The recent era of globalization has witnessed growing cross-country trade integration as firms’ production chains have spread across the world, and with stock market returns becoming more correlated across countries. While research has predominantly focused on how financial integration impacts the propagation of shocks across international financial markets, trade also influences these cross-border spillovers. In particular, one important aspect, highlighted by the recent work of di Giovanni and Hale (2020), is how the global production network influences the transmission of U.S. monetary policy to world stock markets.

World Production Linkages and Stock Market Correlations

The production process of a good or a service may spread across several borders before creating a final good. This global production process (often referred to as the “global value chain”) can be measured by the strength of connections between industry sectors across countries. This is a key first step to analyze international spillovers, since customer-supplier linkages are not equal in size. For example, there might be one key producer of an electronic component that is sourced by many customer firms, which use the component to produce their own goods. Such an asymmetry in the network then implies that shocks to a given firm, sector, or country will have different consequences across economies (Acemoglu et al. [2012]).

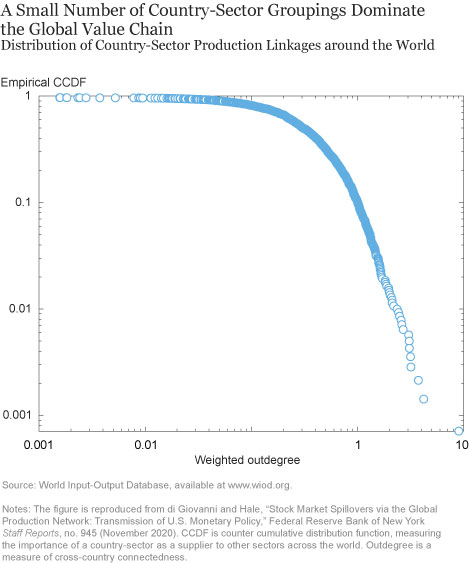

The figure below shows that the distribution of production linkages across and within countries, where the unit of observation is the country-sector level (for example, the Chinese textiles sector). The figure uses data from the World Input-Output Database (WIOD) to plot the counter cumulative distribution function (the CCDF) of the weighted cross-country connections (outdegree) of a given country-sector. (Technically, the CCDF captures the probability of observing a given value of a variable within a data set. That is, if all observations in a data set are either equal to or between zero and one, the CCDF for the value zero would equal one, while the CCDF of observing a value of two would be zero.) This measure quantifies the importance of a country-sector as a supplier to other sectors across the world. Crucially, this measure not only captures direct linkages, such as the degree to which Chinese textiles are used in production by Vietnam’s clothing sector, but indirect linkages such as the subsequent use of Vietnam’s clothing by the Spanish fashion sector in its production of a final garment.

The figure’s construction is designed to line up the dots of country‑sector groups according to how important their connections are to the rest of the world. Moving to the right, it is clear that only a small fraction of the country-sector observations has strong global production linkages (outdegree greater than 1), while the vast majority of country-sector dots have small production linkages (outdegree of 0.01 or below). For example, the largest outdegree value belongs to manufacturing of food products, beverages, and tobacco products in the United States, while at the other extreme, sectors such as Australia’s repair and installation of machinery and equipment have zero cross-sector input-output linkages.

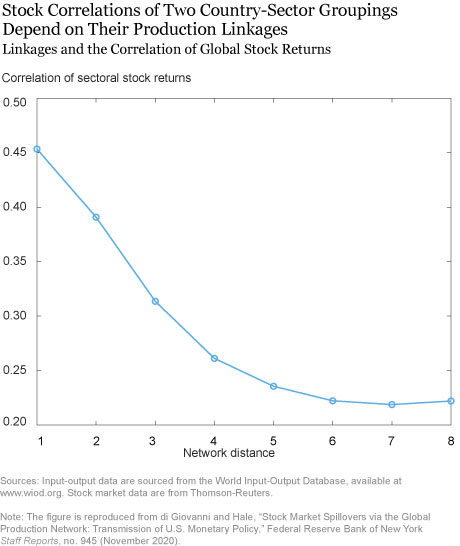

The next figure shows that country-sector pairs that have the strongest production linkages also have more correlated stock market returns. The x-axis plots a measure of how close two country-sector pairs are along the global production network, where the larger the number, the weaker the linkages. The y-axis plots the correlation of sector-specific stock market returns of the corresponding country-sector pairs. As can be seen, the larger the trade (production) connection, the greater the pairs’ stock returns correlation.

How Monetary Policy Shocks Are Transmitted across Countries via Production Linkages

The evidence presented in the figures above suggests that economic or financial developments may propagate along world production linkages and impact global stock market returns. However, several unanswered questions remain, such as how do shocks propagate along the global production network, and how important is the network’s contribution to the overall impact of the shock on stock market returns?

The recent paper by di Giovanni and Hale (2020) begins to answer such questions by focusing on the transmission of one important shock: unexpected changes in U.S. monetary policy. The authors present a conceptual framework that lays out necessary conditions for monetary policy to be transmitted across countries via the global production network. In their setting, changes in demand induced by changes in monetary policy propagate upstream from customers to suppliers. Using a newly constructed data set, the authors use their empirical framework to quantify the role of the global production network in transmitting U.S. monetary policy across international stock markets. Crucially, the empirical estimation also controls for financial variables that have been shown to explain cross-country asset returns (Miranda-Agrippino and Rey [2020]). Further, the framework allows for the decomposition of the estimated impact of a monetary policy shock on stock market returns into contributions from a “direct effect” and a “network effect,” with the latter effect capturing the importance of global production linkages in shock transmission.

Using monthly stock return data at the country-sector level, the estimation finds that the propagation of a U.S. monetary policy shock through the global production network is statistically significant and accounts for most of the total impact. Specifically, average monthly stock returns increase by 0.12 percentage point in response to a one percentage point expansionary surprise in the U.S. monetary policy rate, with nearly 80 percent of this stock return increase due to the spillovers via global production linkages. U.S. monetary policy’s directly impacts the domestic sectors and then spills over from the United States to foreign markets most prominently as the impact on U.S. sectors’ demand propagates upstream to those sectors’ foreign suppliers. This finding is robust to controlling for other variables that may drive a common financial cycle across markets, such as the VIX, the 2-year Treasury rate, and the broad U.S. dollar index. It is also robust to different time periods, different definitions of stock returns and monetary policy shocks, and to controlling for monetary policy shocks in the United Kingdom and the euro area.

Implications

The sizeable role of production linkages in transmission of U.S. monetary policy has a number of important implications. First, if international trade in intermediate goods continues to grow and global supply chains become longer and more complex, the impact of U.S. monetary policy on other countries is likely to increase as well. To the extent that this transmission channel is independent of capital flows and related policies, the results present one of the mechanisms by which capital controls may not be effective in insulating economies from foreign monetary policy actions.

Julian di Giovanni is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Julian di Giovanni, “The International Spillover of U.S. Monetary Policy via Global Production Linkages,” Federal Reserve Bank of New York Liberty Street Economics, January 6, 2021, https://libertystreeteconomics.newyorkfed.org/2021/01/the-international-spillover-of-us-monetary-policy-via-global-production-linkages.html.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics