Shortly after the collapse of Silicon Valley Bank (SVB) in March 2023, a consortium of eleven large U.S. financial institutions deposited $30 billion into First Republic Bank to bolster its liquidity and assuage panic among uninsured depositors. In the end, however, First Republic Bank did not survive, raising the question of whether a reallocation of liquidity among financial institutions can ever reduce the need for central bank balance sheet expansion in the fight against bank runs. We explore this question in this post, based on a recent working paper.

Our Model

The theoretical laboratory for questions about bank runs is the Nobel‑winning model of Diamond and Dybvig (1983), where a representative bank is susceptible to runs by patient depositors who do not need to withdraw early but may choose to do so. We add to this model many banks with differing cash positions and an interbank market where banks can lend to each other to study the scope for effective liquidity reallocation in the face of depositor withdrawals.

As is common in bank-run models, the actions of patient depositors depend on their beliefs about what other patient depositors will do. The original Diamond-Dybvig framework has two equilibria: one where the bank fails because patient depositors believe that enough other patient depositors will withdraw early and one where the bank survives because patient depositors believe that enough other patient depositors will not withdraw early.

Our model with multiple banks admits an interesting equilibrium in between these two cases, where some but not all banks fail. If an individual bank can borrow enough on the interbank market to honor withdrawals by all its depositors, then the bank is run-proof and its patient depositors should not withdraw early, regardless of what other patient depositors do. This motivates us to consider as a benchmark a “conservative equilibrium” where patient depositors believe that all other patient depositors will withdraw early if and only if the bank is not run-proof at the prevailing interest rate for interbank loans.

The Case for Intervention

The interbank rate plays a critical role in the model outlined above. Specifically, the rate is critical to how many banks fail and how many survive because it affects depositor assessment of individual bank solvency. If total liquidity in the system is high relative to the needs of impatient depositors who experience shocks and must withdraw early, then supply and demand forces in the interbank market deliver an interest rate that is low enough for all banks to be run-proof. As the needs of impatient depositors rise relative to total liquidity, the interest rate in the interbank market also rises. The higher the interbank rate, the more expensive it is to obtain additional liquidity to honor early withdrawals by patient depositors. The marginal bank that could withstand a run by borrowing on the interbank market can no longer do so profitably, as the amount it needs to borrow is too high to be fully repaid at the higher interest rate. The minimum level of initial cash that a bank must have to be run-proof thus rises, as does the number of failing banks.

This relationship between the interbank rate and the number of bank failures when liquidity conditions are tight implies an important externality. If a bank were to lend (more) on the interbank market, the interest rate would fall and increase the number of run-proof banks. This positive effect is not internalized by a bank choosing how much to lend, leading to too many bank failures compared to what could be achieved with more interbank lending.

A Blueprint for Intervention

Understanding that the problem is insufficient lending among banks, a central planner would design a system of taxes and transfers that pulls liquidity away from some banks and redistributes it to others. The attempt at liquidity reallocation by the consortium of large U.S. financial institutions in March 2023 had a similar flavor. Among these institutions were banks that had likely experienced inflows from depositors running from SVB, so cash was effectively being redistributed from SVB to First Republic Bank. However, this redistribution occurred slowly and unsystematically. What exactly does the planner’s more effective system look like? Under certain conditions, we find that it mimics a system of centrally allocated IOUs (“I Owe Yous”) that overrides the decentralized market.

To fix ideas, suppose the planner allows some banks to issue IOUs to other banks and dictates that these IOUs must be accepted when issued. The planner only allows IOUs to be issued by banks that can ultimately repay them in cash, with the planner also setting the interest rate for repayment. The IOUs cannot be used to honor withdrawals away from the banking system, which are the withdrawals implicit in Diamond-Dybvig and hence the withdrawals we have focused on so far. Instead, the IOUs can be used to honor withdrawals out of one bank and into another, which are additional withdrawals that can exist in an environment with many banks such as ours. These “within-system” withdrawals arise most simply from checks written by depositors at one bank to depositors at another, but they could also reflect transfers between banks from the settlement of derivatives contracts.

A simple example illustrates how these IOUs reallocate liquidity. Imagine that depositors at Bank A write $100 worth of checks to depositors at Bank B. Instead of delivering cash, Bank A can issue $100 in IOUs to Bank B, deferring cash settlement to a later date. If the interest rate on IOUs is 5 percent, then Bank A will pay Bank B $105 in cash at this later date. By allowing Bank A to issue IOUs, the planner has elicited a loan of $100 from Bank B, which may not have occurred in the decentralized market because of the externality described earlier.

We demonstrate that IOUs can be allocated to a subset of banks to achieve a better outcome than a decentralized market when within-system withdrawals are large in volume and generate most of the cross-sectional variation in banks’ cash positions before depositors begin to withdraw away from the system. By eliciting more lending from some banks, the planner can set a lower interest rate than what prevails in the decentralized market and thus make more banks run-proof. While the banks that are taxed in this arrangement are incrementally worse off, the unconditional probability of bank survival is discretely higher, so banks are better off in expectation and willing to opt into the planner’s arrangement ex ante.

A Historical Precedent

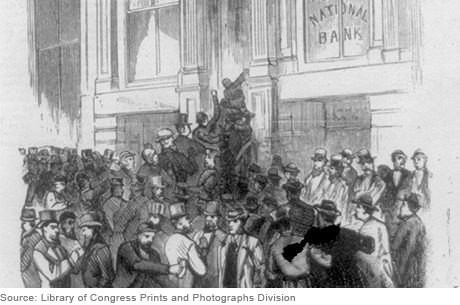

At first glance, translating these IOUs from theory to practice appears challenging. However, a close examination of the historical record reveals that an instrument with many of the same features was used by the New York Clearinghouse (NYCH) before the creation of the Federal Reserve.

The NYCH was an association of all major banks in New York City. Its primary function was to facilitate the check-clearing process, but during banking panics, it became the de facto leader in liquidity management absent a central bank. The NYCH deployed a system of loan certificates among its members at the onset of the Panic of 1873, the first major panic of the National Banking Era. These certificates resemble the IOUs in our model: They were allocated to member banks by the NYCH; allocations were limited by the amount of collateral a bank could pledge to ensure ultimate repayment; they could only be used to defer check-clearing obligations with other members; they could not be refused as interim payment for such obligations; and the interest rate at which they had to be repaid was set by the NYCH.

Calibrating our model to historical data allows us to tease out the value of these loan certificates during the Panic of 1873. Controlling for other interventions by the NYCH, we find that liquidity conditions were tight enough for loan certificates to increase social welfare by 2 percent relative to a decentralized interbank market. A 2 percent increase is notable, as it fills roughly half the gap between the decentralized equilibrium and the “first-best” level of welfare—which is an upper bound on the welfare that any policy, including a liquidity injection by a central bank, could hope to achieve.

Conclusion

In times of major banking distress, central bank liquidity injections are the first line of defense for restoring financial stability. However, our analysis suggests that a system of centrally allocated IOUs—not unlike the loan certificates deployed in New York City during the Panic of 1873—could reduce the size of the required injection by implementing a more efficient allocation of liquidity across banks and increasing bank survival rates.

Kinda Hachem is a financial research advisor in Macrofinance Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Kinda Hachem, “Reallocating Liquidity to Resolve a Crisis,” Federal Reserve Bank of New York Liberty Street Economics, August 12, 2024, https://libertystreeteconomics.newyorkfed.org/2024/08/reallocating-liquidity-to-resolve-a-crisis/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics