The New York Fed’s Treasury Market Practices Group (TMPG) recently released a consultative white paper on clearing and settlement processes for secured financing trades (SFT) involving U.S. Treasury securities. The paper describes the many ways that Treasury SFTs are cleared and settled— information that may not be readily available to all market participants. It also identifies potential risk and resiliency issues, and so promotes discussion about whether current practices have room for improvement. This work is timely given the SEC’s ongoing efforts to improve transparency and lower systemic risk in the Treasury market by increasing the prevalence of central clearing. In this post, we summarize the current state of clearing and settlement for Treasury SFTs and highlight some of the key risks described in the white paper.

The Market for Treasury Secured Financing Transactions

Treasury SFTs—including repurchase agreements (repos) and securities lending—are part of the collateralized U.S. dollar-denominated money markets. Treasury repos are financial transactions in which a party sells U.S. Treasury securities to another party with a promise to repurchase the asset at a pre-specified price and date. Treasury securities lending is the short-term loan of U.S. Treasury securities in exchange for cash or other collateral. Securities lending against cash and repo agreements are economically similar, and investors and firms use repo and securities lending to secure funding for their activities, make markets, and facilitate the implementation of various investment, risk management, and collateral management activities.

How Do Treasury SFT Trades Clear and Settle?

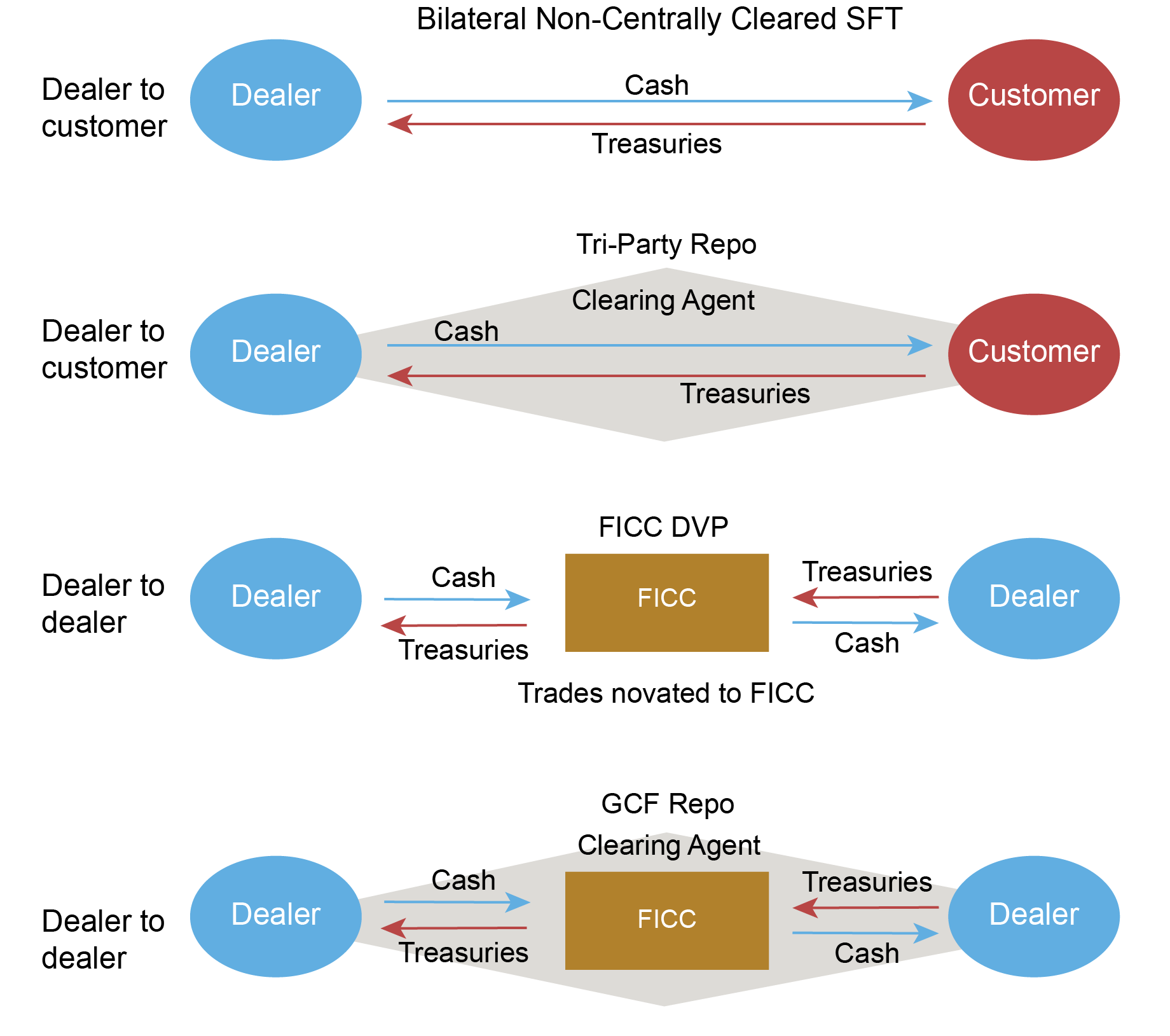

There are two large segments of the Treasury SFT market: dealer-to-customer and dealer-to-dealer. Most dealer-to-customer trades are cleared and settled in one of two ways. The first is on a bilateral basis, when each party to the trade uses its own bespoke clearing and settlement processes. The second leverages the tri-party settlement platform offered by a clearing bank; under this agent-cleared approach, both parties to the trade use the processes offered by the clearing bank.

A third, less common clearing option for dealer-to-customer trades is to utilize the Sponsored Service provided by the sole central counterparty (CCP) in the Treasury market, the Fixed Income Clearing Corporation. Trades that are centrally cleared through the Sponsored Service are either settled on the tri-party repo settlement platform or on a bilateral basis, depending on the nature of the trade.

In contrast to the dealer-to-customer segment, most dealer-to-dealer trades are cleared through the CCP using either its General Collateral Finance (GCF®) Repo Service or Delivery-Versus-Payment (DVP) Service. Trades cleared using the GCF Repo Service are settled on the tri-party settlement platform, whereas for trades cleared using the DVP Service, each market participant uses its respective settlement processes.

The exhibit below summarizes the four main ways that SFTs clear and settle.

Trades in Treasury SFT Markets

Risk and Resiliency Issues

Do market participants fully understand the risks associated with the many clearing and settlement methods available for SFTs? The white paper discusses several concerns on which the TMPG hopes to receive feedback. Here we highlight two: (i) Overall, the clearing and settlement of SFTs is fragmented and (ii) for non-centrally cleared bilateral SFTs, clearing and settlement is bespoke and opaque.

The first risk reflects the fact the clearing and settlement ecosphere for SFTs has organically grown over time to meet the various needs of different market participants. As a result, there are now a multitude of clearing and settlement options available. For a given option, risks to a smooth post-trade process for Treasury SFTs can manifest in several ways, including counterparty credit concerns and operational issues. The large number of clearing and settlement options—this fragmentation in post-trade services—places a significant burden on market participants to fully recognize the inherent risks of each option, and to put the appropriate risk mitigants into place.

In normal times, when a counterparty’s risk of default is idiosyncratic and Treasury market liquidity is deep, the differences in clearing and settlement processes have only small implications for risk. In times of stress, however, when defaults are more common and overall Treasury market liquidity can decrease, these differences could have important risk implications.

The second risk focuses on SFTs, which are neither centrally cleared nor settled on a tri-party settlement platform. For these non-centrally cleared bilateral SFTs, market participants rely upon individualized clearing and settlement arrangements. These may work well during the ordinary course of business, but the bespoke nature of these arrangements, combined with the short period of time between trade execution and trade settlement, can make resolving post-trade disputes a challenging task. Indeed, in times of stress, disputes typically arise more frequently and may be more difficult to resolve in a timely manner, increasing the risk of a disruption to settlement, which could in turn create unexpected credit exposures.

Given that the clearing and settlement risks associated with Treasury SFTs are fairly benign during the normal course of business, some market participants may not fully use the array of risk management tools to mitigate these risks. The opaqueness of these processes obscures a participant’s ability to assess the counterparty credit risk a participant incurs indirectly through the clearing chain. Where transparency is impaired, market participants may not be able to accurately identify, measure, and manage their counterparty risk exposure. This opaqueness could then create an undesirable level of aggregate risk in the Treasury SFT market.

Next Steps

The TMPG awaits more public feedback on the white paper. Based on that feedback, the TMPG expects to finalize the white paper and may provide further voluntary guidance on clearing and settlement best practices.

Adam Copeland is a financial research advisor in Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Frank Keane is a policy and market-monitoring advisor in the Federal Reserve Bank of New York’s Markets Group.

Jenny Phan is a capital markets trading principal in the Federal Reserve Bank of New York’s Markets Group.

How to cite this post:

Adam Copeland, Frank Keane, and Jenny Phan, “Are There Too Many Ways to Clear and Settle Secured Financing Transactions?,” Federal Reserve Bank of New York Liberty Street Economics, May 8, 2023, https://libertystreeteconomics.newyorkfed.org/2023/05/are-there-too-many-ways-to-clear-and-settle-secured-financing-transactions/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics