Financial Vulnerability and Macroeconomic Fragility

What is the effect of a hike in interest rates on the economy? Building on recent research, we argue in this post that the answer to this question very much depends on how vulnerable the financial system is. We measure financial vulnerability using a novel concept—the financial stability interest rate r** (or “r-double-star”)—and show that, empirically, the economy is more sensitive to shocks when the gap between r** and current real rates is small or negative.

CRISK: Measuring the Climate Risk Exposure of the Financial System

A growing number of climate-related policies have been adopted globally in the past thirty years (see chart below). The risk to economic activity from changes in policies in response to climate risks, such as carbon taxes and green subsidies, is often referred to as transition risk. Transition risk can adversely affect the real economy through […]

Monitoring Banks’ Exposure to Nonbanks: The Network of Interconnections Matters

The first post in this series discussed the potential exposure of banks to the open-end funds sector, by virtue of commonalities in asset holdings that expose banks to balance sheet losses in the event of an asset fire sale by these funds. In this post, we summarize the findings reported in a recent paper of ours, in which we expand the analysis to consider a broad cross section of non-bank financial institution (NBFI) segments. We unveil an innovative monitoring insight: the network of interconnections across NBFI segments and banks matters. For example, certain nonbank institutions may not have a meaningful asset overlap with banks, but their fire sales could nevertheless represent a vulnerability for banks because their assets overlap closely with other NBFIs that banks are substantially exposed to.

Banking System Vulnerability: 2022 Update

To assess the vulnerability of the U.S. financial system, it is important to monitor leverage and funding risks—both individually and in tandem. In this post, we provide an update of four analytical models aimed at capturing different aspects of banking system vulnerability with data through 2022:Q2, assessing how these vulnerabilities have changed since last year. The four models were introduced in a Liberty Street Economics post in 2018 and have been updated annually since then.

Federal Reserve System Conference on the Financial Stability Considerations for Monetary Policy

How does monetary policy affect financial vulnerabilities and, in turn, how does the state of the financial system interact with the maximum employment and price stability goals of monetary policy? These were the key questions covered in the September 30 conference organized by the Federal Reserve System. The conference was co-led by Federal Reserve Board Vice Chair Lael Brainard and Federal Reserve Bank of New York President and CEO John C. Williams, each of whom offered prepared remarks. The program also included a panel of current and former central bank policymakers to explore the themes of the conference, as well as paper presentations with discussants. In this post, we discuss highlights of the conference. The agenda includes links to all of the presentations as well as videos for each session.

What Is Corporate Bond Market Distress?

Corporate bonds are a key source of funding for U.S. non-financial corporations and a key investment security for insurance companies, pension funds, and mutual funds. Distress in the corporate bond market can thus both impair access to credit for corporate borrowers and reduce investment opportunities for key financial sub-sectors. In a February 2021 Liberty Street Economics post, we introduced a unified measure of corporate bond market distress, the Corporate Bond Market Distress Index (CMDI), then followed up in early June 2022 with a look at how corporate bond market functioning evolved over 2022 in the wake of the Russian invasion of Ukraine and the tightening of U.S. monetary policy. Today we are launching the CMDI as a regularly produced data series, with new readings to be published each month. In this post, we describe what constitutes corporate bond market distress, motivate the construction of the CMDI, and argue that secondary market measures alone are insufficient to capture market functioning.

The First Global Credit Crisis

June 2022 marks the 250th anniversary of the outbreak of the 1772-3 credit crisis. Although not widely known today, this was arguably the first “modern” global financial crisis in terms of the role that private-sector credit and financial products played in it, in the paths of financial contagion that propagated the initial shock, and in the way authorities intervened to stabilize markets. In this post, we describe these developments and note the parallels with modern financial crises.

How (Un‑)Informed Are Depositors in a Banking Panic? A Lesson from History

How informed or uninformed are bank depositors in a banking crisis? Can depositors anticipate which banks will fail? Understanding the behavior of depositors in financial crises is key to evaluating the policy measures, such as deposit insurance, designed to prevent them. But this is difficult in modern settings. The fact that bank runs are rare and deposit insurance universal implies that it is rare to be able to observe how depositors would behave in absence of the policy. Hence, as empiricists, we are lacking the counterfactual of depositor behavior during a run that is undistorted by the policy. In this blog post and the staff report on which it is based, we go back in history and study a bank run that took place in Germany in 1931 in the absence of deposit insurance for insight.

Were Banks Exposed to Sell‑offs by Open‑End Funds during the Covid Crisis?

Should open-end mutual funds experience redemption pressures, they may be forced to sell assets, thus contributing to asset price dislocations that in turn could be felt by other entities holding similar assets. This fire-sale externality is a key rationale behind proposed and implemented regulatory actions. In this post, I quantify the spillover risks from fire sales, and present some preliminary results on the potential exposure of U.S. banking institutions to asset fire sales from open-end funds.

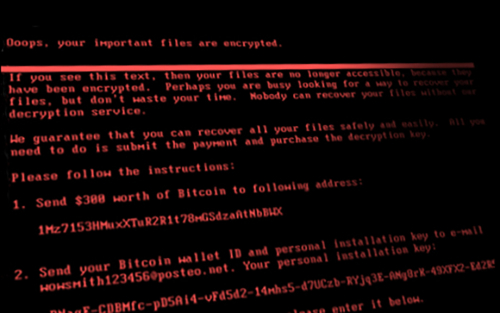

Cyberattacks and Supply Chain Disruptions

Cybercrime is one of the most pressing concerns for firms. Hackers perpetrate frequent but isolated ransomware attacks mostly for financial gains, while state-actors use more sophisticated techniques to obtain strategic information such as intellectual property and, in more extreme cases, to disrupt the operations of critical organizations. Thus, they can damage firms’ productive capacity, thereby potentially affecting their customers and suppliers. In this post, which is based on a related Staff Report, we study a particularly severe cyberattack that inadvertently spread beyond its original target and disrupted the operations of several firms around the world. More recent examples of disruptive cyberattacks include the ransomware attacks on Colonial Pipeline, the largest pipeline system for refined oil products in the U.S., and JBS, a global beef processing company. In both cases, operations halted for several days, causing protracted supply chain bottlenecks.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics