The Transatlantic Economy Policy Responses to the Pandemic and the Road to Recovery Conference

The Federal Reserve Bank of New York, the European Commission, and the Center for Economic and Policy Research (CEPR) jointly organized the conference “Transatlantic Economic Policy Responses to the Pandemic and the Road to Recovery,” on November 18, 2021. The conference brought together U.S. and European-based policymakers and economists from academia, think tanks, and international financial institutions to discuss issues that transatlantic policymakers are facing. The conference was held before the Russian invasion of Ukraine and the global monetary tightening. Still, its medium to long-term focus provides interesting insights on economic policy challenges ahead.

The Bond Market Selloff in Historical Perspective

Treasury yields have risen sharply in recent months. The yield on the most recently issued ten-year note, for example, rose from 1.73 percent on March 4 to 3.48 percent on June 14, reaching its highest level since April 2011. Increasing yields result in realized or mark-to-market losses for fixed-income investors. In this post, we put these losses in historical perspective and investigate whether longer-term yield changes are better explained by expectations of higher short-term rates or by investors demanding greater compensation for holding Treasury securities.

Do Corporate Profits Increase When Inflation Increases?

When inflation is high, companies may raise prices to keep up. However, market watchers and journalists have wondered if corporations have taken advantage of high inflation to increase corporate profits. We look at this question through the lens of public companies, finding that in general, increased prices in an industry are often associated with increasing corporate profits. However the current relationship between inflation and profit growth is not unusual in the historical context.

The Global Dash for Cash in March 2020

The economic disruptions associated with the COVID-19 pandemic sparked a global dash-for-cash as investors sold securities rapidly. This selling pressure occurred across advanced sovereign bond markets and caused a deterioration in market functioning, leading to a number of central bank actions. In this post, we highlight results from a recent paper in which we show that these disruptions occurred disproportionately in the U.S. Treasury market and offer explanations for why investors’ selling pressures were more pronounced and broad-based in this market than in other sovereign bond markets.

Consumer Scores and Price Discrimination

Most American consumers likely are familiar with credit scores, as every lender in the United States uses them to evaluate credit risk. But the Customer Lifetime Value (CLV) that many firms use to target ads, prices, products, and service levels to individual consumers may be less familiar, or the Affluence Index that ranks households according to their spending power. These are just a few among a plethora of scores that have emerged recently, consequence of the abundant consumer data that can be gathered online. Such consumer scores use data on age, ethnicity, gender, household income, zip code, and purchases as inputs to create numbers that proxy for consumer characteristics or behaviors that are of interest to firms. Unlike traditional credit scores, however, these scores are not available to consumers. Can a consumer benefit from data collection even if the ensuing scores are eventually used “against” her, for instance, by enabling firms to set individualized prices? Would it help her to know her score? And how would firms try to counteract the consumer’s response?

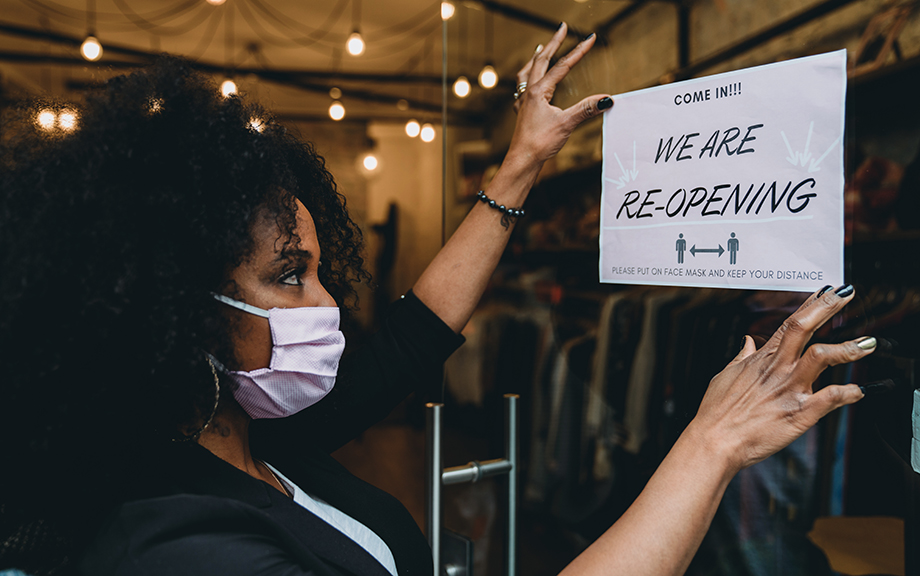

Did Changes to the Paycheck Protection Program Improve Access for Underserved Firms?

Prior research has shown that many small and minority-owned businesses failed to receive Paycheck Protection Program (PPP) loans in 2020. To increase program uptake to underserved firms, several changes were made to the PPP in 2021. Using data from the Federal Reserve Banks’ 2021 Small Business Credit Survey, we argue that these changes were effective in improving program access for nonemployer firms (that is, businesses with no employees other than the owner(s)). The changes may also have encouraged more applications from minority-owned firms, but they do not appear to have reduced disparities in approval rates between white- and minority-owned firms.

The Fed’s Inaugural Conference on the International Roles of the U.S. Dollar

The U.S. dollar has played a preeminent role in the global economy since the second World War. It is used as a reserve currency and the currency of denomination for a large fraction of global trade and financial transactions. The status of the U.S. dollar engenders important considerations for the effectiveness of U.S. policy instruments and the functioning of global financial markets. These considerations include understanding potential factors that may alter the dominance of the U.S. dollar in the future, such as changes in the macroeconomic and policy environments or the development of new technologies and payment systems.

The U.S. Dollar’s Global Roles: Revisiting Where Things Stand

Will developments in technology, geopolitics, and the financial market reduce the dollar’s important roles in the global economy? This post updates prior commentary [here, here, and here], with insights about whether recent developments, such as the pandemic and the sanctions on Russia, might change the roles of the dollar. Our view is that the evidence so far points to the U.S. dollar maintaining its importance internationally. A companion post reports on the Inaugural Conference on the International Roles of the U.S. Dollar jointly organized by the Federal Reserve Board and Federal Reserve Bank of New York and held on June 16-17.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics