Credit enables firms to weather temporary disruptions in their business that may impair their cash flow and limit their ability to meet commitments to suppliers and employees. The onset of the COVID recession sparked a massive increase in bank credit, largely driven by firms drawing on pre-committed credit lines. In this post, which is based on a recent Staff Report, we investigate which firms were able to tap into bank credit to help sustain their business over the ensuing downturn.

Bank Credit during the Pandemic

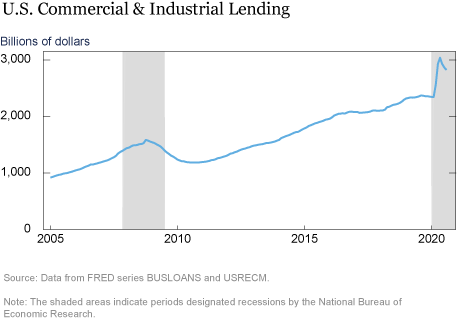

Between February 2020 and June 2020, bank credit increased by a total of $555 billion, an increase of 23.5 percent, as seen in the chart below. In contrast, at the height of the financial crisis, between August 2008 and October 2008, credit increased by $73 billion, an increase of 4.8 percent. Using data from the FR Y-14Q Schedule H1B, a loan-level regulatory report filed quarterly by banks with greater than $100 billion in assets, we examine how the access to credit during the COVID recession was distributed across firms.

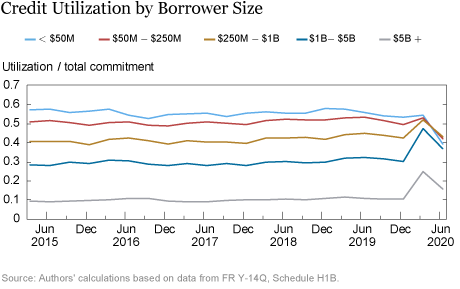

Although total outstanding C&I loans increased sharply in the first quarter of 2020, our work shows that this overall increase is almost entirely comprised of drawdowns by large firms with pre-existing credit lines. In particular, the chart below illustrates that large firms have relatively more dry powder to begin with, as they do not utilize their credit lines as much prior to the crisis. In the first quarter of 2020, aggregate drawdowns on credit lines (measured as a share of total commitments) increased across larger firms, those with $250 million or more in assets. In contrast, aggregate drawdowns were unchanged for small and medium-sized enterprises, those with less than $250 million in assets. The relative increase in drawdown rates is particularly pronounced for the largest firms, those with more than $1 billion in assets (see also Li, Strahan, and Zhang (2020) and Greenwald, Krainer, and Paul (2020)). Smaller and medium sized businesses decreased their utilized credit in the second quarter. In our Staff Report, we relate these drawdowns to the availability of Paycheck Protection Program loans.

Credit Demand versus Credit Supply

Is the use of credit lines by large firms bank-driven or demand driven? Large firms may have experienced more severe liquidity shocks in the COVID recession and thus may have demanded more credit. In our Staff Report, we show that the size gradient in drawdown rates survives controls for industry, state, and bond market access, removing the possibility of large firms operating in more severely impacted industries or states or having used their credit lines solely because of the bond market turmoil in March 2020.

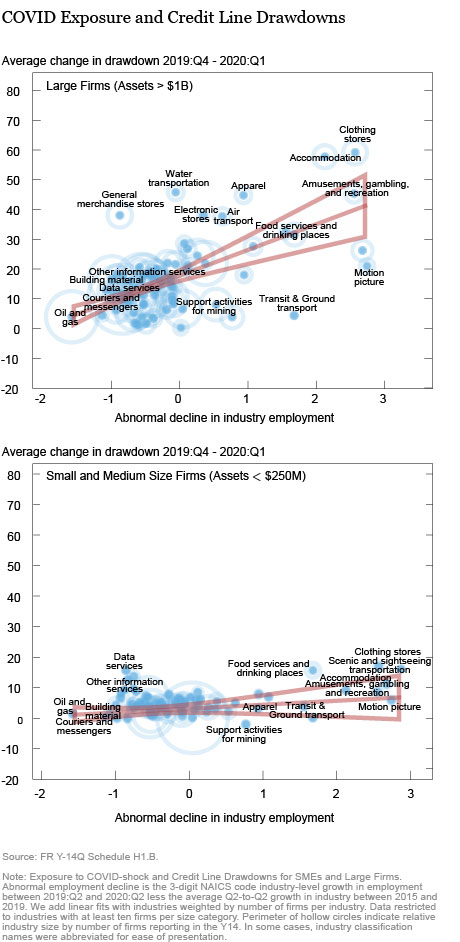

To further isolate the role of credit constraints from demand, we construct a measure of the exposure of firms to the COVID recession based on their industry. In particular, we measure the percent change in national employment in the firm’s industry between the second quarter of 2019 and the second quarter of 2020 less the trailing five year change. The “abnormal” change in employment measures the shock to a firm’s line of business, which we interpret as a proxy for the demand for credit. The measure lines up with the actual exposure of the business to COVID‑related disruptions. For example, the six industries with the largest “abnormal” declines in employment are (1) scenic and sightseeing, (2) transportation, (3) motion picture and sound recording studios, (4) performing arts and spectator sports, (5) clothing stores, and (6) gambling.

Within firms with more than $1 billion in assets, higher industry exposure is strongly associated with higher drawdown rates (see top panel of the above chart). In contrast, for firms with less than $250 million in assets, the drawdown rate is largely insensitive to the industry exposure (see bottom panel of the above chart).

To further rule out confounding shocks that operate within industries, we also apply an instrumental variable approach. We take the physical proximity requirements in each industry as an instrument for the “abnormal” change in employment that industry experienced between the second quarter of 2019 and the second quarter of 2020. Physical proximity requirements are measured via the ONET survey question “How physically close to other people are you when you perform your current job?” Using the responses, we restrict the variation in industry exposure to the part coming from physical proximity requirements in each industry. Through this method, we confirm the pattern of large affected firms drawing their credit lines, while small firms do not.

Altogether our evidence suggests that the ability of small firms to draw their credit lines was limited during the COVID shock. In our paper, we provide more perspective and show that smaller firms also seem to be more constrained outside of the COVID recession. For instance, we find that small firms have typically much tighter loan terms: Their credit lines often typically have short maturity, require collateral, and interests are nonetheless higher. And these loan terms mattered during the COVID shock. Controlling for loan terms reduces the difference in drawdown sensitivity between small and large firms; this suggests that the pre-COVID loan terms granting lenders ex post discretion to extend credit (for example, through shorter maturities or collateral requirements) can partially explain the inability of small firms to access credit.

Summing Up

Our work shows that bank liquidity in bad times such as the COVID shock mostly flows toward larger rather than smaller borrowers. This is consistent with lenders placing stricter loan terms on small borrowers, which give lenders greater discretion in providing funds. This fact, in turn, places greater constraints on smaller companies from drawing on their credit lines to weather a downturn, which can have wider detrimental economic effects.

Gabriel Chodorow-Reich is an associate professor of economics at Harvard University.

Harry Cooperman is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Olivier Darmouni is an associate professor of business at Columbia University.

Stephan Luck is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Matthew Plosser is an officer in the Bank’s Research and Statistics Group.

How to cite this post:

Gabriel Chodorow-Reich, Harry Cooperman, Olivier Darmouni, Stephan Luck, and Matthew Plosser, Weathering the Storm: Who Can Access Credit in a Pandemic?,” Federal Reserve Bank of New York Liberty Street Economics, October 13, 2020, https://libertystreeteconomics.newyorkfed.org/2020/10/weathering-the-storm-who-can-access-credit-in-a-pandemic.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics