Access to credit plays a central role in shaping economic opportunities of households and businesses. Access to credit also plays a crucial role in helping an economy successfully exit from the pandemic doldrums. The ability to get a loan may allow individuals to purchase a home, invest in education and training, or start and then expand a business. Hence access to credit has important implications for upward mobility and potentially also for inequality. Adverse selection and moral hazard problems due to asymmetric information between lenders and borrowers affect credit availability. Because of these information issues, lenders may limit credit or post higher lending rates and often require borrowers to pledge collateral. Consequently, relatively poor individuals with limited capital endowment may experience credit denial, irrespective of the quality of their investment ideas. As a result, their exclusion from credit access can hinder economic mobility and entrench income inequality. In this post, we describe the results of our recent paper which contributes to the understanding of this mechanism.

Access to Credit Has a Positive Effect on the Income of Small Business Owners

In our paper, we study how banks’ credit decisions (credit acceptance or rejection) affect applicants’ income and its distribution in a developed economy. We identify this effect using a unique data set of business loan applications to a single large European bank during the time period 2002-16. Our focus is on loan applications from small and micro enterprises (with total assets less than EUR 10 million) that are majority-owned by individuals and do not have a credit relationship with another regulated bank. For these applicants, the bank decides whether to grant loans based on a credit score cutoff rule. Specifically, each applicant is assigned a credit score at the time of the loan application, which consists of an internal rating constructed by the bank. Then, credit is granted to applicants with credit scores above the cutoff, and denied otherwise. We exploit the cutoff rule as a source of variation in the bank’s credit decision. Our approach builds on the idea that applicants whose credit scores are around the cutoff share approximately the same traits, including similar incomes. Thus, we quantify the effect of a loan origination on individual income by comparing changes in the income of accepted and denied applicants, who prior to the bank’s credit decision have similar credit scores.

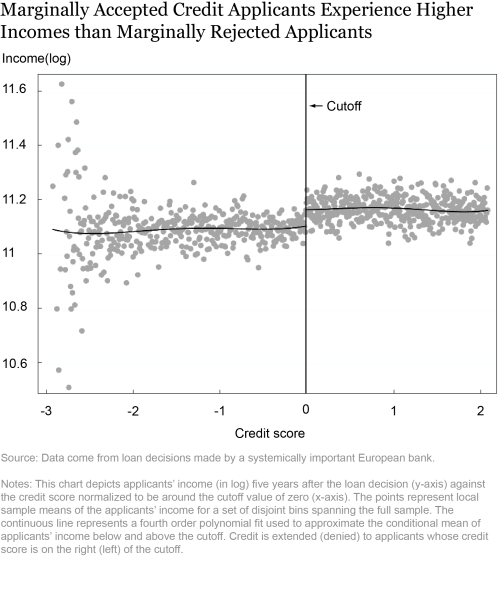

Our main finding is summarized by the chart below, which shows applicants’ income five years after the loan decision against the credit score. The chart reveals a clear upward shift in applicants’ income around the cutoff, with marginally accepted applicants experiencing higher incomes than marginally rejected applicants. In general, our analysis shows that access to credit has a positive effect on the income of small business owners. Specifically, being approved for a loan implies an increase in the recipient’s income of approximately 6 percent one to three years after the loan decision, and an increase of 11 percent five years after.

We next investigate the economic channels behind the observed positive impact of a loan origination on individual income. We document that firms of accepted applicants use the borrowed funds to make investments and expand their business, ultimately experiencing higher profitability and growth rates compared to firms of rejected applicants. We also show that the effect of credit access on income is more pronounced when we compare marginally accepted and rejected applicants whose credit score is positively affected by the soft information held by the bank (for example, on the quality of the investment opportunities of the firm). Overall, these results suggest that credit provision to small businesses is pivotal to foster entrepreneurship and economic mobility.

Our Findings Support a Negative Finance-Inequality Nexus

A natural implication of our key findings is that the income distribution of applicants around the cutoff changes in response to the bank’s credit decisions. Using two standard aggregate measures of income inequality (the Gini coefficient and the Theil index), we document a tighter income distribution among accepted applicants and a wider income distribution among rejected applicants.

We next examine how credit origination affects the income distribution in the economy more generally. First, we show that loan approval has a stronger effect on applicants’ future income in low-income regions compared to high-income regions, thus potentially affecting the income distribution within and across geographical areas. Second, we exploit the Great Recession to analyze how an economic crisis and associated credit crunch affect the credit-income relationship. We show that the positive effect of credit access on individual income is somewhat stronger during the crisis period, when small business owners are more credit-constrained. Overall, these results are in line with the theory pointing to a negative relationship between credit availability and income inequality.

Our findings have two key and interrelated economic implications. First, credit decisions strongly affect applicants’ future income and its subsequent dynamics, altering lifetime income expectations and realizations. Second, credit decisions exert substantial effects on the income distribution. In general, our study supports the idea that extending credit to individuals with good investment ideas improves economic mobility and reduces income inequality.

Manthos Delis is a professor of financial economics at Montpellier Business School.

Fulvia Fringuellotti is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Fulvia Fringuellotti is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Steven Ongena is a professor of banking at the University of Zurich.

Additional Posts in this Series

Banking the Unbanked: The Past and Future of the Free Checking Account

Hold the Check: Overdrafts, Fee Caps, and Financial Inclusion

How to cite this post:

Manthos Delis, Fulvia Fringuellotti, and Steven Ongena, “Credit, Income, and Inequality,” Federal Reserve Bank of New York Liberty Street Economics, July 1, 2021, https://libertystreeteconomics.newyorkfed.org/2021/07/credit-income-and-inequality.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics