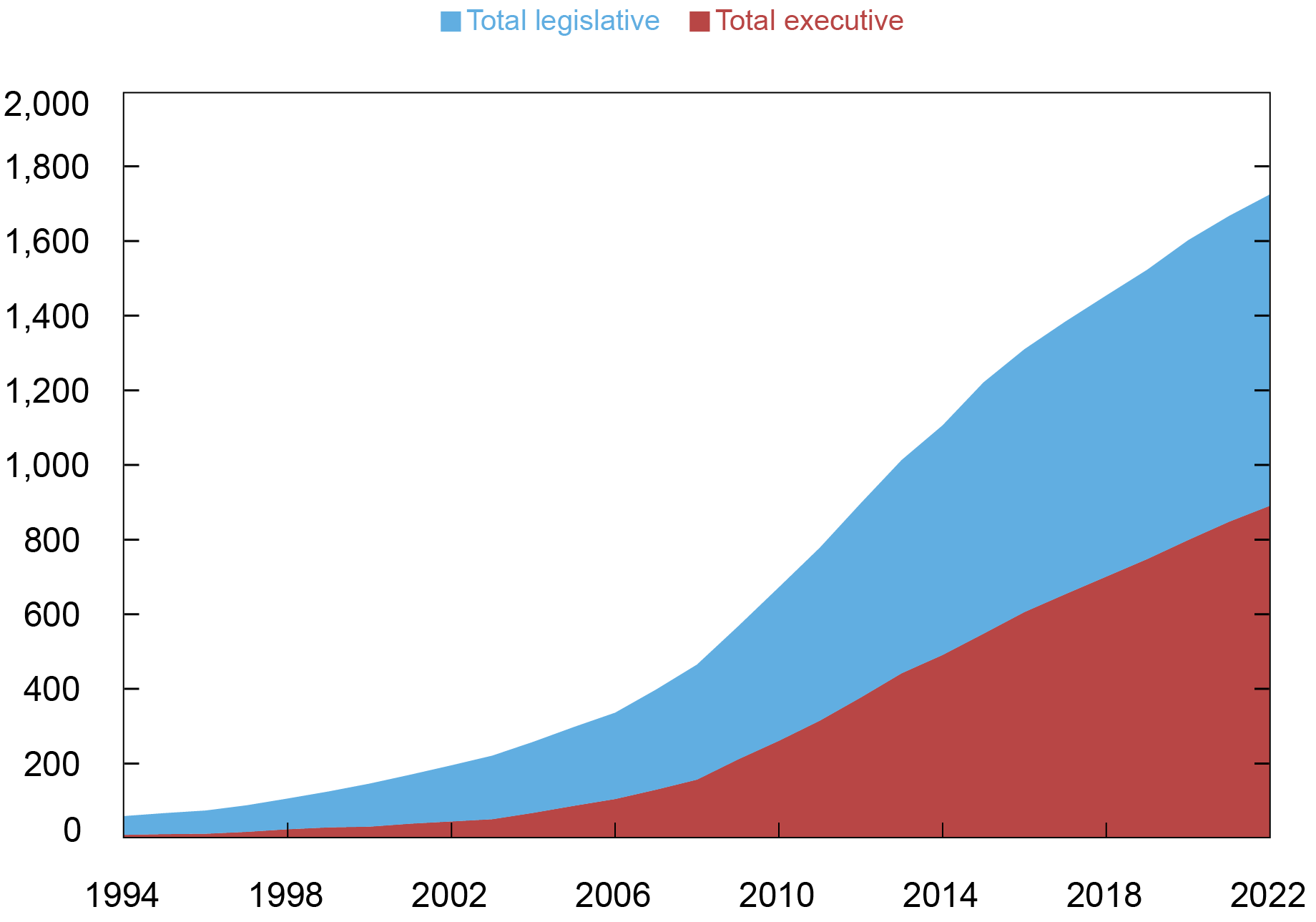

A growing number of climate-related policies have been adopted globally in the past thirty years (see chart below). The risk to economic activity from changes in policies in response to climate risks, such as carbon taxes and green subsidies, is often referred to as transition risk. Transition risk can adversely affect the real economy through the banking sector. For example, a shock to borrowers’ transition risk can impair their ability to repay, which can then lead to an amplified effect on banks’ current and expected future profits, resulting in a systemic undercapitalization of banks. In a recent Staff Report co-authored with Robert Engle and Richard Berner, we examine whether banks are sufficiently capitalized to absorb losses during stressful conditions due to heightened climate (transition) risk.

The Cumulative Number of Climate-Related Policies across the World

Note: “Policies” covers climate-related laws, as well as regulations promoting low carbon transitions.

Challenges to Assessing the Climate Risk to the Financial System

Despite the widespread adoption of climate policies and the importance of understanding their effect on the banking sector, there has been little understanding of the potential impact of climate change on the financial system due to several challenges, as pointed out by Bolton et al. (2020). For example, while the literature on systemic risk measurement (for example, Brownlees and Engle, 2017; Acharya et al., 2016; Adrian and Brunnermeier, 2016; Allen et al., 2012) has provided useful indices of systemic distress in the context of financial crises, no such measures exist to analyze climate-related risks.

One of the key challenges to measuring the climate risk of financial institutions is that analyses based on past climate events may not effectively capture changes in the perception of risk. Market expectations may change without a direct experience of climate change events, and asset prices today can reflect changes in future climate risk even though the damages or impacts are decades away. Secondly, both the perceived climate risk and how firms, banks, and markets respond to it change over time. Finally, the lack of reliable data sources poses a significant challenge. Although voluntary climate-related disclosures exist, they often suffer from incompleteness and inconsistencies in quality.

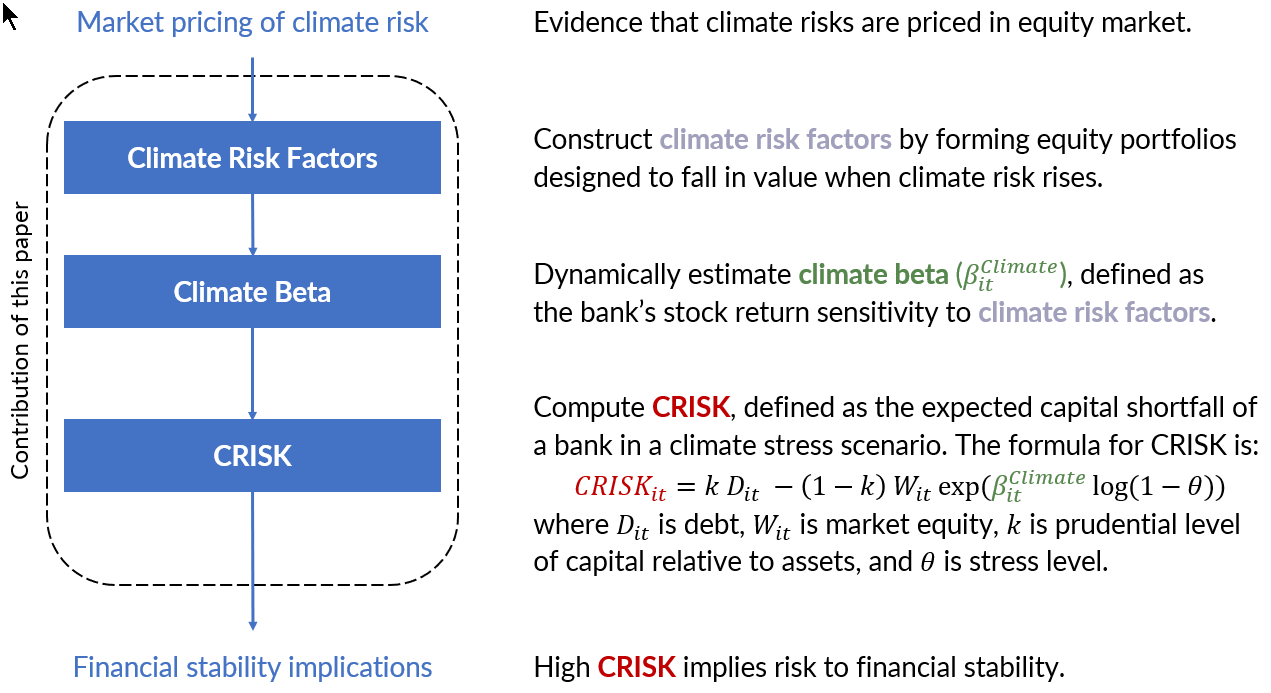

We develop a market-based methodology that addresses these challenges. We handle the first challenge by constructing climate risk factors based on portfolios designed to decline in value as the transition risk rises, and by measuring the banks’ stock return sensitivity, called the climate beta, to the climate risk factor. We contend with the second challenge by estimating the climate beta dynamically, which allows for time-variation in the responses of firms and investors to changes in the transition risk. Finally, we confront the data gap challenge as we only use market data that are consistent in quality, comparable across firms, and less susceptible to the noise and bias inherent in voluntary climate disclosures.

CRISK: A New Measure of Climate Risk

We develop a novel measure, CRISK, defined as the banks’ expected capital shortfall conditional on climate stress. The capital shortfall is taken as the capital reserves the financial firm needs to hold to meet prudential capital requirements. CRISK is a function of a given financial firm’s size, leverage, and the expected equity loss conditional on climate stress. As shown in the chart below, the latter is computed using the estimated climate beta and an assumption regarding the level of climate stress. To consider a sufficiently severe yet plausible stress scenario, we take the lowest one percentile of the six-month return distribution of the climate risk factor to calibrate the stress level.

CRISK Estimation Steps

Climate Risk Exposure of Global Banks

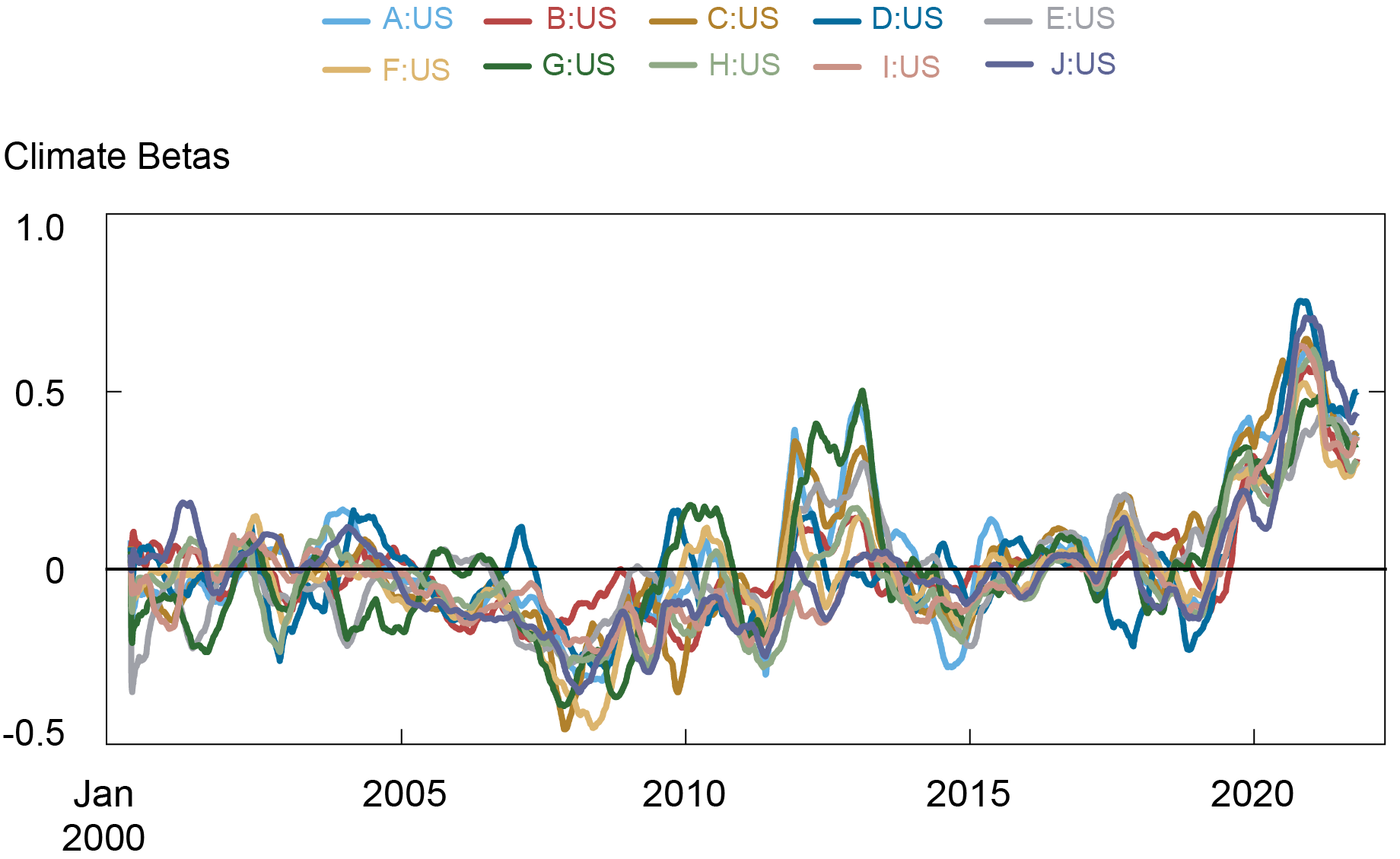

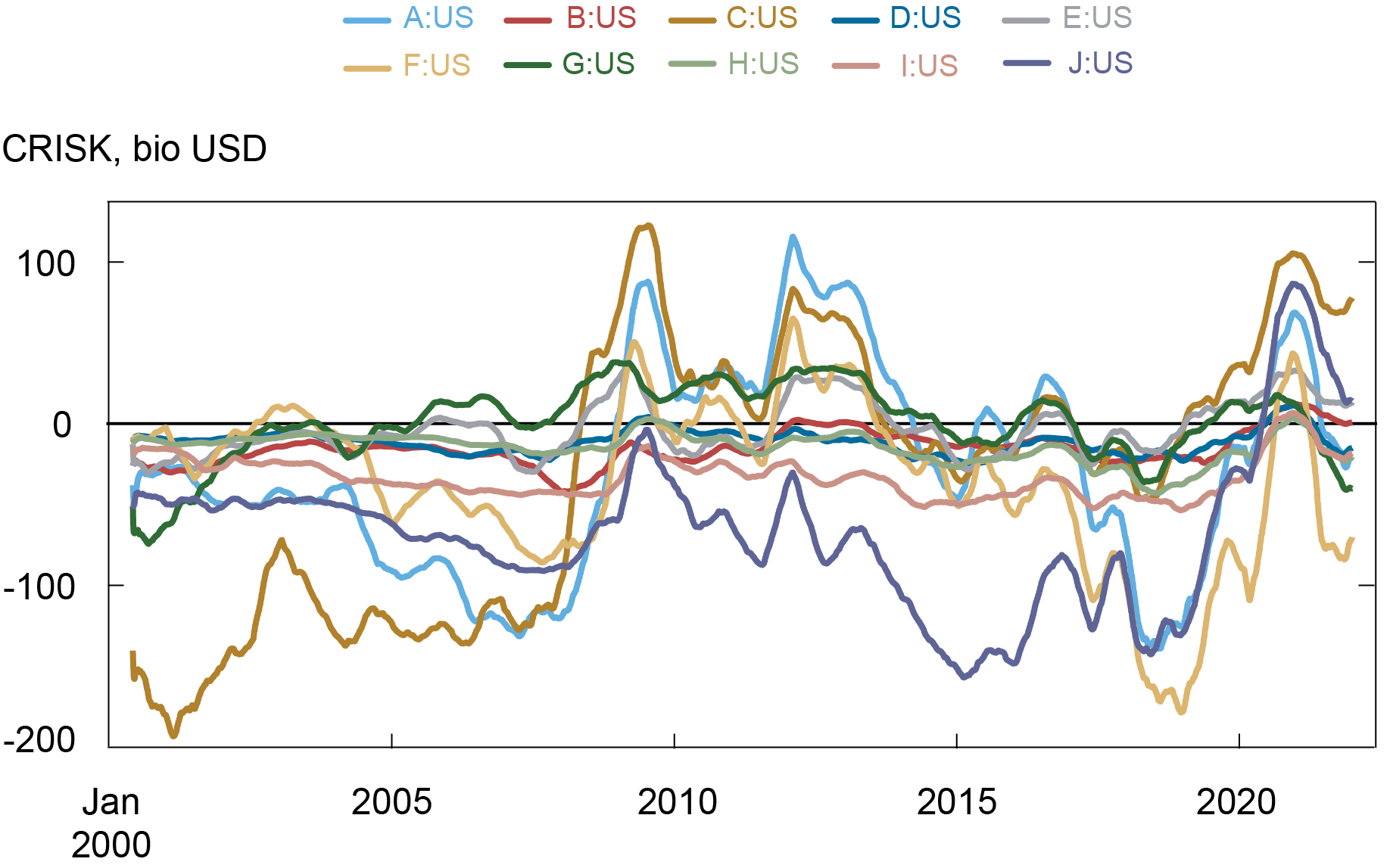

We apply our methodology to estimate climate betas of large global banks. The climate beta and CRISK estimates vary depending on climate risk factors as well as the severity of the scenario. Here, we summarize our findings based on the scenario based on returns of the stranded asset factor (developed by Litterman) which serves as a proxy for market expectations on future transition risk arising from fossil fuel energy firms’ assets becoming “stranded” along most transition paths.

We find that the climate beta varies over time as shown in the first chart below, highlighting the importance of our dynamic estimation. The climate beta and CRISK (as shown the second chart below) substantially increased during 2020, across all banks in our sample. In 2020, the aggregate CRISK of the top four U.S. banks increased by 425 billion U.S. dollars (USD), which corresponds to approximately 47 percent of their market capitalization. Our decomposition analysis reveals that 40 percent of the CRISK increase in 2020 was due to an increase in climate betas, and 40 percent was due to a decrease in equity values. In our paper, we show that the climate beta captures the effects of transition risk and not the concurrent COVID outbreak.

Our results can be interpreted as follows. When fossil fuel energy prices plummeted in 2020, which would happen under a sudden and disorderly transition, “brown” borrowers’ loans became particularly riskier, and the banks’ stock returns became more sensitive to the transition risk, thereby increasing banks’ climate risk exposure. Indeed, we find evidence supporting this mechanism from the validation exercise in the paper.

Climate Beta of U.S. Banks

Notes: The sample banks are the top 10 largest U.S. banks by average total assets in 2019. The sample period is from June 2000 to December 2021.

CRISK of U.S. Banks

Notes: The sample banks are the top 10 largest U.S. banks by average total assets in 2019. The sample period is from June 2000 to December 2021.

Versatility of the CRISK Framework

Our framework is versatile as it can be applied to financial institutions other than banks and can be aggregated at the economy level. For instance, in the paper we compute the aggregate CRISK of 105 financial firms, including banks, broker-dealers, and insurance companies, in the U.S. to gauge the system-wide measure of climate risk. Moreover, our framework can also admit a wide variety of climate stress scenarios. In the paper, we consider a less extreme scenario by taking 5 percent quantile instead of 1 percent quantile of returns of the climate risk factor. We also consider other factors that can be associated with various stylized versions of transition scenario (for example, carbon tax, a mixture of a carbon tax and green subsidy).

Final Words

Climate transition risk, by impairing borrowers’ ability to repay, can reduce current and expected future profits in the banking sector. The effects of such risks on banks’ capitalization could result in negative externalities on the real economy, such as a decrease in credit supply and economic growth. We provide a market-based methodology to measure the potential effect of transition risk on banks’ capitalization. Our new measure of systemic climate risk, or CRISK, can complement other models, scenarios, and measures to assist both private and public sectors.

Hyeyoon Jung is a financial research economist in Climate Risk Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Hyeyoon Jung, “CRISK: Measuring the Climate Risk Exposure of the Financial System,” Federal Reserve Bank of New York Liberty Street Economics, April 20, 2023, https://libertystreeteconomics.newyorkfed.org/2023/04/crisk-measuring-the-climate-risk-exposure-of-the-financial-system/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics