Why Do Banks Fail? The Predictability of Bank Failures

Can bank failures be predicted before they happen? In a previous post, we established three facts about failing banks that indicated that failing banks experience deteriorating fundamentals many years ahead of their failure and across a broad range of institutional settings. In this post, we document that bank failures are remarkably predictable based on simple accounting metrics from publicly available financial statements that measure a bank’s insolvency risk and funding vulnerabilities.

Why Do Banks Fail? Three Facts About Failing Banks

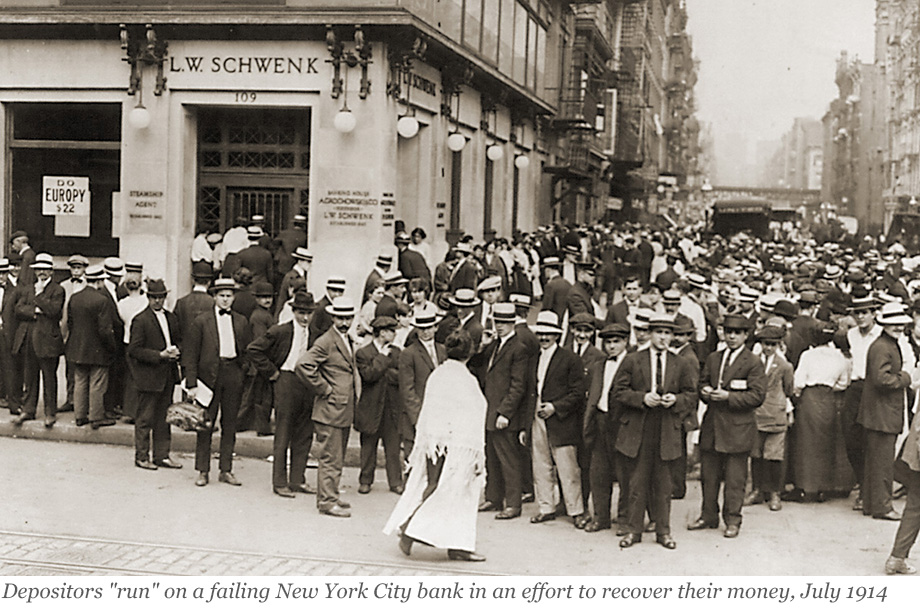

Why do banks fail? In a new working paper, we study more than 5,000 bank failures in the U.S. from 1865 to the present to understand whether failures are primarily caused by bank runs or by deteriorating solvency. In this first of three posts, we document that failing banks are characterized by rising asset losses, deteriorating solvency, and an increasing reliance on expensive noncore funding. Further, we find that problems in failing banks are often the consequence of rapid asset growth in the preceding decade.

Banking System Vulnerability: 2024 Update

After a period of relative stability, a series of bank failures in 2023 renewed questions about the fragility of the banking system. As in previous years, we provide in this post an update of four analytical models aimed at capturing different aspects of the vulnerability of the U.S. banking system using data through 2024:Q2 and discuss how these measures have changed since last year.

Can I Speak to Your Supervisor? The Importance of Bank Supervision

In March of 2023, the U.S. banking industry experienced a period of significant turmoil involving runs on several banks and heightened concerns about contagion. While many factors contributed to these events—including poor risk management, lapses in firm governance, outsized exposures to interest rate risk, and unrecognized vulnerabilities from interconnected depositor bases, the role of bank supervisors came under particular scrutiny. Questions were raised about why supervisors did not intervene more forcefully before problems arose. In response, supervisory agencies, including the Federal Reserve and Federal Deposit Insurance Corporation, commissioned reviews that examined how supervisors’ actions might have contributed to, or mitigated, the failures. The reviews highlighted the important role that bank supervisors can play in fostering a stable banking system. In this post, we draw on our recent paper providing a critical review and summary of the empirical and theoretical literature on bank supervision to highlight what that literature tells us about the impact of supervision on supervised banks, on the banking industry and on the broader economy.

A Retrospective on the Life Insurance Sector after the Failure of Silicon Valley Bank

Following the Silicon Valley Bank collapse, the stock prices of U.S banks fell amid concerns about the exposure of the banking sector to interest rate risk. Thus, between March 8 and March 15, 2023, the S&P 500 Bank index dropped 12.8 percent relative to S&P 500 returns (see right panel of the chart below). The stock prices of insurance companies tumbled as well, with the S&P 500 Insurance index losing 6.4 percent relative to S&P 500 returns over the same time interval (see the center panel below). Yet, insurance companies’ direct exposure to the three failed banks (Silicon Valley Bank, Silvergate, and Signature Bank) through debt and equity was modest. In this post, we examine the possible factors behind the reaction of insurance investors to the failure of Silicon Valley Bank.

Internal Liquidity’s Value in a Financial Crisis

A classic question for U.S. financial firms is whether to organize themselves as entities that are affiliated with a bank-holding company (BHC). This affiliation brings benefits, such as access to liquidity from other affiliated entities, as well as costs, particularly a larger regulatory burden. This post highlights the results from a recent Staff Report that sheds light on this tradeoff. This work uses confidential data on the population of broker-dealers to study the benefits of being affiliated with a BHC, with a focus on the global financial crisis (GFC). The analysis reveals that affiliation with a BHC makes broker-dealers more resilient to the aggregate liquidity shocks that prevailed during the GFC. This results in these broker-dealers being more willing to hold riskier securities on their balance sheet relative to broker-dealers that are not affiliated with a BHC.

Physical Climate Risk and Insurers

As the frequency and severity of natural disasters increase with climate change, insurance—the main tool for households and businesses to hedge natural disaster risks—becomes increasingly important. Can the insurance sector withstand the stress of climate change? To answer this question, it is necessary to first understand insurers’ exposure to physical climate risk, that is, risks coming from physical manifestations of climate change, such as natural disasters. In this post, based on our recent staff report, we construct a novel factor to measure the aggregate physical climate risk in the financial market and discuss its applications, including the assessment of insurers’ exposure to climate risk and the expected capital shortfall of insurers under climate stress scenarios.

Learning by Bouncing: Overdraft Experience and Salience

Overdraft credit, when banks and credit unions allow customers to spend more than their checking account holds, has many critics. One fundamental concern is whether overdrafts are salient—whether account holders know how often they overdraw and how much it costs them. To shed light on this question, we asked participants in the New York Fed’s Survey of Consumer Expectations about their experience with and knowledge of their banks’ overdraft programs. The large majority knew how often they overdrew their account and by how much. Their overdraft experience, we find, begets knowledge; of respondents who overdrew their account in the previous year, 84 percent knew the fee they were charged, roughly twice the share for other respondents. However, even experienced overdrafters were relatively unaware of other overdraft terms and practices, such as the maximum overdraft allowed or whether their financial institution processed larger transactions first.

Banking System Vulnerability: 2023 Update

The bank failures that occurred in March 2023 highlighted how unrealized losses on securities can make banks vulnerable to a sudden loss of funding. This risk, which materialized following the rapid rise in interest rates that began in early 2022, underscores the importance of monitoring the vulnerabilities of the banking system. In this post, as in previous years, we provide an update of four analytical models aimed at capturing different aspects of vulnerability of the U.S. banking system, with data through the second quarter of 2023. In addition, we discuss changes made to the methodology based on the lessons from March 2023 and assess how the system-level vulnerability has evolved.

How Exposed Are U.S. Banks’ Loan Portfolios to Climate Transition Risks?

Much of the work on climate risk has focused on the physical effects of climate change, with less attention devoted to “transition risks” related to negative economic effects of enacting climate-related policies and phasing out high-emitting technologies. Further, most of the work in this area has measured transition risks using backward-looking metrics, such as carbon emissions, which does not allow us to compare how different policy options will affect the economy. In a recent Staff Report, we capitalize on a new measure to study the extent to which banks’ loan portfolios are exposed to specific climate transition policies. The results show that while banks’ exposures are meaningful, they are manageable.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics