Several centralized crypto entities failed in 2022, resulting in the cascading failure of other crypto firms and raising questions about the protection of crypto investors. While the total amount invested in the crypto sector remains small in the United States, more than 10 percent of all Americans are invested in cryptocurrencies. In this post, we examine whether migrating crypto activities from centralized platforms to decentralized finance (DeFi) protocols might afford investors better protection, especially in the absence of regulatory changes. We argue that while DeFi provides some benefits for investors, it also introduces new risks and so more work is needed to make it a viable option for mainstream investors.

Recent Failures of Centralized Crypto Entities

Similar to traditional financial intermediaries, centralized crypto entities provide deposit, lending, and trading services, as well as custody of customers’ digital assets. While there is a long history of closures of centralized crypto exchanges (CEXs), 2022 witnessed two episodes of broad-based crypto failures.

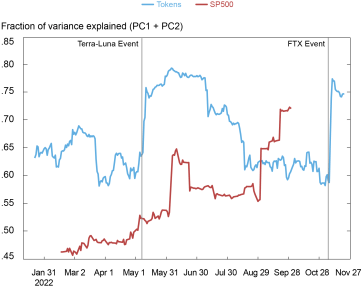

In the summer of 2022, several centralized crypto entities experienced liquidity problems due to large customer withdrawals, which led some –such as Celsius Network (a lending pool) and Voyager Digital (a brokerage firm)—to file for bankruptcy. More recently, the failure of FTX had a broad impact on the crypto ecosystem. In the chart below, we show that during both of these events, the correlation between the prices of the 100 largest crypto tokens spiked (blue line), consistent with increased contagion. By comparison, in normal periods, the correlation of token prices generally tracks that between stocks in the S&P500 (red line).

Correlation between Crypto Token Prices Spiked during Failure Episodes

Notes: We obtain token rankings data from Amberdata, and take the top 100 tokens in terms of market capitalization. We drop tokens with at least one daily return that exceeds 300 percent to exclude outliers. For the S&P 500 stocks, we use the daily close prices from CRSP till the last quarter update of September 30, 2022. We compute the fraction of variation explained by the first two principal components (PC) for crypto tokens and S&P 500 stocks, respectively, based on a rolling window of two months.

How Crypto Failures Affect Investors

While investors in traditional and crypto entities face similar risks, crypto investors may experience greater risk of losses due in part to a lack of compliance and the absence of a comprehensive regulatory framework. Many centralized crypto lenders are fragile due to maturity and liquidity mismatches. For example, the lending pools, such as Celsius, take in tokens as collateral and then lend them out to fund longer-term risky projects. CEXs may also experience funding mismatches because they often bundle trading with custody and lending services (by comparison, traditional exchanges can only provide trading services, by regulation). Faced with customers seeking to withdraw their deposited tokens en masse, centralized crypto entities may therefore be unable to meet all redemption requests. This liquidity risk is amplified when firms have concentrated loan portfolios or borrow using their own privately issued tokens as collateral to create wrong-way risk. Further, poor corporate governance hinders the ability to manage these risks and inhibits crypto investors from disciplining managers.

We focus on three areas of particular concern for crypto investors: custody, governance, and disclosure.

Custody of Customer Assets

In traditional brokerages and exchanges in the United States, customer and firm assets are required to be segregated by regulation so that, in the event of failure, customers have a high probability of recovery. For example, most customers of Lehman’s broker-dealer, LBI, were made whole, as LBI’s assets were segregated from those of customers. In contrast, some crypto firms have commingled customer funds. Indeed, in its chapter 11 filing, Celsius maintains that, under its terms of use, customers are not entitled to the return of the specific digital asset that they had deposited.

Centralized entities have the option to implement decentralized custody of assets through multiparty computation, whereby the private key of a digital wallet is shared among multiple parties, with each party in possession of a portion of the key acting as an approver, thus mitigating the risk that an internal bad actor can gain access to a full key. However, computation and communication costs may limit its adoption.

Governance

Crypto firms often structure themselves to avoid regulations that publicly traded companies are subject to regarding standards for internal control, corporate governance, and financial disclosures. For example, FTX’s chapter 11 filing notes various instances of mismanagement of cash and inadequate financial reporting. Further, FTX granted privileged trading terms to Alameda, an affiliated proprietary trading firm, such as relief from automatic liquidations of collateral when margin calls were made.

Disclosure

Unless they are publicly traded, crypto firms are not required to disclose audited financial statements, and often choose not to disclose, as noted in various bankruptcy filings.

Could DeFi Protocols Better Protect Investors?

DeFi is a collective term that generally refers to open-source software programs running on open-access blockchains. Unlike centralized crypto entities, DeFi automates various financial activities through smart contract code, bypassing the need for intermediaries.

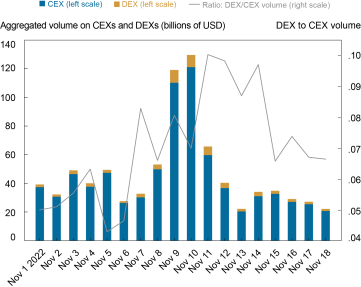

DeFi protocols appear to have continued to function as intended in 2022 and no protocols have been closed down. After FTX collapsed, trading volumes on decentralized exchanges (DEXs) increased relative to CEXs, as shown in the chart below, suggesting that users may view decentralized crypto trading as a safer alternative to CEX. Of course, it could also be the case that the recent relative increase in DEX trading volume instead reflects the deleveraging and automatic liquidation of collateral attendant to the collapse in crypto prices.

Volume on Decentralized Exchanges Increased Relative to Volume on Centralized Exchanges after FTX Collapse

Notes: For DEXs, we plot the daily traded dollar volume aggregated across all DEXs mentioned on The Block (orange bar). For CEXs, we compute the daily traded dollar volume across the 20 largest CEXs ranked by their trust score on CoinGecko (blue bar). We also plot the ratio of DEXs to CEXs volumes (solid line). We focus on the period around the collapse of FTX.

How do DeFi protocols differ from centralized crypto firms in providing custody of customer assets, governance, and disclosure?

Custody of Customer Assets

In DeFi, unlike in centralized entities, users maintain self-custody over their assets, meaning they retain control of their private keys for accessing their tokens. For example, in a DEX, a smart contract called an automated market maker (AMM) pools tokens deposited by investors and uses an algorithm to price them in the liquidity pool. As the AMM returns their share of pool tokens to liquidity providers whenever they exit, customer tokens cannot be misused.

Governance

Internal controls can be automated in DeFi. For example, when a counterparty delays its payments, a smart contract can incorporate automatic actions that are executed by the network. Corporate mismanagement is further mitigated in DeFi by the use of observable governance tokens. Holders of these tokens make proposals and vote on the direction of DeFi projects, such as changes to the interest rate or collateral requirements of a lending protocol, or modifications to the pricing function of an AMM smart contract. Users know who is entitled to vote, and what is being voted on.

However, governance tokens are mostly held by a few accounts (early investors, developers, and large account holders), potentially facilitating manipulation and embezzlement by insiders. In a notable example, an insider in Wonderland, a decentralized autonomous organization (DAO), accumulated many Wonderland governance tokens and then founded another DeFi project that issued tokens with no market value. This insider then coerced Wonderland into passing a vote to pay $25 million for these tokens.

Disclosure

The transparency and immutability features of the distributed ledger underlying DeFi protocols allow DeFi users to track the entire flow of transactions. Funds in the smart contract are publicly visible and can be audited. Pricing and trading rules are also encoded in the smart contract. As the same algorithm is executed by both parties, the risk of trading errors is eliminated.

All Aboard the DeFi Train?

Can investors obtain better protection when crypto firms fail if activities migrate from centralized crypto entities to DeFi protocols? Decentralization provides some clear benefits to investors, by preventing misuse of customer funds and providing more transparency surrounding data and code. Governance procedures are also more transparent, though voting power can be highly concentrated and thus subject to manipulation. Moreover, the technology in DeFi allows different types of financial services to interact with few frictions. For instance, a flash loan allows users to simultaneously (or atomically) conduct and fund an arbitrage trade—something that would not be possible on a centralized platform.

However, the technology also facilitates the creation of excessive leverage due to the repeated use of the same collateral for borrowing and lending. Further, bugs in smart contract codes, as well as hacks to oracles and smart contracts, resulted in an estimated loss of more than $1.3 billion in 2022:Q1. DeFi protocols may also introduce novel legal risks. In particular, the legal obligations of DeFi platforms are often opaque, and users may have little recourse should they seek to modify a transaction as the parties involved are anonymous and may be located anywhere in the world.

For DeFi to gain widespread adoption, it will be important to devise technological solutions that mitigate smart contract and oracle risk. These include, for example, extensive testing and code audits that can reveal potential bugs before the code is deployed on the ledger.

Agostino Capponi is an associate professor of industrial engineering and operations research at Columbia University, where he is also the director of the Center for Digital Finance and Technologies.

Nathan Kaplan is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Asani Sarkar is a financial research advisor in Non-Bank Financial Institution Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Agostino Capponi, Nathan Kaplan, and Asani Sarkar, “Can Decentralized Finance Provide More Protection for Crypto Investors?,” Federal Reserve Bank of New York Liberty Street Economics, December 21, 2022, https://libertystreeteconomics.newyorkfed.org/2022/12/can-decentralized-finance-provide-more-protection-for-crypto-investors/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics