Anatomy of the Bank Runs in March 2023

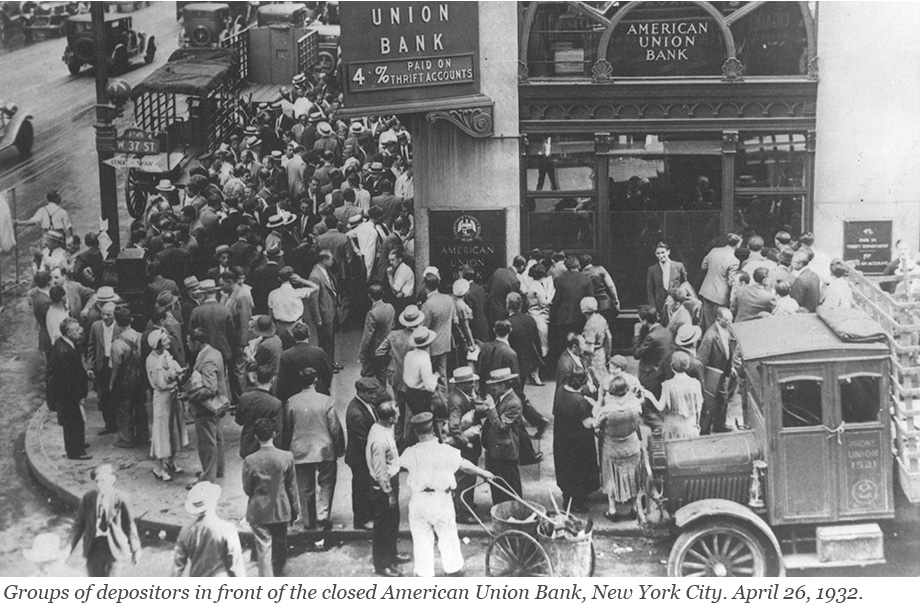

Runs have plagued the banking system for centuries and returned to prominence with the bank failures in early 2023. In a traditional run—such as depicted in classic photos from the Great Depression—depositors line up in front of a bank to withdraw their cash. This is not how modern bank runs occur: today, depositors move money from a risky to a safe bank through electronic payment systems. In a recently published staff report, we use data on wholesale and retail payments to understand the bank run of March 2023. Which banks were run on? How were they different from other banks? And how did they respond to the run?

The Recent Rise in Discount Window Borrowing

The Federal Reserve’s primary credit program—offered through its “discount window” (DW)—provides temporary short-term funding to fundamentally sound banks. Historically, loan activity has been low during normal times due to a variety of factors, including the DW’s status as a back-up source of liquidity with a relatively punitive interest rate, the stigma attached to DW borrowing from the central bank, and, since 2008, elevated levels of reserves in the banking system. However, beginning in 2022, DW borrowing under the primary credit program increased notably in comparison to past years. In this post, we examine the factors that may have contributed to this recent trend.

Securing Secured Finance: The Term Asset‑Backed Securities Loan Facility

The asset-backed securities (ABS) market, by supporting loans to households and businesses such as credit card and student loans, is essential to the flow of credit in the economy. The COVID-19 pandemic disrupted this market, resulting in higher interest rate spreads on ABS and halting the issuance of most ABS asset classes. On March 23, 2020, the Fed established the Term Asset-Backed Securities Loan Facility (TALF) to facilitate the issuance of ABS backed by a variety of loan types including student loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA), thereby re-enabling the flow of credit to households and businesses of all sizes. In this post, we describe how the TALF works, its impact on market conditions, and how it differs from the TALF that the Fed established in 2009.

Is Stigma Attached to the European Central Bank’s Marginal Lending Facility?

The European Central Bank (ECB)’s marginal lending facility has been used by banks to borrow funds both in normal times and during the crisis that started in 2007. In this post, we argue that how a central bank communicates the purpose of a facility is important in determining how users of the facility are perceived. In particular, the ECB never refers to the marginal lending facility as a back-up source of funds. The ECB’s neutral approach may be a key factor in explaining why financial institutions are less reluctant to use the marginal lending facility than the Fed’s discount window.

Which Dealers Borrowed from the Fed’s Lender‑of‑Last‑Resort Facilities?

Crisis Chronicles: Railway Mania, the Hungry Forties, and the Commercial Crisis of 1847

Money was plentiful in the United Kingdom in 1842, and with low yields on government bonds and railway shares paying handsome dividends, the desire to speculate spread—as one observer put it, “the contagion passed to all, and from the clerk to the capitalist the fever reigned uncontrollable and uncontrolled” (Francis’s History of the Bank of England).

Crisis Chronicles: The Panic of 1825 and the Most Fantastic Financial Swindle of All Time

Centered in London, the banking panic of 1825 has been called the first modern financial crisis, the first Latin American crisis, and the first emerging market crisis. And while the panic displayed many of the key elements of past crises we have covered—fluctuations in money growth, an investment bubble, a stock market crash, and bank runs—this crisis had its own twists, including a Bank of England that hesitated before stepping in as lender of last resort. But it is perhaps best known for an infamous bond market swindle surrounding an entirely made-up Central American principality. In this edition of Crisis Chronicles, we explore the Panic of 1825 and visit the mythical nation of Poyais.

How Liquidity Standards Can Improve Lending of Last Resort Policies

Prior to the Great Recession, the focus of bank regulation was on bank capital with little consensus about the need for liquidity regulation.

Uncertainty, Liquidity Hoarding, and Financial Crises

One of the most interesting phenomena marking the recent financial crisis were the disruptions in the interbank market, where banks borrow and lend reserves to each other.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics