Dealer Balance Sheets and Corporate Bond Liquidity Provision

At the N.Y. Fed: The Evolution of OTC Derivatives Markets

Advent of Trade Reporting for U.S. Treasury Securities

Greater transparency is coming to the U.S. Treasury securities market. Members of the Financial Industry Regulatory Authority (FINRA) will be required to report their trades in Treasuries using FINRA’s Trade Reporting and Compliance Engine (TRACE) starting July 10, 2017. Although initial collection efforts are focused on providing such data to the official sector, the public will likely have access in the future. In this post, I discuss the motivation for such reporting, how it came to be decided on, and the evidence from the corporate bond market on how public access to such data affects trading costs.

Credit Market Arbitrage and Regulatory Leverage

At the N.Y. Fed: Capital Flows, Policy Dilemmas, and the Future of Global Financial Integration

The New York Fed recently hosted the third bi-annual Global Research Forum on International Macroeconomics and Finance, an event organized in conjunction with the European Central Bank (ECB) and the Federal Reserve Board. Bringing together a diverse group of academics, policymakers, and market participants, the two-day conference (November 17-18) was aimed at promoting discussion of frontier research on empirical and theoretical issues in international finance, banking, and open-economy macroeconomics. Understanding the drivers and implications of international capital flows was a major area of focus, along with the policy challenges posed by global financial integration.

Are All CLOs Equal?

Stavros Peristiani and João A.C. Santos Asset securitization is an important source of corporate funding in capital markets. Collateralized loan obligations (CLOs) are securitization structures that allow syndicated bank lenders and bond underwriters to repackage business loans and sell them to investors as securities. CLOs are actively overseen by a collateral manager that has the […]

At the N.Y. Fed: Second Annual Conference on the Evolving Structure of the U.S. Treasury Market

The New York Fed recently hosted a second conference on the evolving structure of the Treasury market, co-sponsored with the U.S. Department of the Treasury, the Federal Reserve Board, the U.S. Securities and Exchange Commission (SEC), and the U.S. Commodity Futures Trading Commission (CFTC). The conference reviewed developments in the Treasury market since the Joint Staff Report on the “flash rally” of October 15, 2014, and the preceding year’s conference on the evolving structure of the Treasury market, including advances related to transaction data reporting and official perspectives on rules and regulations.

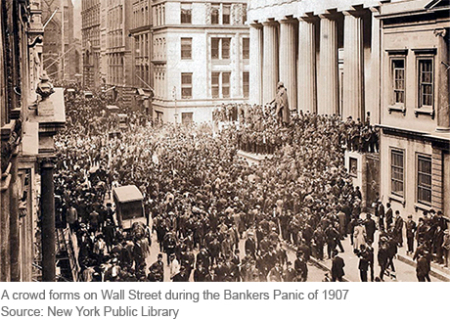

The Final Crisis Chronicle: The Panic of 1907 and the Birth of the Fed

The panic of 1907 was among the most severe we’ve covered in our series and also the most transformative, as it led to the creation of the Federal Reserve System. Also known as the “Knickerbocker Crisis,” the panic of 1907 shares features with the 2007-08 crisis, including “shadow banks” in the form high-flying, less-regulated trusts operating beyond the safety net of the time, and a pivotal “Lehman moment” when Knickerbocker Trust, the second-largest trust in the country, was allowed to fail after J.P. Morgan refused to save it.

Performance Bonds for Bankers: Taking Aim at Misconduct

Given the long list of problems that have emerged in banks over the past several years, it is time to consider performance bonds for bankers. Performance bonds are used to ensure that appropriate actions are taken by a party when monitoring or enforcement is expensive. A simple example is a security deposit on an apartment rental. The risk of losing the deposit motivates renters to take care of the apartment, relieving the landlord of the need to monitor the premises. Although not quite as simple as a security deposit, performance bonds for bankers could provide more incentive for bankers to take better care of our financial system.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics