The Federal Reserve Bank of New York’s 2016 SCE Housing Survey indicates that home price growth expectations have declined somewhat relative to last year, but the majority of households still view housing as a good financial investment. Mortgage rate expectations have also declined since last year’s survey, and renters now perceive that it has become somewhat less difficult to get a mortgage if they wanted to buy a home.

This latest survey marks the third installment of the SCE Housing Survey, which has been fielded annually every February since 2014. With this release the New York Fed is also unveiling a new SCE Housing Survey interactive web feature, which presents time trends for variables of interest for the overall sample, as well as for various demographic groups. As in previous years, we are also releasing a detailed background report, which describes the sample and presents summary statistics for a larger number of questions.

The primary goal of the SCE Housing Survey is to provide rich and high-quality information on consumers’ experiences, behavior, and expectations related to housing. The survey, among other things, collects data on households’ home price growth perceptions and expectations, intentions regarding moving and buying in the future, and access to credit. For homeowners, we collect detailed information on their mortgage debt, past actions and experiences—such as foreclosure or refinancing—and expectations regarding future actions—such as taking out new debt or investing in the home. For renters, among other things, we elicit preferences for owning and perceptions regarding the ease of obtaining a mortgage.

We next discuss two major findings from the survey.

Home Price Expectations

We asked our survey respondents to estimate the value of a typical home in their zip code, and what they think the value of that home would be one and five years from today. Based on these responses, we can compute the expected annual change in home prices over the next one- and five-year periods, respectively. The evolution of the mean expectation over the two horizons is shown in the chart below. The mean expected change in home prices over the next one-year period in the 2016 survey is 3.3 percent, nearly a full percentage point below the mean forecast in the first two surveys. This is primarily a result of a decline in the 75th percentile of the cross-sectional distribution (which declined from 6.7 percent in the 2015 survey to 5.3 percent in the most recent release). The mean expectation over the longer horizon (five years ahead) also exhibits a similar downward trend since 2014. This decrease in the expected growth of home prices is in line with the change in the average expectations of housing market experts relative to where they stood in 2015.

Housing as an Investment

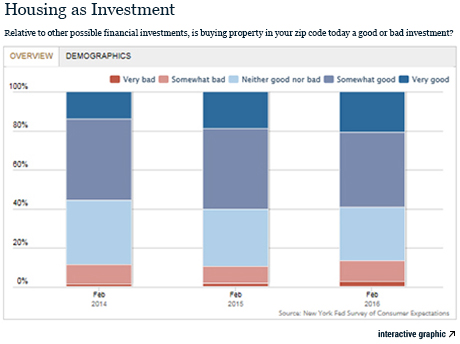

Respondents are asked to assess how good an investment buying property in their zip code would be today, on a qualitative scale (from “very good” to “very bad”). The chart below shows the distribution of responses in the three surveys.

Looking at the 2016 distribution, we see that about 60 percent of respondents think that buying property in their zip code is a (very or somewhat) good investment, and only about 13 percent think it is a bad investment. While overall attitudes toward housing continue to remain positive, a comparison of the responses with the first two surveys indicates that attitudes have become somewhat more polarized over time: the proportion of respondents who think that housing is a very good investment increased from 14 percent in 2014 to 21 percent in 2016; likewise, the proportion reporting that housing is a very bad investment rose from 1.3 percent in 2014 to 2.9 percent in 2016.

The SCE Housing Survey is the third product under the Survey of Consumer Expectations umbrella, following the monthly SCE release, and the Credit Access Survey. We plan to continue fielding the survey every February.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Andreas Fuster is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Basit Zafar is a research officer in the Bank’s Research and Statistics Group.

Kevin Morris is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this blog post:

Andreas Fuster, Basit Zafar, and Kevin Morris, “Just Released: 2016 SCE Housing Survey Shows Modest Decline in Home Price Expectations,” Federal Reserve Bank of New York Liberty Street Economics (blog), June 2, 2016, http://libertystreeteconomics.newyorkfed.org/2016/05/just-released-2016-sce-housing-survey-shows-modest-decline-in-home-price-expectations.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics