About one in twenty American households are unbanked (meaning they do not have a demand deposit or checking account) and many more are underbanked (meaning they do not have the range of bank-provided financial services they need). Unbanked and underbanked households are more likely to be lower-income households and households of color. Inadequate access to financial services pushes the unbanked to use high-cost alternatives for their transactional needs and can also hinder access to credit when households need it. That, in turn, can have adverse effects on the financial health, educational opportunities, and welfare of unbanked households, thereby aggravating economic inequality. Why is access to financial services so uneven? The roots to part of this problem are historical, and in this post we will look back four decades to changes in regulation, shifts in the ownership structure of retail financial services, and the decline of free/low-cost checking accounts in the United States to search out a few of the contributory factors.

The Unbanked

The economics of banking do not incentivize the delivery of financial services to those who may need them most. Since profits at retail banks are driven heavily by the size of the balances their customers deposit or borrow, product offerings and marketing efforts are disproportionately focused on clients with higher levels of income and wealth. Checking accounts display the characteristics of a good that has a high degree of income elasticity for lower-income households. In other words, a checking account is a good that lower-income households may choose to forego if household budgets are tight (as during a spell of unemployment); meanwhile, checking accounts have near-universal penetration among wealthier households. For a subset of consumers, estimated by the FDIC in 2019 to be just over 5 percent of the population, basic account access remains lacking, particularly among those with irregular incomes, less documentation, and a lack of credit history.

Significantly, almost half of this unbanked group previously had bank accounts and now choose not to have one. Reported factors in this decision include distrust of banks, high fees, or large minimum balances. Although the size of the unbanked population has been falling over time, it tends to go up and down with the state of the economy and level of employment, having recently peaked at 8.2 percent of U.S. households in 2011 and risen again as the result of the pandemic, underscoring that for poorer households, checking accounts are often a good they choose to forego when income falls.

Those without bank accounts still need financial services, including money transfer and credit. According to research by Mehrsa Baradaran on low-earners in How the Other Half Banks, expenditure on financial services by unbanked households could amount to as much as 10 percent of their income. Often, this spending is due to high interest rates (on such services as payday loans), wire fees (especially for those providing or receiving remittances), or overdraft/transaction fees on transaction accounts.

Low-cost, low-minimum bank accounts were once widely available in the United States. In the 1960s and 1970s, an era of regulated deposit pricing, banks competed for new depositors through aggressive advertising and incentives (the proverbial toaster) and offered low-fee checking accounts with low or no minimum balance requirements. Customers with larger balances cross-subsidized those with smaller balances, since the cost of servicing smaller accounts was often greater than the revenues they generated. The repricing of this era was concurrent with the Savings and Loan Crisis and the associated declines in financial inclusion and access to low-cost financial services products have continued to this day.

This post looks at some historical factors that accompanied changes in the supply of checking accounts to low- and moderate-income households in the United States. Part of this change in supply was structural, as institutions that had been founded to serve low- and middle-income communities either changed strategy or were acquired. Other changes happened at a product and customer level as banks reduced the cross-subsidies from higher-balance customers to lower-balance ones through minimum balance requirements, increased account fees, and overdraft charges.

Comparative Market Structure

All countries face challenges in achieving full financial inclusion, but the United States is relatively unusual among richer countries in the size of its unbanked and underbanked population. In neighboring Canada, for example, more than 99 percent of the population has access to a basic transaction account, including 98 percent of the poorest 40 percent of the population. Japan, Germany, Singapore, and the countries of Scandinavia show similar levels of access. The FDIC’s 2019 Survey of Household Use of Banking and Financial Services, in contrast, showed that about a quarter (23.3 percent) of U.S. households with annual incomes of less than $15,000 were unbanked, as were 10.4 percent of households earning between $15,000 and $30,000.

The United States is also somewhat unusual among wealthier countries in the scale of its not-for-profit banking sector. The United States does not have a universal Giro- or Postbank, as in much of Europe or Japan, and although it does have a vibrant credit union sector (accounting for about 8 percent of all banking assets), the mutual banking sector is smaller than in many other OECD nations.

This was not always the case. As recently as the 1970s, mutuals (thrifts, mutual savings and loans [S&Ls], and affinity-based mutuals) accounted for half of the residential lending market and commanded a significant share of the deposit market. A large number of these mutual banks were founded in the late 19th and early 20th centuries with the goal of ensuring financial inclusion for the working poor, at a time in which banking services were provided primarily to the well-to-do. Their missions were sometimes rooted in communitarian self-help and sometimes in paternalist philanthropy. Mutual savings and loans were present in most parts of the country and savings banks were once particularly prevalent in the cities and towns of the northeastern United States. Fraternal and friendly societies, including provident societies, also provided financial services as part of lodge, club, or church membership.

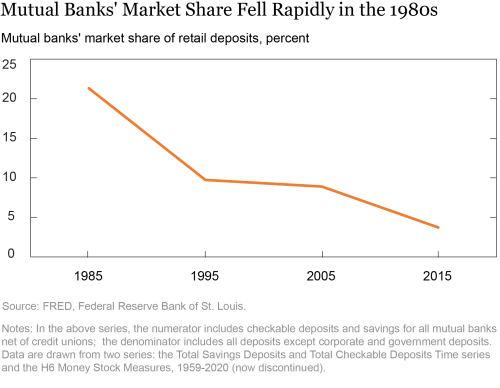

FRED data show the rapid decline of mutual banks in the U.S. banking market, both in terms of their number and their assets. In the chart below, the rapid fall in the deposit share of mutuals between 1985 and 1995 is particularly apparent. Many of these organizations still exist, but are no longer mutual-based, having demutualized or been acquired by for-profit commercial firms and migrated upmarket along with their customer base.

While traditional mutuals have declined, there has been a revival since the 1980s in credit unions. Like the mutual savings banks and savings and loans, credit unions have a mutual structure, more akin to a not-for-profit, usually linked to some form of employer, professional affiliation, or local geography. While credit unions have grown their deposit

base at nearly 7 percent per annum on average since the 1980s, nominal growth of other mutuals (savings banks, S&Ls) has been negligible.

Over this same period (since 1989), commercial banks have grown in scale and scope, with total deposits growing from $2 trillion to over $17 trillion today. The acquisition wave that began in the 1980s has been associated with a commercial banking sector that is dominated by regional and national banking networks, which market themselves based on brand and convenience and do not generally compete on price in the market for retail deposits. The top four banking groups now account for more than 35 percent of U.S. commercial bank deposits.

The Great Repricing

Many factors came together in the 1970s and 1980s as banks began differentiating between higher- and lower-balance customers. Because deposit markets in this era were still very local and data on retail deposit pricing was just beginning to be widely available, we rely here on press and other primary sources’ descriptions from that era. In exploring why price differentiation grew in the 1980s and 1990s, we describe some of those factors, but we think of these as correlates, not proof of causality.

Through their exposure to short-term interest rates, money market mutual funds offered savers higher rates and greater protection against inflation than demand deposit accounts could offer, as they were subject to Regulation Q restrictions on the payment of interest. To compete, banks launched a high-interest account with limited transactions allowed per month, the NOW Account (Negotiated Order of Withdrawal). These products were approved for rollout nationwide in 1980 by an act of Congress and a 5 percent interest rate cap was lifted in 1986.

These products were widely popular with customers, but much less profitable on average than checking accounts had previously been. In the years following the introduction of the NOW account, banks searched for ways by which they could still offer interest on checking accounts without losing revenue. Banks instituted higher fees on lower balance customers and relatively high account minimums to ensure break-even for this new product. These balances (typically ranging on the order of $1,000 minimum balance at commercial banks, and around $300 at thrifts, such as savings banks and S&Ls) were publicly justified by bankers arguing that higher minimum balances reflected the increased break-even point on interest-paying deposits.

There was extensive writing about these new accounts both within the press and in the burgeoning industry of saver-oriented consumer reporting. In 1983, the New York Times reported that account fees had more than doubled since the start of the decade and minimum balances for fee waivers, as high as $2,500 in some local markets, had been introduced. A few years later, Sheshunoff, a leading publisher of deposit product comparisons, reported that transaction fees on checking accounts nearly doubled yet again in many of the markets it covered between 1985 and 1988.

In parallel, as changes in the deposit market intensified, mutual banks came under a long and painful period of financial stress on their lending portfolios. The causes and impacts of the waves of bank failures triggered by the Savings and Loan Crisis are covered in an extensive literature of their own. Many mutuals failed, converted, or were acquired in this period, but their deposits and branch infrastructure still made them attractive acquisition targets.

Throughout the 1980s and early 1990s, through both voluntary and arranged mergers, struggling mutuals were among the first retail players to be consolidated in the two and a half decades of retail banking consolidation that followed. The loss of the mutuals reduced the options available to low-balance customers, particularly in the regional markets of the northeast where they had historically been strongest. Mutuals tended to have lower minimum balance requirements and lower fees. Studies from the period also show that commercial banks with large branch networks also tended to pay lower rates on deposits than either community banks or mutuals did.

Due in no small part to increased computing power and growing sophistication in cost-accounting, customer-level profit segmentation became a lens through which banks have looked at retail customers, not only in banking but across a wide range of industries since the late 1980s. Banks needed to know what products to target at which customers and where the break-even points would be on each product, leading to changes in the way retail banks were managed at the customer level. A bibliography of some of this literature can be found here.

With profitability segmentation, bank clients could be divided into “A,” “B,” and “C” tiers (“A” being the most potentially lucrative, but the terms will vary by firm) based on current balances and potential future profit. Higher balance “A” customers tend to cover more than their allocated share of bank expenses and make a large contribution to bank profits; customers in the “B” and “C” tiers tend to make a marginal or negative contribution. Consequently, lower tier clients saw an increase in account service and overdraft fees, so that they would be more profitable on a stand-alone basis. In more recent years, higher overdraft charges have continued this trend of imposing fees to make lower-balance customers more profitable.

There may be signs of change in the market. Fintech firms are increasingly offering low-cost checking account options in a marketplace less tied to costly brick-and-mortar infrastructure. As of this posting, some major banks have also begun announcing an end to some or all overdraft fees on retail accounts (although other fees will likely stay in place). This may or may not be a longer-term trend, but it would go some way toward addressing one of the most clear-cut cases of product pricing impacting low-balance customers.

The following post in this series will dive more deeply into the dynamics of account overdraft fees and their implications for inequality.

Summing Up

The great repricing of bank products that began four decades ago has been associated with profound changes in financial inclusion. Compared to that earlier era, there are fewer institutions offering low-minimum, low-fee accounts and retail deposit and transaction products are more differentiated based on balances, with the associated fees hitting lower-balance customers hardest. As a result, a substantial number of low- and middle-income consumers choose to be unbanked to avoid fees, a figure that rises when the economy is not performing well. Loss of access to a transaction account can have knock-on effects in terms of inequality, particularly through the mechanism of credit access, banking relationships, and credit histories. Greater availability of low-cost checking accounts, by this logic, would translate into higher rates of inclusion in what is arguably the cornerstone product for inclusion in the economy.

If the past is prelude, this leads us to think about alternative futures. Will traditional banks increasingly forego fees and allow greater cross-subsidization between customer segments? As many credit unions offer increasingly liberal terms for membership, will they help fill the gap for financial inclusion? Alternatively, will technology fill the void, enabling banks or fintechs to serve clients that are currently high-cost much more cheaply so that there are very few “C” customers left? Or perhaps, as was the case a century ago, it is time for mission-driven organizations to think again about mutual banking?

Stein Berre is a senior vice president in the Federal Reserve Bank of New York’s Supervision Group.

Stein Berre is a senior vice president in the Federal Reserve Bank of New York’s Supervision Group.

Kristian Blickle is an economist in the Bank’s Research and Statistics Group.

Kristian Blickle is an economist in the Bank’s Research and Statistics Group.

How to cite this post:

Stein Berre, Kristian Blickle, and Rajashri Chakrabarti, “Banking the Unbanked: The Past and Future of the Free Checking Account,” Federal Reserve Bank of New York Liberty Street Economics, June 30, 2021, https://libertystreeteconomics.newyorkfed.org/2021/06/banking-the-unbanked-the-past-and-future-of-the-free-checking-account.html.

Additional Posts in this Series

Hold the Check: Overdrafts, Fee Caps, and Financial Inclusion

Credit, Income, and Inequality

Related Reading

Once Upon a Time in the Banking Sector: Historical Insights into Banking Competition

The ‘Banking Desert’ Mirage

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics