Anatomy of the Bank Runs in March 2023

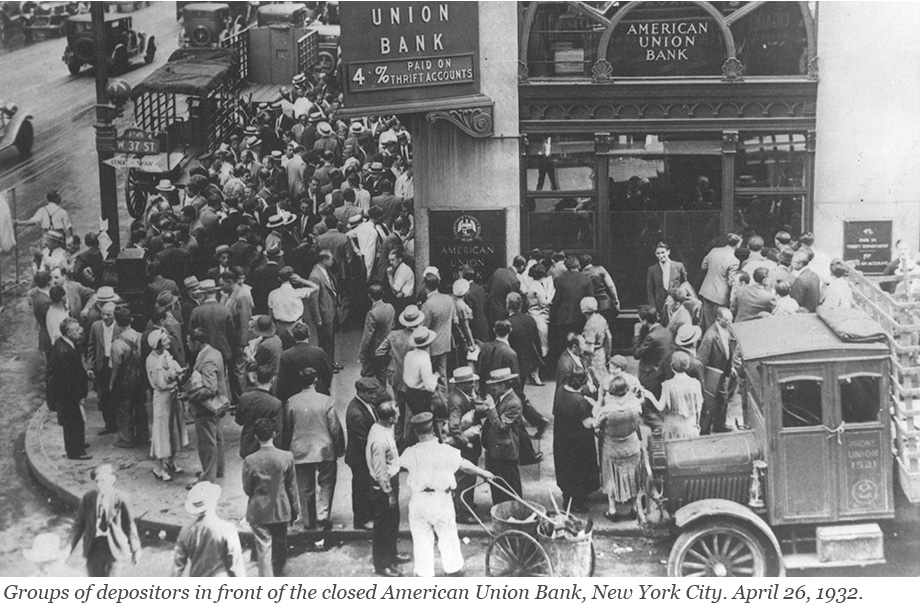

Runs have plagued the banking system for centuries and returned to prominence with the bank failures in early 2023. In a traditional run—such as depicted in classic photos from the Great Depression—depositors line up in front of a bank to withdraw their cash. This is not how modern bank runs occur: today, depositors move money from a risky to a safe bank through electronic payment systems. In a recently published staff report, we use data on wholesale and retail payments to understand the bank run of March 2023. Which banks were run on? How were they different from other banks? And how did they respond to the run?

To Whom It May Concern: Demographic Differences in Letters of Recommendation

Letters of recommendation from faculty advisors play a critical role in the job market for Ph.D. economists. At their best, they can convey important qualitative information about a candidate, including the candidate’s potential to generate impactful research. But at their worst, these letters offer a subjective view of the candidate that can be susceptible to conscious or unconscious bias. There may also be similarity or affinity bias, a particularly difficult issue for the economics profession, where most faculty members are white men. In this post, we draw on our recent working paper to describe how recommendation letters differ by the gender, race, or ethnicity of the job candidate and how these differences are related to early career outcomes.

Thinking of Pursuing a PhD in Economics? Info on Graduate School and Beyond

Becoming a PhD economist can provide a fulfilling and financially secure career path. However, getting started in the field can be daunting if you don’t know much about the preparation you’ll need and the available job opportunities. If you’re wondering what it means to be an economics researcher or how to become one, please read on. We’ll review how to prepare for a career in economics research, what an economics PhD program entails, and what types of opportunities it might bring. Economic education is a core component of the Federal Reserve Bank of New York’s mission to serve the community. To empower would-be economists, this post provides information for students who seek a career in economics research. We hope this information will be helpful to students interested in economics, regardless of their background and economic situation. This information is most applicable to students applying to programs in the United States.

2023 State‑of‑the‑Field Conference on Cyber Risk to Financial Stability

The Federal Reserve Bank of New York and Columbia University’s School of International and Public Affairs (SIPA) co-organized the fourth annual State-of-the-Field Conferences on Cyber Risk to Financial Stability, on April 14, 2023. The conference builds on joint activity by the New York Fed and SIPA since 2017. Each year, the conference convenes panels to confront the same three questions: What are we learning about cyber risk to financial stability? What are we doing to improve resilience and stability? And what’s next? This blog post reviews some of these conversations from the 2023 conference.

How Is the Corporate Bond Market Functioning as Interest Rates Increase?

The Federal Open Market Committee (FOMC) has increased the target interest rate by 3.75 percentage points since March 17, 2022. In this post we examine how corporate bond market functioning has evolved along with the changes in monetary policy through the lens of the U.S. Corporate Bond Market Distress Index (CMDI). We compare this evolution to the 2015 tightening cycle for context on how bond market conditions have evolved as rates increase. The overall CMDI has deteriorated but remains close to historical medians. The investment-grade CMDI index has deteriorated more than the high-yield, driven by low levels of primary market issuance.

Federal Reserve System Conference on the Financial Stability Considerations for Monetary Policy

How does monetary policy affect financial vulnerabilities and, in turn, how does the state of the financial system interact with the maximum employment and price stability goals of monetary policy? These were the key questions covered in the September 30 conference organized by the Federal Reserve System. The conference was co-led by Federal Reserve Board Vice Chair Lael Brainard and Federal Reserve Bank of New York President and CEO John C. Williams, each of whom offered prepared remarks. The program also included a panel of current and former central bank policymakers to explore the themes of the conference, as well as paper presentations with discussants. In this post, we discuss highlights of the conference. The agenda includes links to all of the presentations as well as videos for each session.

Do Corporate Profits Increase When Inflation Increases?

When inflation is high, companies may raise prices to keep up. However, market watchers and journalists have wondered if corporations have taken advantage of high inflation to increase corporate profits. We look at this question through the lens of public companies, finding that in general, increased prices in an industry are often associated with increasing corporate profits. However the current relationship between inflation and profit growth is not unusual in the historical context.

What Is Corporate Bond Market Distress?

Corporate bonds are a key source of funding for U.S. non-financial corporations and a key investment security for insurance companies, pension funds, and mutual funds. Distress in the corporate bond market can thus both impair access to credit for corporate borrowers and reduce investment opportunities for key financial sub-sectors. In a February 2021 Liberty Street Economics post, we introduced a unified measure of corporate bond market distress, the Corporate Bond Market Distress Index (CMDI), then followed up in early June 2022 with a look at how corporate bond market functioning evolved over 2022 in the wake of the Russian invasion of Ukraine and the tightening of U.S. monetary policy. Today we are launching the CMDI as a regularly produced data series, with new readings to be published each month. In this post, we describe what constitutes corporate bond market distress, motivate the construction of the CMDI, and argue that secondary market measures alone are insufficient to capture market functioning.

How Is the Corporate Bond Market Responding to Financial Market Volatility?

The Russian invasion of Ukraine increased uncertainty around the world. Although most U.S. companies have limited direct exposure to Ukrainian and Russian trading partners, increased global uncertainty may still have an indirect effect on funding conditions through tightening financial conditions. In this post, we examine how conditions in the U.S. corporate bond market have evolved since the start of the year through the lens of the U.S. Corporate Bond Market Distress Index (CMDI). As described in a previous Liberty Street Economics post, the index quantifies joint dislocations in the primary and secondary corporate bond markets and can thus serve as an early warning signal to detect financial market dysfunction. The index has risen sharply from historically low levels before the invasion of Ukraine, peaking on March 19, but appears to have stabilized around the median historical level.

The Banking Industry and COVID‑19: Lifeline or Life Support?

By many measures the U.S. banking industry entered 2020 in a robust state. But the widespread outbreak of the COVID-19 virus and the associated economic disruptions have caused unemployment to skyrocket and many businesses to suspend or significantly reduce operations. In this post, we consider the implications of the pandemic for the stability of the banking sector, including the potential impact of dividend suspensions on bank capital ratios and the use of banks’ regulatory capital buffers.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics