Anatomy of the Bank Runs in March 2023

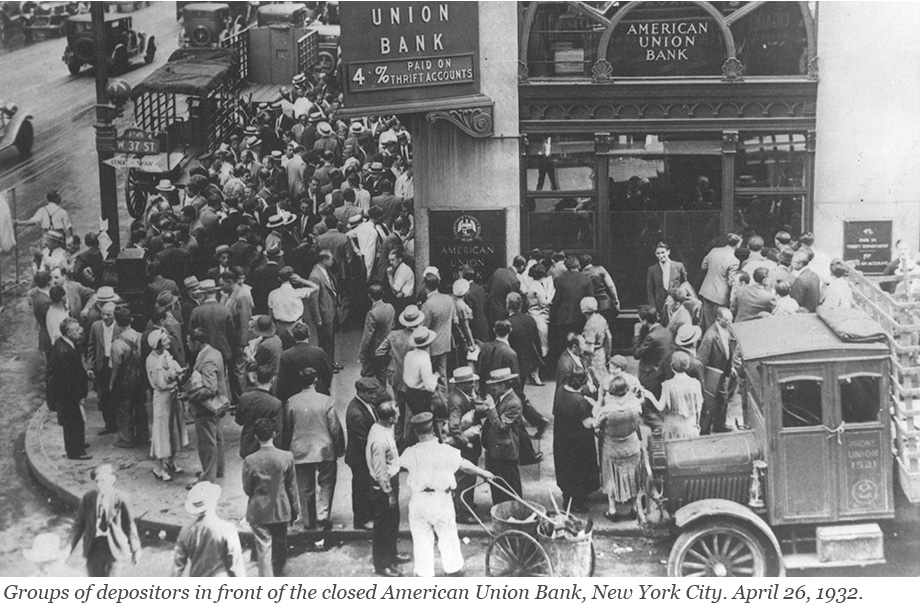

Runs have plagued the banking system for centuries and returned to prominence with the bank failures in early 2023. In a traditional run—such as depicted in classic photos from the Great Depression—depositors line up in front of a bank to withdraw their cash. This is not how modern bank runs occur: today, depositors move money from a risky to a safe bank through electronic payment systems. In a recently published staff report, we use data on wholesale and retail payments to understand the bank run of March 2023. Which banks were run on? How were they different from other banks? And how did they respond to the run?

Why Do Banks Fail? The Predictability of Bank Failures

Can bank failures be predicted before they happen? In a previous post, we established three facts about failing banks that indicated that failing banks experience deteriorating fundamentals many years ahead of their failure and across a broad range of institutional settings. In this post, we document that bank failures are remarkably predictable based on simple accounting metrics from publicly available financial statements that measure a bank’s insolvency risk and funding vulnerabilities.

Reallocating Liquidity to Resolve a Crisis

Shortly after the collapse of Silicon Valley Bank (SVB) in March 2023, a consortium of eleven large U.S. financial institutions deposited $30 billion into First Republic Bank to bolster its liquidity and assuage panic among uninsured depositors. In the end, however, First Republic Bank did not survive, raising the question of whether a reallocation of liquidity among financial institutions can ever reduce the need for central bank balance sheet expansion in the fight against bank runs. We explore this question in this post, based on a recent working paper.

The Anatomy of Labor Demand Pre‑ and Post‑COVID

Has labor demand changed since the COVID-19 pandemic? In this post, we leverage detailed data on the universe of U.S. online job listings to study the dynamics of labor demand pre- and post-COVID. We find that there has been a significant shift in listings out of the central cities and into the “fringe” portion of large metro areas, smaller metro areas, and rural areas. We also find a substantial decline in job listings in computer and mathematical and business and financial operations occupations, and a corresponding increase in job openings in sales, office and administrative support, food preparation, and especially healthcare occupations. These patterns (by geography and by occupation) are interconnected: the biggest declines in job listings by occupation occurred in the largest and densest geographies, and the strongest increases in job listings by occupation occurred in the smaller and less populated geographies.

Do Economic Crises in Europe Affect the U.S.? Some Lessons from the Past Three Decades

In this post we summarize the main results of our contribution to a recent e-book, “The Making of the European Monetary Union: 30 years since the ERM crisis,” on the economic and financial crises in Europe since 1992-93, and focus on the spillovers of those crises onto the United States and the global economy. We find that the answer to the question in the title of this post is a (moderate) yes.

Measuring the Financial Stability Real Interest Rate, r**

Comparing our financial stability real interest rate, r** (“r-double-star”) with the prevailing real interest rate gives a measure of how vulnerable the economy is to financial instability. In this post, we first explain how r** can be measured, and then discuss its evolution over the last fifty years and how to interpret the recent banking turmoil within this framework.

Banks Runs and Information

The collapse of Silicon Valley Bank (SVB) and Signature Bank (SB) has raised questions about the fragility of the banking system. One striking aspect of these bank failures is how the runs that preceded them reflect risks and trade-offs that bankers and regulators have grappled with for many years. In this post, we highlight how these banks, with their concentrated and uninsured deposit bases, look quite similar to the small rural banks of the 1930s, before the creation of deposit insurance. We argue that, as with those small banks in the early 1930s, managing the information around SVB and SB’s balance sheets is of first-order importance.

Financial Fragility without Banks

Proponents of narrow banking have argued that lender of last resort policies by central banks, along with deposit insurance and other government interventions in the money markets, are the primary causes of financial instability. However, as we show in this post, non-bank financial institutions (NBFIs) triggered a financial crisis in 1772 even though the financial system at that time had few banks and deposits were not insured. NBFIs profited from funding risky, longer-dated assets using cheap short-term wholesale funding and, when they eventually failed, authorities felt compelled to rescue the financial system.

Mitigating the Risk of Runs on Uninsured Deposits: the Minimum Balance at Risk

The incentives that drive bank runs have been well understood since the seminal work of Nobel laureates Douglas Diamond and Philip Dybvig (1983). When a bank is suspected to be insolvent, early withdrawers can get the full value of their deposits. If and when the bank runs out of funds, however, the bank cannot pay remaining depositors. As a result, all depositors have an incentive to run. The failures of Silicon Valley Bank and Signature Bank remind us that these incentives are still present for uninsured depositors, that is, those whose bank deposits are larger than deposit insurance limits. In this post, we discuss a policy proposal to reduce uninsured depositors’ incentives to run.

The Global Dash for Cash in March 2020

The economic disruptions associated with the COVID-19 pandemic sparked a global dash-for-cash as investors sold securities rapidly. This selling pressure occurred across advanced sovereign bond markets and caused a deterioration in market functioning, leading to a number of central bank actions. In this post, we highlight results from a recent paper in which we show that these disruptions occurred disproportionately in the U.S. Treasury market and offer explanations for why investors’ selling pressures were more pronounced and broad-based in this market than in other sovereign bond markets.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics