Inventory investment plays a central role in business cycle fluctuations. This post examines whether inventory investment amplifies or dampens economic fluctuations following a tightening in financial conditions. We find evidence supporting an amplification mechanism. This analysis suggests that inventory accumulation will be a drag on economic activity this year but provide a boost in 2020.

As detailed in the NIPA Handbook, inventory investment is the change in the stock of inventories held by private businesses. It includes goods ready for sale, those currently in production, as well as materials and supplies. With the exception of inventory investment, all product-side components of GDP, such as personal consumption expenditures, record final sales that occur in a given period irrespective of whether the goods were produced in earlier periods. Movements of goods to and from the inventory stock ensure that production is allocated to when it actually occurred, which is a key guiding principle used by the Bureau of Economic Analysis when constructing the national accounts.

A leading theory of inventory investment is the so-called buffer stock, according to which firms maintain inventories to insulate production from sharp movements in sales. This theory implies that the stock of inventories would increase in response to an unexpected decline in sales so as to leave production largely unaffected (for shocks of limited size).

An alternative theory, known as the “constant inventory-sales ratio” hypothesis, suggests firms attempt to maintain inventories at a specified level relative to sales. As a result, when sales decline, inventories are adjusted downward to maintain a constant ratio to sales. As a result, inventories amplify rather than dampen economic fluctuations, because production declines not only in response to lower sales but inventory destocking as well. As a preview to the regression analysis, we find that final sales and inventory investment show a slight negative correlation in the post-World War II sample, which becomes stronger during the Great Moderation. This evidence would be consistent with the buffer stock hypothesis.

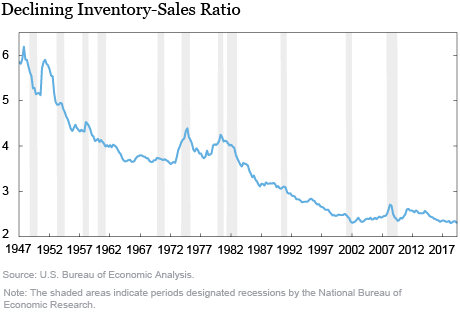

As shown in the chart below, the inventory-to-sales ratio has declined significantly since the 1950s, a pattern that is commonly ascribed to improvements in inventory management technology—such as just-in-time systems, which allow firms to maintain performance with a smaller stock of inventories. Prior to the mid-1980s, the inventory-to-sales ratio rose sharply during recessions; moreover, recessions were often associated with large inventory adjustments (so-called “liquidationist recessions”). During the Great Moderation this behavior appeared to be less evident, with the important exception of the Great Recession.

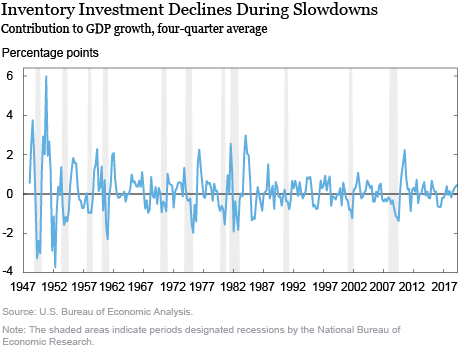

The chart below illustrates the cyclical behavior of inventories in more detail by showing the

rolling four-quarter average contribution of inventory investment to real GDP growth. NBER recessions (shaded areas) are periods of inventory decumulation, but inventory investment jumps back and is consistently positive following a recession. It is also interesting to note that periods of inventory decumulation can also occur outside of recessions, for example, during the economic slowdown of 2015.

To study whether private inventories act as amplifiers or buffers to shocks, we focus on how they respond to a tightening in financial conditions, specifically the response of inventory investment to shocks to the spread between Moody’s Baa corporate bond yield to 10-Year Treasuries (or BAA spread). Academic research has shown that financial shocks are an important driver of the business cycle, and changes in the BAA spread are a good proxy for these shocks. This may be because investors correctly predict a slowdown in economic activity and consequently require compensation for holding riskier securities and credit spreads widen. Alternatively, financial market shocks boost spreads, which lower economic activity by increasing firms’ cost of funds. Either way, we estimate a simple model for the evolution of (quarterly) real GDP, the growth contribution from inventory investment and final sales. As regressors we include the lag of the two contributions in addition to the change in the BAA spread during the previous year and the year prior to that. The corresponding parameter estimates are shown in the table below.

Before discussing parameter estimates for past changes in BAA spreads, note that while higher past final sales boost current sales, GDP, and inventory accumulation (second row, across columns), higher past inventory investment is associated with a decline in current inventory investment (column 2, row 1). This suggests that firms de-stock inventories after an increase in inventory investment, in line with the notion that inventories act as amplifiers of the business cycle.

Turning to the relationship to credit conditions, a 100 basis point widening in the BAA spread is associated with a decline in the inventory contribution to GDP growth of about 65 basis points. This is a very large effect and almost twice as large as the decline in final sales. In fact, these results suggest that much of the predictability of BAA spreads for future economic activity results from inventory adjustments. As noted earlier, according to the buffer theory, a shock about future economic activity should be buffeted in part through inventories. However, the sign on inventory investment is negative instead of positive, contrary to the buffer theory.

Interestingly, the coefficient on the change in the BAA spread in the year before the prior year (column 2, row 4) is in fact positive and almost of the same magnitude as the coefficient on the lagged change in the BAA spread (column 2, row 3). This means that although inventory accumulation drops sharply when financial conditions tighten the year prior, it tends to bounce back the year after. Under the buffer theory one should expect inventories to rise first and decline afterward. Thus the results suggest that inventory investment amplifies financial shocks.

Taking these results to the recent data, credit spreads widened about 45 basis points in 2018. Our simple regression model implies that this will dampen the contribution of inventories to GDP growth (Q4/Q4) by about 20 basis points in 2019 and to support growth by about the same magnitude in 2020.

Richard K. Crump is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Richard K. Crump is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

David O. Lucca is an assistant vice president in the Bank’s Research and Statistics Group.

David O. Lucca is an assistant vice president in the Bank’s Research and Statistics Group.

Casey McQuillan is a senior research analyst in the Bank’s Research and Statistics Group.

Casey McQuillan is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this post:

Richard K. Crump, David O. Lucca, and Casey McQuillan, “Real Inventory Slowdowns,” Federal Reserve Bank of New York Liberty Street Economics, November 18, 2019, https://libertystreeteconomics.newyorkfed.org/2019/11/real-inventory-slowdowns.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics