More than a year into the COVID-19 pandemic, the U.S. banking system has remained stable and seems to have weathered the crisis well, in part because of effects of the policy actions undertaken during the early stages of the pandemic. In this post, we provide an update of four analytical models that aim to capture different aspects of banking system vulnerability and discuss their perspective on the COVID pandemic. The four models, introduced in a Liberty Street Economics post in November 2018 and updated annually since then, monitor vulnerabilities of U.S. banking firms and the way in which these vulnerabilities interact to amplify negative shocks.

How Do We Measure Banking System Vulnerability?

We consider the following measures, all based on analytical frameworks developed by New York Fed staff or adapted from academic research, that use public regulatory data on bank holding companies to capture key dimensions of systemic vulnerability of the banking system: capital, fire sales, liquidity, and run vulnerability.

- Capital vulnerability. This index measures how well capitalized the banks are projected to be after a severe macroeconomic shock. Using the CLASS model, a top-down stress testing model developed by New York Fed staff, we project banks’ regulatory capital ratios under a macroeconomic scenario equivalent to the 2008 financial crisis. The vulnerability index measures the aggregate amount of capital (in dollars) needed under that scenario to bring each bank’s capital ratio to at least 10 percent.

- Fire-sale vulnerability. This index measures the magnitude of systemic spillover losses among banks caused by asset fire sales under a hypothetical stress scenario. The measure calculates the fraction of aggregate bank capital that would be lost because of fire-sale spillovers. It is based on the article (published in the Journal of Finance) “Fire-Sale Spillovers and Systemic Risk.”

- Liquidity stress ratio. This ratio measures the potential liquidity shortfall of banks under conditions of liquidity stress. It is defined as the ratio of runnability-adjusted liabilities plus off-balance sheet exposures (with each liability and off-balance sheet exposure category weighted by its expected outflow rate) to liquidity-adjusted assets (with each asset category weighted by its expected market liquidity).

- Run vulnerability. This measure gauges a bank’s vulnerability to runs, taking into account both liquidity and solvency. The framework considers a shock to assets and a concurrent loss of funding that forces costly asset liquidations. An individual bank’s run vulnerability calculates the critical fraction of unstable funding that the bank needs to retain in the stress scenario to prevent insolvency.

How Have the Vulnerability Measures Evolved Over Time?

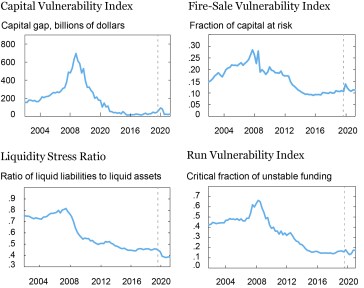

The chart below shows how the different aspects of vulnerability have evolved since 2002, according to the four measures calculated for the fifty largest U.S. bank holding companies (BHCs). The dashed lines indicate the pre-COVID values as of the fourth quarter of 2019.

Source: Authors’ calculations, based on FR Y-9C reports.

Note: The dashed lines indicate values as of the fourth quarter of 2019.

What Have Been the Drivers of Bank Vulnerability Through the COVID Pandemic?

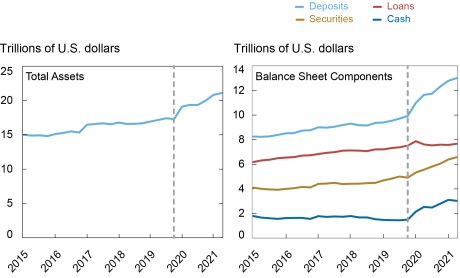

The COVID pandemic has led to significant changes to banks’ balance sheets compared to the pre-COVID state. These changes have affected the four measures of systemic vulnerability in different ways. The chart below shows the development of key components of the aggregate balance sheets of the fifty largest BHCs.

Liquid Assets Make Up Greater Share of Banks’ Balance Sheets

Source: Authors’ calculations, based on FR Y-9C reports.

Note: The dashed lines indicate values as of the fourth quarter of 2019.

Compared to the pre-COVID level in the fourth quarter of 2019, aggregate assets of the banks in our sample increased by $1.8 trillion in first quarter of 2020 alone and then a further $2 trillion by the second quarter of 2021, for a total increase of more than 20 percent during the COVID pandemic so far (left panel of the above chart). Most of that increase was in the form of a $1.7 trillion increase in securities, mostly Treasuries and agency mortgage-backed securities, and a $1.5 trillion increase in cash (mostly from reserves, as shown in the right panel). Combined with a smaller increase in loans of $180 billion (after a brief spike in the first quarter of 2020 due to drawdowns on credit lines), these changes resulted in a significant increase in the share of liquid assets on banks’ balance sheets. On the liability side, the balance sheet expansion was almost exclusively in the form of deposits, which increased by $3.1 trillion. Most of that expansion was in transaction accounts, while time deposits decreased somewhat, resulting in an increase in the share of funding from less stable sources.

How Have the Different Vulnerability Measures Fared through the Pandemic?

Capital Vulnerability Index: After continuing an increasing pre-COVID trend in the first half of 2020, the Capital Vulnerability Index decreased close to the lowest level in the sample during the third quarter of 2020. The increase at the onset of the pandemic was mostly due to an increase in loan provisions and a reduction in net interest margin. The subsequent drop reflects the increase in capital levels supported by dividend restrictions and a lower predicted capital depletion, at least partly driven by the drop in net charge-offs starting in the third quarter of 2020.

Fire-Sale Vulnerability Index: The sudden increase in total assets at the beginning of 2020 implied an increase in the size of the banking sector relative to the rest of the financial system; the fact that the balance sheet expansion was through deposits implied an increase in banks’ leverage. The combined increases in relative size and leverage led to a spike in the Fire-Sale Vulnerability Index in the first quarter of 2020. The concurrent increase in liquid assets—which was more pronounced among the largest banks—reduced connectedness, attenuating the increase in fire-sale vulnerability. Relative size and leverage reverted through the end of 2020 but have increased somewhat over the first half of 2021.

Liquidity Stress Ratio: The Liquidity Stress Ratio fell significantly over the course of 2020, largely reflecting an increase in banks’ holdings of cash and cash equivalents (mostly reserves). The decrease in the ratio has been only partially moderated by the simultaneous increase in deposits. The slight increase of the Liquidity Stress Ratio in the first two quarters of 2021 was driven by a shift from cash toward less liquid assets, combined with an increase in unused commitments and a shift toward less stable forms of deposit funding.

Run Vulnerability Index: The shift toward more liquid assets since the beginning of 2020 initially led to a decline in the Run Vulnerability Index, which reached a new sample low in the third quarter of 2020. Although deposits have continued to go up, the increase has been in less stable types of deposits. Combined with a slight increase in predicted leverage in stress situations, this reduction in funding stability has led to an increase in the Run Vulnerability Index, returning it roughly to its pre-COVID level.

Lessons Learned and Future Outlook

Overall, the banking system entered the COVID-19 pandemic with historically low vulnerability according to our four measures. While Capital Vulnerability and Fire-Sale Vulnerability briefly increased at the beginning of the pandemic in early 2020, all four measures currently indicate low levels of vulnerability, comparable to or lower than the pre-COVID period.

Important contributors to the resilience of the banking system so far have been the regulatory changes put in place following the 2007–09 financial crisis as well as the policy actions during the COVID-19 pandemic. The low levels of our vulnerability measures in the pre-COVID period reflect historically high capital ratios and liquid assets related to post-crisis capital and liquidity regulation.

During the COVID-19 pandemic, the Federal Reserve’s balance sheet expansion further increased banks’ liquid assets in the form of reserves, which directly reduced vulnerability to fire sales and to funding stress (liquidity stress ratio and run vulnerability). In addition, the Federal Reserve restricted large banks’ dividend payments from the third quarter of 2020 to the second quarter of 2021 to ensure their resilience. Although loan loss provisions increased, the CLASS model is driven by actual charge-offs which decreased markedly during the pandemic, likely driven by loan forbearance and, more generally, by measures such as the CARES act, that helped businesses and consumers navigate the crisis. Thus, bank capital was preserved or increased which directly reduced capital vulnerability but also fire-sale vulnerability and run vulnerability.

While this policy mix bolstered financial stability, the unprecedented nature of the COVID-19 pandemic implies continuing uncertainty about potential future losses on bank loans, both in terms of size and timing.

Matteo Crosignani is a senior economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas Eisenbach is a senior economist in the Bank’s Research and Statistics Group.

Fulvia Fringuellotti is an economist in the Bank’s Research and Statistics Group.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics