The importance of the U.S. dollar in the context of the international monetary system has been examined and studied extensively. In this post, we argue that the dollar is not only the dominant global currency but also a key variable affecting global economic conditions. We describe the mechanism through which the dollar acts as a procyclical force, generating what we dub the “Dollar’s Imperial Circle,” where swings in the dollar govern global macro developments.

The Imperial Circle

Behind our analysis lies a multi-polar characterization of the global economy, comprised of the United States, advanced economy countries, and emerging market economies. In our multi-country DSGE model, as in the Dominant Currency Paradigm (DCP), we assume that firms in the emerging market bloc set their export prices in dollars while firms in advanced economy countries set export prices in their own currency. A stronger dollar therefore creates a competitive disadvantage for emerging market economies. We also assume that there are financing constraints so that firms need to borrow in dollars to finance purchases of imported intermediate inputs. As we show in our model simulations, presented in a recent staff report, these two forces make dollar appreciation particularly detrimental for the manufacturing sector in emerging market economies.

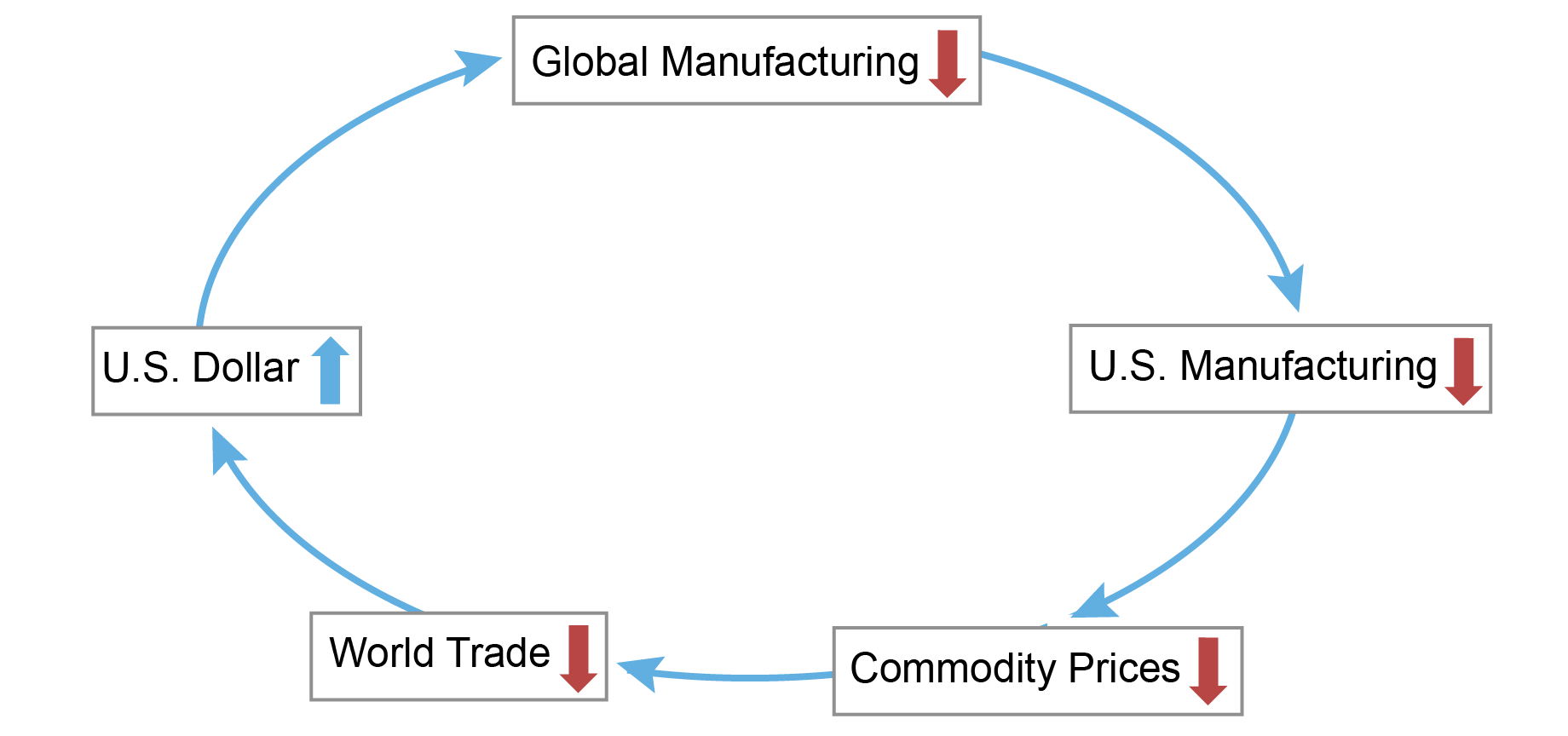

The chart below visualizes the Dollar’s Imperial Circle. A tightening of U.S. monetary policy sets the circle in motion, generating an appreciation of the dollar. Given the structural features of the global economy, tighter policy and an appreciation of the dollar lead to a contraction in manufacturing activity globally, led by a relatively larger decline in emerging market economies. The resulting contraction in global (ex-U.S.) manufacturing will spill back to the U.S. manufacturing sector due to the reduction in foreign final demand for U.S. goods. These same forces will also lead to a drop in commodity prices and world trade. In the final turn of our mechanism, given that the U.S. economy is relatively less exposed to global developments, the contraction of global manufacturing and global trade is associated with a further strengthening of the dollar, reinforcing the circle.

A Strengthening Dollar Is a Procyclical Force Governing Global Manufacturing and Trade

Background Structure

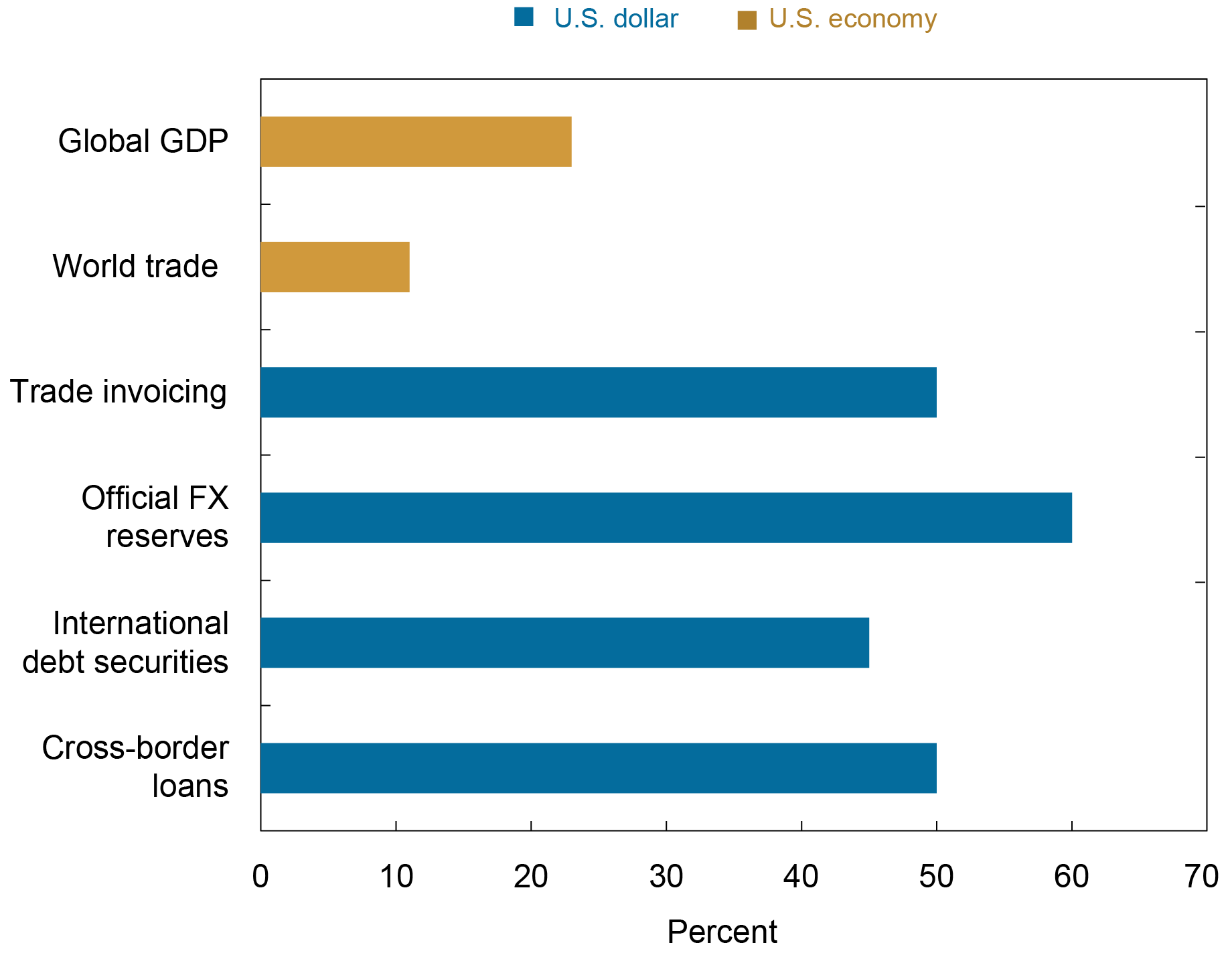

Behind the Dollar’s Imperial Circle are two key asymmetries in the structure of the international monetary system and the U.S. economy. The first asymmetry arises from the fact that global use of the dollar in the international monetary system greatly exceeds the relative size of the U.S. economy. The following chart captures this fundamental asymmetry.

The U.S. Dollar’s Role in International Monetary System Eclipses the United States’ Presence in the Global Economy

More precisely, research by Goldberg and Tille (2008) documents how the dollar is the dominant invoicing currency in international trade, which, consistent with our mechanism, acts to amplify the impact of dollar movements on global manufacturing. Besides its dominant role in trade invoicing, the U.S. dollar is also the dominant currency in international banking. About 60 percent of international and foreign currency liabilities and claims are denominated in U.S. dollars (see Bertaut et al. (2021)).

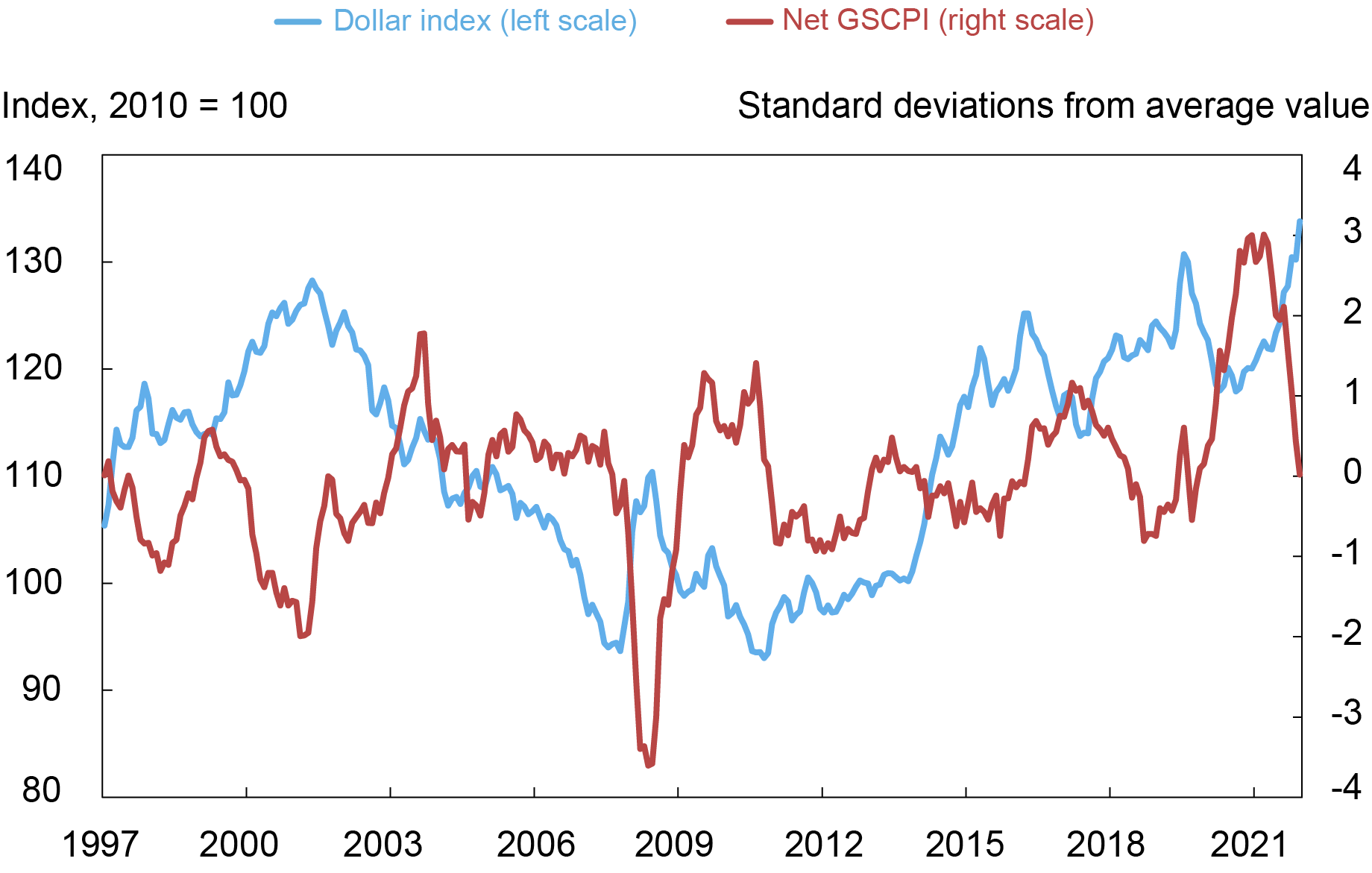

In addition, as discussed by Bruno and Shin (2021), a strong dollar tends to reduce the availability of the dollar financing needed to support supply chain linkages. As a result, movements in the dollar affect global activity through this financial channel. The chart below captures the link between the broad dollar index and global supply chain imbalances, a measure that builds upon the New York Fed’s Global Supply Chain Pressure Index (GSCPI).

Broad Dollar Index Is Negatively Correlated with the Global Supply Chain Pressure Index

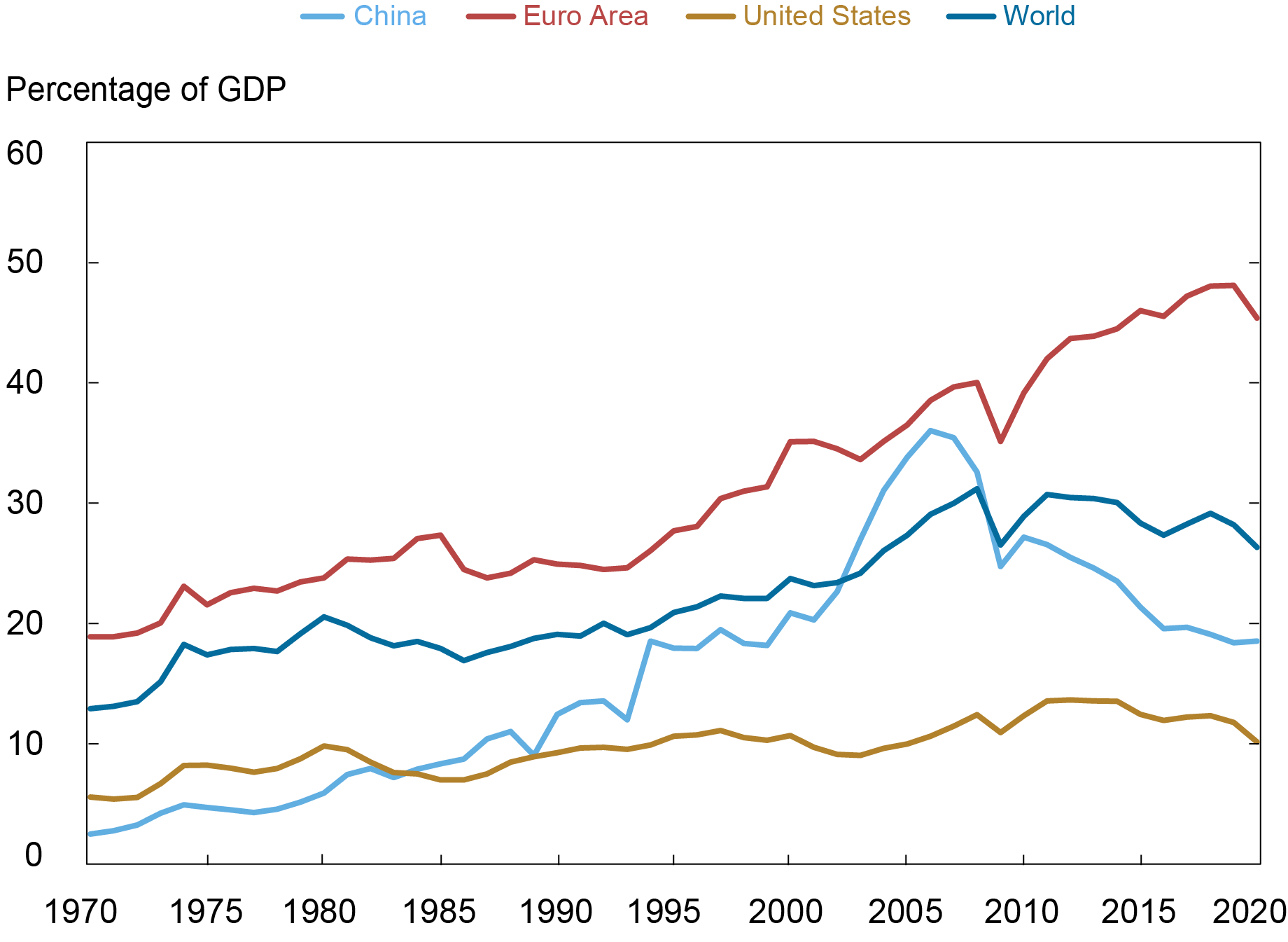

The second asymmetry occurs as the U.S. economy is less exposed to movements in global trade relative to its trading partners. The chart below shows that over the past fifty years, trade has played an increased role for many countries—most notably in the euro area and China, where the size of exports as a share of GDP has more than doubled. In the United States, meanwhile, the importance of trade has remained relatively lower and stationary over the same period.

Export’s Share of GDP Has Risen in the Euro Area and China, while Holding Steady in the United States

To summarize, we emphasize that these asymmetries present a dichotomy: the hegemonic role of the dollar in international trade and finance has expanded, while the exposure of the U.S. economy to the global economy has been relatively stagnant. This dichotomy creates the conditions for the dollar to act as a self-fulfilling procyclical force.

The Circle in Motion

Examples of what can start the process include a hawkish shift in the Federal Reserve’s monetary policy stance (relative to that of other central banks) or a negative shock that hits the rest of the world harder (such as the 2022 energy shock, with the U.S. being energy self-sufficient).

Once the dollar begins to strengthen, the subsequent dynamics imply a decline in global manufacturing due to dollar invoicing and the credit-intensive global value chain. Manufacturing activity, where credit-intensive global value chains are more pervasive, will tend to suffer more. The contraction in global (ex-U.S.) manufacturing will spill back to the U.S. manufacturing due to production linkages and a reduction in demand. This will also lead to a decline in commodity prices and world trade. As the U.S. economy is less exposed to global developments, the dollar will benefit in relative terms from a worldwide economic decline, reinforcing the circle. In our staff report, we show how these different forces interact using our global macroeconomic model.

More broadly, these theoretical results are borne out by data. The table below shows the relationship between the broad dollar index and Purchasing Managers’ Indexes (PMI) for U.S. and global (ex-U.S.) manufacturing in the pre- and post-Global Financial Crisis periods. The correlations listed in the table suggest that a broad nominal dollar appreciation is associated with a contraction in manufacturing activity, as predicted by our global macro model incorporating the proposed mechanism, and this relationship is stable over the two subperiods considered. Similarly, a dollar appreciation is negatively associated with commodity prices and world trade (as also documented also by Bruno and Shin (2021) and Obstfeld and Zhou (2022)).

The Appreciation of the Dollar Is Associated with Lower Global Manufacturing, Trade, and Commodity Prices

Correlations between broad dollar index and select variables, pre- and post-Global Financial Crisis

| Variable | 1/01-12/09 | 1/10-12/19 |

| Global Manufacturing PMI (ex-U.S.) | -0.51 | -0.38 |

| U.S. Manufacturing PMI | -0.65 | -0.42 |

| World trade volume | -0.69 | -0.48 |

| Commodity prices | -0.82 | -0.76 |

Note: Correlations are calculated for year-over-year changes in the broad dollar index and stated variables.

Conclusions

In this blog post, we emphasize the role of the dollar as a self-fulfilling procyclical force that governs global macroeconomic developments. We refer to this mechanism as the Dollar’s Imperial Circle to highlight the central role of the U.S. dollar as a dominant macroeconomic variable.

Ozge Akinci is an economic research advisor in International Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gianluca Benigno is a professor of economics at the University of Lausanne and former head of International Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Serra Pelin is a PhD Candidate in economics at the University of California, Berkeley.

Jonathan Turek runs the research firm JST Advisors and is the author of the Cheap Convexity blog.

How to cite this post:

Ozge Akinci, Gianluca Benigno, Serra Pelin, and Jonathan Turek, “The Dollar’s Imperial Circle,” Federal Reserve Bank of New York Liberty Street Economics, March 1, 2023, https://libertystreeteconomics.newyorkfed.org/2023/03/the-dollars-imperial-circle/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics