Immediately following the presidential election of 2016, both consumer and investor sentiments were buoyant and financial markets boomed. That these sentiments affect financial asset prices is not so surprising, given past stock market evidence and episodes such as the dot-com bubble. Perhaps more surprising, the risk of corporate default—which is driven mainly by firms’ financial health but also by bond liquidity—also fell following the election, as indicated by lower yield spreads. In this post, I show that, although expectations of better corporate and macroeconomic conditions were the primary drivers of lower credit risk, improved investor sentiment also contributed.

Investor Sentiment and Credit Risk around November 2016 Election

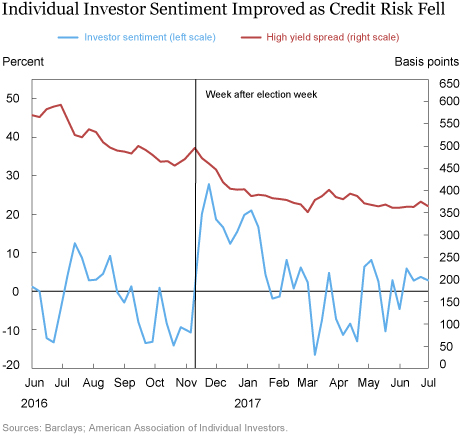

Yield spreads of high-yield (HY) corporate bonds measure, to a large extent, the additional credit risk of the bond relative to a Treasury bond. As shown below, yield spreads (red line) fell leading up to the election, increased in the two weeks just before election week, then decreased again following the election and through February 2017. Investor sentiment (blue line) is measured by the percentage of individual investors who are bullish minus the percentage who are bearish in surveys by the American Association of Individual Investors (survey-based sentiment measures are recommended). Sentiment improved sharply by 20 percentage points following election week and continued to be positive until January 2017, coinciding with the decline in yields during this period.

But Fundamentals Were Also Improving

Since investor sentiment reflects beliefs about future market movements, sentiment changes may anticipate news about the economy or firms that in turn changes credit risk. For example, improved investor sentiment in the corporate bond market may presage weaker macroeconomic performance and higher credit risk. Stronger sentiment may also reflect more positive news about companies.

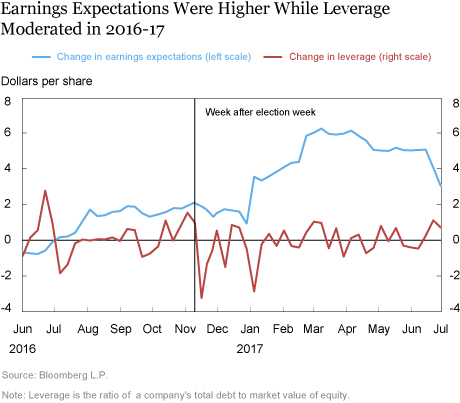

In the last months of 2016 and the beginning of 2017, positive corporate and economic news likely supported lower yield spreads. For example, the change in twelve-month ahead expectations of company earnings per share had been rising since the summer of 2016 while the ratio of debt to equity, or leverage, was steady (see the following chart).

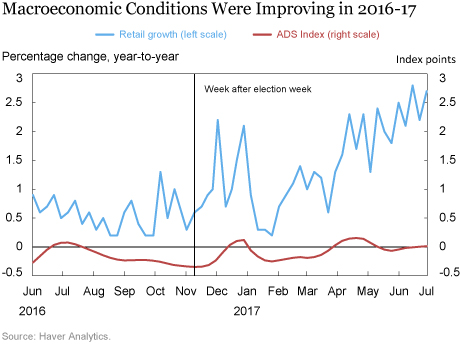

On the macroeconomic front, retail sales growth was positive and rising (see chart below). The ADS index (which tracks initial jobless claims, payroll employment, industrial production, personal income less transfer payments, manufacturing and trade sales, and quarterly real GDP) became positive in December 2016, indicative of improving macroeconomic conditions. Also, oil prices had been mostly increasing since November 2016, further contributing to lower yield spreads.

Was It All Fundamentals or Did Sentiment Also Drive Credit Risk?

So how strongly was investor sentiment associated with credit risk after accounting for firm fundamentals (that is, changes in leverage and earnings), equity volatility, and macro indicators? We regress weekly changes in the yield spread on changes in these variables and also changes in liquidity (measured by corporate bond mutual fund flows, corporate bond issuances, and bond liquidity in secondary trading markets) since improved liquidity is known to lower yield spreads.

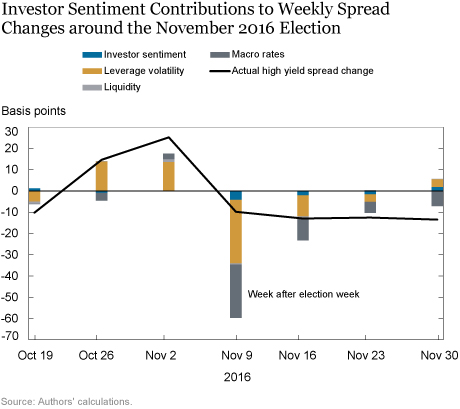

The bar chart below shows the estimated contribution to weekly changes in yield spreads of changes in leverage and volatility (gold), macro indicators (dark gray), liquidity (light gray) and sentiment (blue) along with the actual yield spread change (black line). Lower stock volatility and higher stock prices (resulting in lower market-implied leverage) following election week implied a large drop in yield spreads. Positive news on interest rates and macro indicators also drove down yield spreads. In the three weeks before election week, sentiment changes contributed minimally to yield spread changes but did so moderately during election week and in the following three weeks. However, to the extent that stock market performance was driven in part by sentiment, the contribution attributable to sentiment may have been larger.

How Long Did the Sentiment Effects Last?

The effects of investor sentiment on yield spreads continued to be apparent through the first quarter of 2017 but died out by the second quarter. Therefore, while sentiment effects were associated with the election period and pushed up bond prices for some time afterward, they may not have affected the longer-term path of bond prices.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Asani Sarkar is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Asani Sarkar is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this blog post:

Asani Sarkar, “Did Investor Sentiment Affect Credit Risk around the 2016 Election?,” Federal Reserve Bank of New York Liberty Street Economics (blog), November 29, 2017, http://libertystreeteconomics.newyorkfed.org/2017/11/did-investor-sentiment-affect-credit-risk-around-the-2016-election.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics