Daily investment at the Federal Reserve’s Overnight Reverse Repo (ON RRP) facility increased from a few billion dollars in March 2021 to more than $2.3 trillion in June 2022 and has stayed above $2 trillion since then. In this post, which is based on a recent staff report, we discuss two channels—a deposit channel and a wholesale short-term debt channel—through which banks’ balance-sheet costs have increased investment by money market mutual funds (MMFs) in the ON RRP facility.

Banks’ Balance-Sheet Costs

In response to the COVID-19 pandemic, the Federal Reserve rapidly expanded its balance sheet, sharply increasing banks’ reserve balances and therefore tightening the constraints based on the size of their balance sheets. One of these constraints is the Supplementary Leverage Ratio (SLR), the U.S. implementation of the Basel III leverage ratio, which became effective in January 2018. The SLR limits banks’ leverage by requiring them to hold capital greater than a fixed proportion of their assets. Like all capital ratios, the SLR disincentivizes banks from expanding their balance sheets by issuing more debt, either in the form of deposits or in the form of wholesale funding; in other words, the SLR introduces a cost for banks based on the size of their balance sheets. Since the SLR treats all assets in the same way regardless of their riskiness, a balance-sheet expansion becomes particularly costly if it is used to finance very safe assets with low returns, such as reserves and Treasuries.

To facilitate financial intermediation by banks during the COVID-19 crisis, starting in April 2020 for bank holding companies and in June 2020 for depository institutions, the Federal Reserve excluded central bank reserves and U.S. Treasury securities from the SLR calculation. The temporary measure reduced regulatory pressure on the size of banks’ balance sheets. When the measure expired on March 31, 2021, Treasury securities and reserves were again included in the SLR calculation, increasing banks’ balance-sheet costs relative to the relief period. Our research shows that these tighter balance-sheet constraints increased MMFs’ investment at the ON RRP facility through a deposit channel and through a wholesale short-term debt channel.

Banks Push Deposits Toward Affiliated MMFs

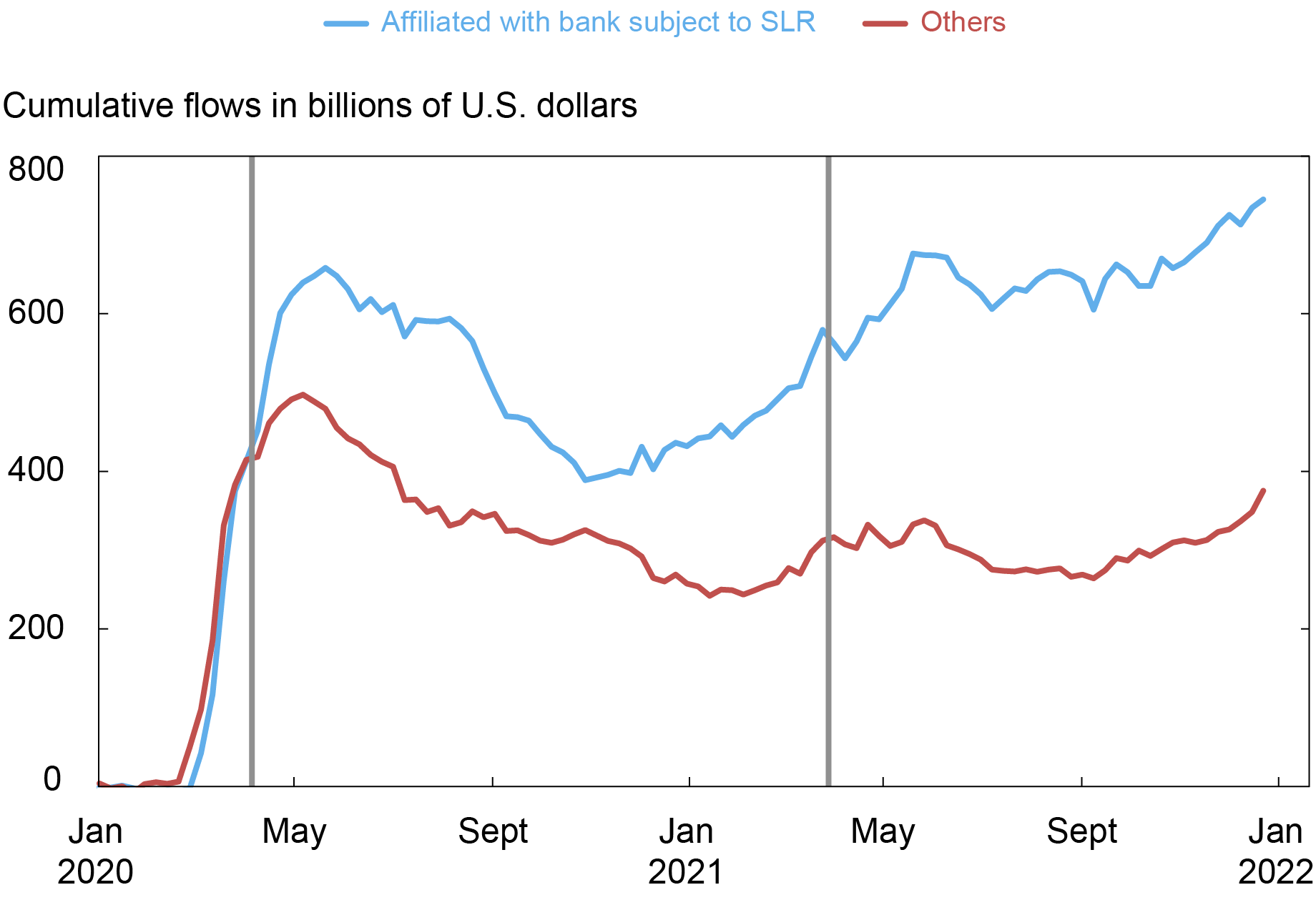

Following the expiration of the SLR relief, banks subject to the SLR had an incentive to respond to the increase in balance-sheet costs by pushing deposits toward their affiliated MMFs (for example, MMFs sponsored by an asset manager belonging to the same bank-holding company). These affiliated MMFs should have therefore seen greater inflows after March 2021 compared to MMFs that are not affiliated with banks subject to the SLR. Indeed, the chart below shows that after the SLR relief expired, MMFs affiliated with banks subject to SLR grew larger relative to other MMFs.

MMFs Affiliated with Banks Subject to the SLR Experienced Greater Inflows after the SLR Relief

Note: The vertical lines represent the start and end of the SLR relief for bank holding companies.

We exploit the variation in the SLR calculation introduced by the 2020-21 relief program to identify, through a set of regressions, the effect of banks’ balance-sheet constraints on MMFs’ assets under management (AUM). We find that, on average, an MMF affiliated with a bank subject to the SLR grew $2.7 billion more than a non-affiliated MMF after the SLR relief period. The effect is stronger for government funds (which are closer substitutes for bank deposits than prime funds) and for funds eligible to invest in the ON RRP (which can easily accommodate large inflows by placing cash at the facility). To highlight how the tightness of the SLR constraint affects inflows to MMFs after the SLR-relief period, we additionally show that MMFs affiliated with banks closer to their SLR requirement experienced greater inflows.

Banks Reduce Borrowing from MMFs

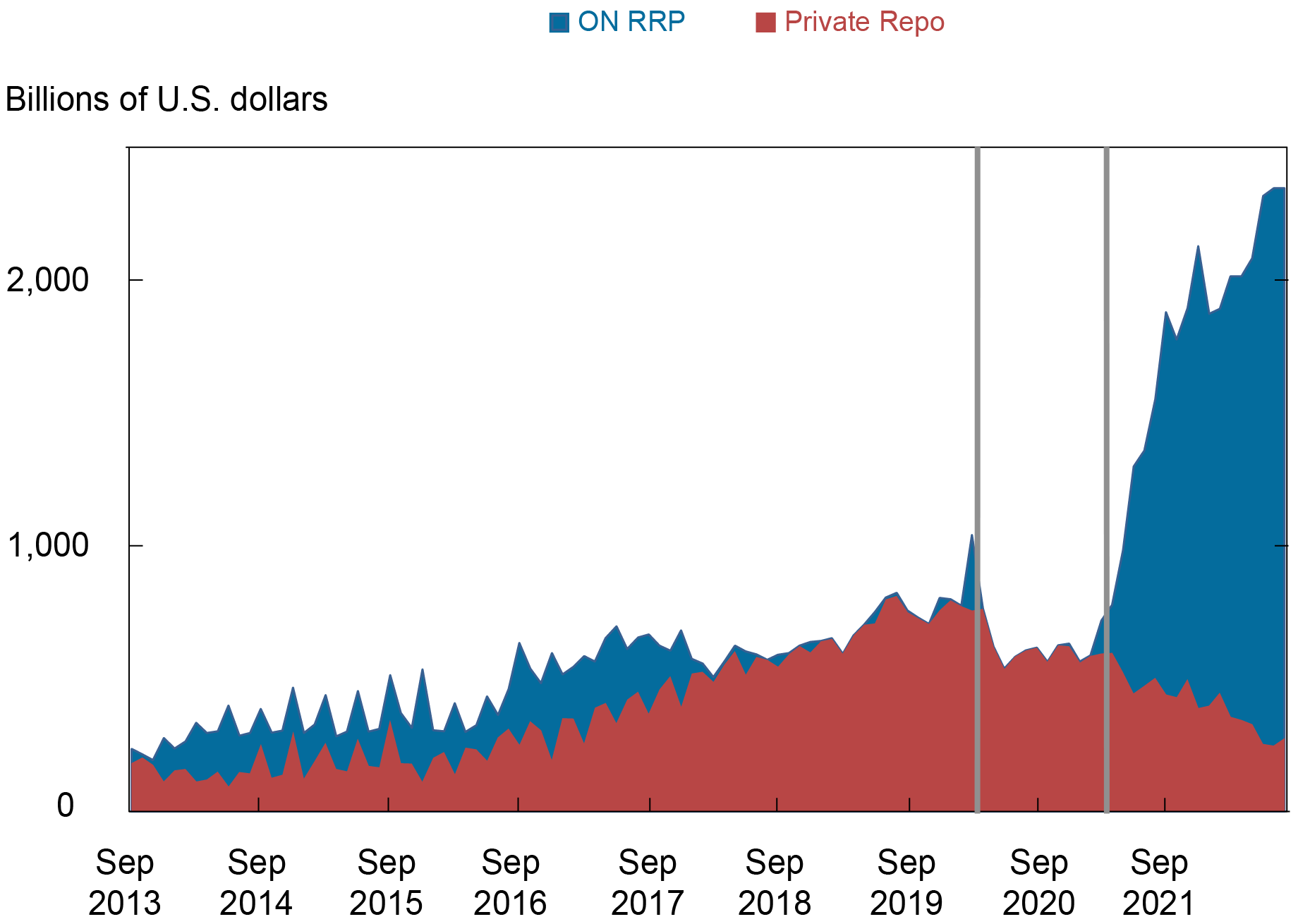

Banks’ balance-sheet constraints also limit MMFs’ investment options by reducing banks’ incentives to borrow in the wholesale funding market. Banks and especially dealers affiliated with bank holding companies are key intermediaries in the repo market, obtaining a significant proportion of their funding from MMFs. From the perspective of MMFs, banks’ repos are an important investment option. If tighter balance-sheet constraints incentivize banks to reduce their issuance of wholesale short-term debt securities, including overnight repos, MMFs may turn to alternative, yet similar, investment opportunities, such as the ON RRP. Indeed, the next chart shows that, while MMFs’ ON RRP usage increased substantially after the expiration of the SLR relief, MMFs’ holdings of Treasury-backed private repos—which are mainly issued by banks and dealers affiliated with bank holding companies—decreased.

After the SLR Relief, Private Repos In MMF Portfolios Declined, while ON RRP Investment Increased

Notes: Volumes include Treasury-backed repos, which account for roughly 70 percent of total MMF repo lending from 2013-21. The vertical lines represent the start and end of the SLR relief for bank holding companies.

To identify the impact of banks’ balance-sheet costs on MMFs’ ON RRP investment through the wholesale short-term funding channel, we exploit the fact that a reduction in banks’ supply of repos affects government funds more than prime funds, since government funds can only lend to private counterparties via repos. This portfolio restriction, in practice, constrains government funds to only lend to banks and their affiliated dealers as banks and dealers are the main repo borrowers among the set of MMF counterparties. Prime funds, in contrast, can also lend to non-financial corporations and local governments. In a regression setting, we show that the share of ON RRP investment in the portfolio of government funds increased by 19 percentage points more than that of prime funds after the SLR relief ended. If we measure MMFs’ dependence on private repos based on their actual portfolio allocations before 2020, we find a similar result: a 10-percentage-point increase in the share of private repos in an MMF’s fourth-quarter 2019 portfolio increases the share of ON RRP investment in the fund’s post-relief portfolio by 3.9 percentage points. Both regression results point to the impact of banks’ balance-sheet constraints on the investment choices of MMFs.

Summing Up

In this post, we explore how banks’ balance-sheet constraints impact MMFs’ investment in the ON RRP facility. We identify two channels: a deposit channel and a wholesale short-term debt channel. Through the deposit channel, constrained banks push excess deposits into affiliated MMFs, causing an increase in the size of the MMF industry and, therefore, in its ON RRP usage. Through the wholesale short-term debt channel, constrained banks also reduce their demand for wholesale short-term borrowing, causing MMFs to replace their private repo lending to banks with ON RRP investment.

Gara Afonso is the head of Banking Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Cipriani is head of Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Catherine Huang is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gabriele La Spada is a financial research economist in Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Gara Afonso, Marco Cipriani, Catherine Huang, and Gabriele La Spada, “Banks’ Balance‑Sheet Costs and ON RRP Investment,” Federal Reserve Bank of New York Liberty Street Economics, May 18, 2023, https://libertystreeteconomics.newyorkfed.org/2023/05/banks-balance-sheet-costs-and-on-rrp-investment/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

In end, qt didn’t have effect as liquidity flowed to mmf instead of thru banks? Also, is there a shortage of treasures as banks hold in lieu of cash on balance sheet? Excellent work again, thanks!!!