In a recent blog post, we showed that consumer expectations worsened sharply through March, as the COVID-19 epidemic spread and affected a growing part of the U.S. population. In this post, we document how much of this deterioration can be directly attributed to the coronavirus outbreak. We then explore how the effect of the outbreak has varied over time and across demographic groups.

To address these issues, we use data that extend to April 12 and look at new questions included in the Survey of Consumer Expectations (SCE) since the beginning of March: in addition to the typical monthly questions about their actual expectations, respondents are asked about their counterfactual expectations—that is, what their expectations would have been if the COVID-19 outbreak had not occurred. By taking the difference between the actualand counterfactual expectations, we can directly evaluate the effect that the coronavirus outbreak had on expectations for each respondent. The conclusion is clear: consumers attribute all of the recent deterioration in their spending, income, and job-security expectations to the outbreak. Since the stimulus bill was signed, however, the effects of the coronavirus on the perceived risk of job loss and expectations for spending growth have slightly decreased. The effect on income growth expectations has continued to increase, but at a slower pace. Finally, we find that the impact of the outbreak on expectations is widespread across all demographic groups.

Coronavirus Outbreak Hits Consumer Expectations in March

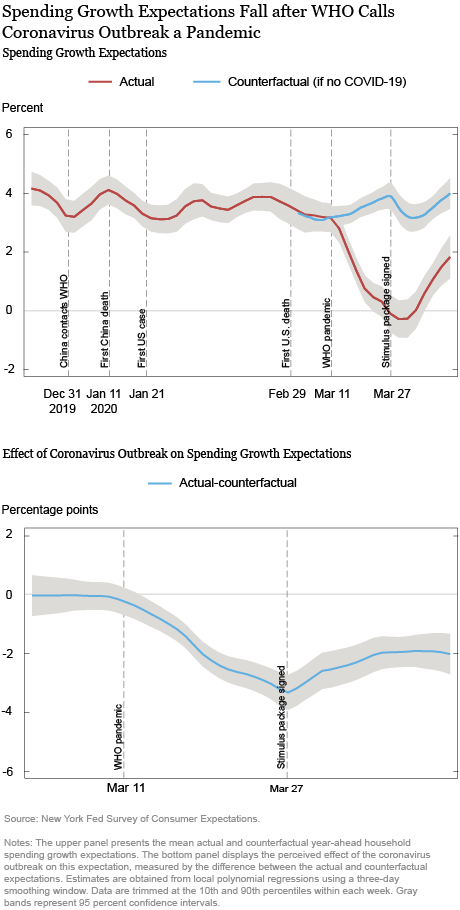

As we documented in our last blog post, expected spending growth sharply deteriorated over the course of March: it reached -0.1 percent at the start of April, down from around 3.8 percent at the end of February. In the chart below, we clearly see that spending expectations (in red, upper panel) started to diverge from the counterfactual expectations (in blue, upper panel) after March 11, when the World Health Organization (WHO) declared the COVID-19 outbreak a pandemic. The pattern of counterfactual expectations indicates that spending expectations would have remained around their average in February in the absence of the outbreak. It shows that consumers entirely attribute the deterioration in their spending expectations since the end of February to the coronavirus outbreak. The bottom panel in the chart below displays the difference between the actual and counterfactual expectations, which directly measures the effect of the coronavirus outbreak. The effect gradually increased after March 11 and has slightly decreased since the CARES Act was signed on March 27, suggesting that households are expecting some relief from the stimulus package.

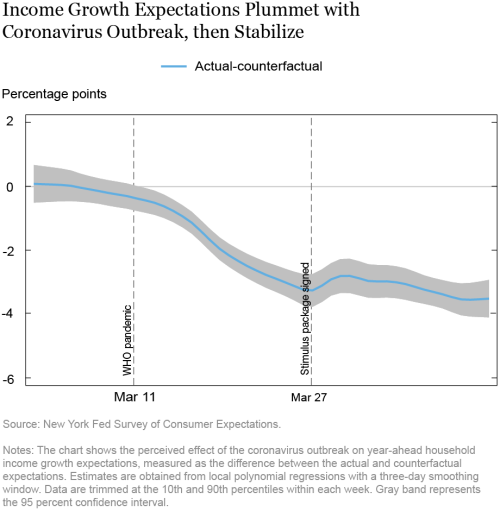

Similarly, we present the perceived effect of the coronavirus outbreak on income growth expectations in the chart below. The negative effect of COVID-19 on income expectations became statistically significant after March 11 and increased through the course of the month. Following the signing of the CARES Act on March 27, the negative effect of the COVID-19 outbreak appears to have stabilized, resulting in a 3.2 percentage point drop in income growth expectations. This corresponds exactly to the magnitude of the drop in actual income growth expectations reported in the SCE between the end of February (3.9 percent) and early April (0.7 percent): this shows that all of the deterioration in income growth expectations in that period can be attributed to the coronavirus outbreak.

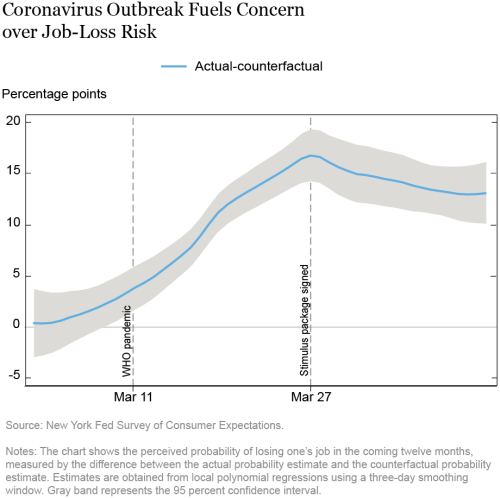

Labor market expectations have also been greatly affected by the outbreak. The chart below shows that the effect of the outbreak on the perceived probability of losing one’s job in the coming twelve months became significant just before the WHO declared the outbreak a pandemic. Job-loss concerns gradually increased through March, peaking on March 27 before decreasing slightly. The magnitude of the effect is striking: consumers who took the survey since the end of March perceive that the coronavirus outbreak increased their risk of job loss by 13.6 percentage points. The jump in the mean perceived risk of job loss reported in the SCE was of the same order of magnitude over the same period, around 11.8 percentage points. Again, this shows that consumers attribute all of the deterioration in their labor market situation to the coronavirus outbreak.

Has the Effect of the Coronavirus Outbreak Been Perceived Similarly by Different Demographic Groups?

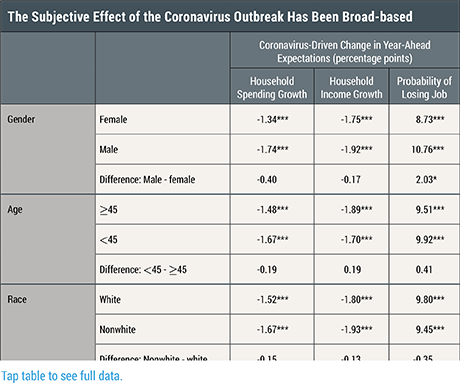

The table below shows the effect of COVID-19 on expectations for various demographic groups, based on survey data from March 1 to April 12. All groups expect the coronavirus to have a sizeable and statistically significant negative effect on their spending growth, corresponding to a 1.6 percentage point drop. This effect is significantly smaller for respondents without a college degree and for those with household incomes of less than $60,000. The coronavirus outbreak has also led to substantial and statistically significant declines in income growth expectations for all demographic groups, amounting to a 1.8 percentage point decrease, on average. The decline is significantly larger among respondents with lower levels of financial literacy.

Across all groups, the outbreak has also led to a large and statistically significant increase in the perceived probability of losing a job over the next twelve months. The coronavirus-related increase in job-loss probability is slightly (but significantly) larger for men (10.8 percentage points) than women (8.7 percentage points). As part of the new set of questions introduced in the March Survey of Consumer Expectations (SCE), respondents are also asked to gauge the risk of someone in their household becoming infected with the coronavirus. We note that the COVID-19 effect on the probability of job loss is substantially larger for respondents who perceive a high risk that someone in their household may get infected with the coronavirus.

Conclusion

To sum up, we show that the coronavirus outbreak is directly responsible for the sharp deterioration in expectations since March. The CARES Act stimulus plan seems to have attenuated the COVID-19 effect on some of the expectations, but the effect remains large and has been widespread across all demographic groups (based on gender, age, income, race, and education level).

Olivier Armantier is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gizem Koşar is an economist in the Bank’s Research and Statistics Group.

Rachel Pomerantz is a senior research analyst in the Bank’s Research and Statistics Group.

Daphne Skandalis is an economist in the Bank’s Research and Statistics Group.

Kyle Smith is a senior research analyst in the Bank’s Research and Statistics Group.

Giorgio Topa is a vice president in the Bank’s Research and Statistics Group.

Giorgio Topa is a vice president in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Olivier Armantier, Gizem Koşar, Rachel Pomerantz, Daphne Skandalis, Kyle Smith, Giorgio Topa, and Wilbert van der Klaauw. “How Widespread Is the Impact of the COVID-19 Outbreak on Consumer Expectations?,” Federal Reserve Bank of New York Liberty Street Economics, April 16, 2020, https://libertystreeteconomics.newyorkfed.org/2020/04/how-widespread-is-the-impact-of-the-covid-19-outbreak-on-consumer-expectations.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics