up the majority of bankruptcy filings. Also noteworthy is the sharp decline among the youngest borrowers in filing after the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The youngest borrowers saw a sharp drop-off in filings in 2005, as they may have been most likely to apply for Chapter 7, which was suddenly made more difficult. Additionally, there has been some news as of late about bankruptcy filings among Americans 65 and older being on the upswing compared to the rates in 1991. Although our data begin in 1999, we don’t see evidence of an upswing since that time. Bankruptcy filings among older Americans have always been quite low. Even after climbing during the Great Recession, filings fell again to very low levels. The share of bankruptcies filed by older Americans is larger, but this mainly reflects their increasing share of the population— bankruptcies per person have remained quite low.

Older borrowers have longer credit histories with more borrowing experience, as well as higher and typically steadier incomes; thus, they often have higher credit scores and are safer bets for lenders. Tighter mortgage underwriting during the years following the Great Recession has limited mortgage borrowing by younger and less creditworthy borrowers; meanwhile, student loan balances and participation rose dramatically and credit standards loosened for auto loans and credit cards. Consequently, there has been a relative shift toward non-housing balances among younger borrowers, while housing balances moved to the older and more creditworthy borrowers with lower delinquency rates and better performance overall. These charts and their underlying data will be updated on a quarterly basis going forward, and we will continue to monitor these changes in borrowing and repayment behavior of U.S. households.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this blog post:

Andrew F. Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Just Released: A Look at Borrowing, Repayment, and Bankruptcy Rates by Age,” Federal Reserve Bank of New York Liberty Street Economics (blog), November 16, 2018, https://libertystreeteconomics.newyorkfed.org/2018/11/just-released-a-look-at-borrowing-repayment-and-bankruptcy-rates-by-age.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics