Anatomy of the Bank Runs in March 2023

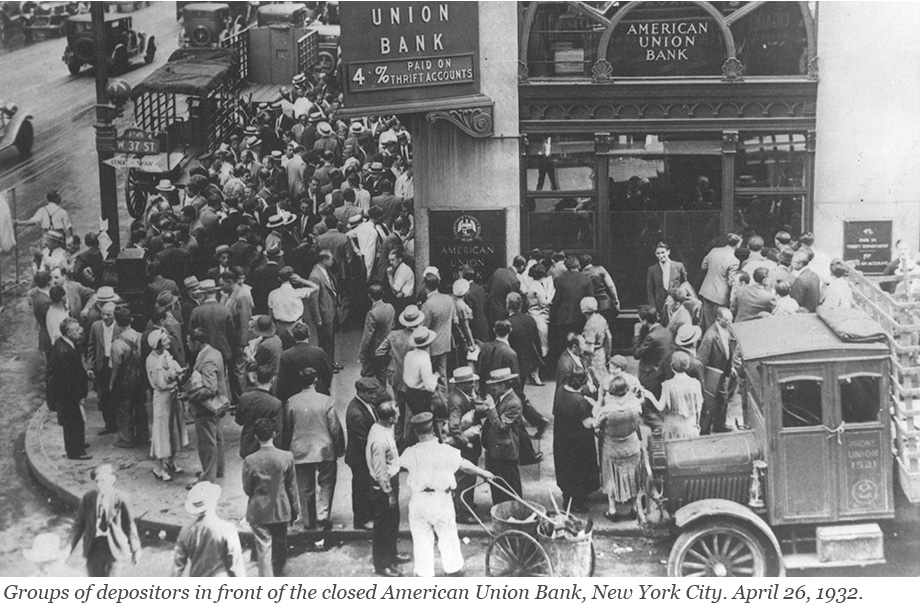

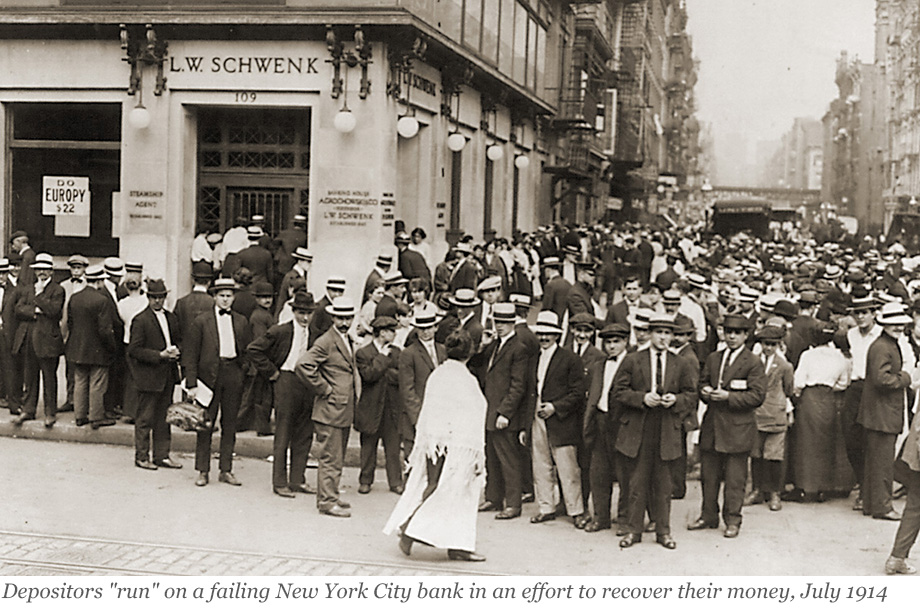

Runs have plagued the banking system for centuries and returned to prominence with the bank failures in early 2023. In a traditional run—such as depicted in classic photos from the Great Depression—depositors line up in front of a bank to withdraw their cash. This is not how modern bank runs occur: today, depositors move money from a risky to a safe bank through electronic payment systems. In a recently published staff report, we use data on wholesale and retail payments to understand the bank run of March 2023. Which banks were run on? How were they different from other banks? And how did they respond to the run?

Why Do Banks Fail? Bank Runs Versus Solvency

Evidence from a 160-year-long panel of U.S. banks suggests that the ultimate cause of bank failures and banking crises is almost always a deterioration of bank fundamentals that leads to insolvency. As described in our previous post, bank failures—including those that involve bank runs—are typically preceded by a slow deterioration of bank fundamentals and are hence remarkably predictable. In this final post of our three-part series, we relate the findings discussed previously to theories of bank failures, and we discuss the policy implications of our findings.

Why Do Banks Fail? The Predictability of Bank Failures

Can bank failures be predicted before they happen? In a previous post, we established three facts about failing banks that indicated that failing banks experience deteriorating fundamentals many years ahead of their failure and across a broad range of institutional settings. In this post, we document that bank failures are remarkably predictable based on simple accounting metrics from publicly available financial statements that measure a bank’s insolvency risk and funding vulnerabilities.

Why Do Banks Fail? Three Facts About Failing Banks

Why do banks fail? In a new working paper, we study more than 5,000 bank failures in the U.S. from 1865 to the present to understand whether failures are primarily caused by bank runs or by deteriorating solvency. In this first of three posts, we document that failing banks are characterized by rising asset losses, deteriorating solvency, and an increasing reliance on expensive noncore funding. Further, we find that problems in failing banks are often the consequence of rapid asset growth in the preceding decade.

Reallocating Liquidity to Resolve a Crisis

Shortly after the collapse of Silicon Valley Bank (SVB) in March 2023, a consortium of eleven large U.S. financial institutions deposited $30 billion into First Republic Bank to bolster its liquidity and assuage panic among uninsured depositors. In the end, however, First Republic Bank did not survive, raising the question of whether a reallocation of liquidity among financial institutions can ever reduce the need for central bank balance sheet expansion in the fight against bank runs. We explore this question in this post, based on a recent working paper.

Banking System Vulnerability: 2023 Update

The bank failures that occurred in March 2023 highlighted how unrealized losses on securities can make banks vulnerable to a sudden loss of funding. This risk, which materialized following the rapid rise in interest rates that began in early 2022, underscores the importance of monitoring the vulnerabilities of the banking system. In this post, as in previous years, we provide an update of four analytical models aimed at capturing different aspects of vulnerability of the U.S. banking system, with data through the second quarter of 2023. In addition, we discuss changes made to the methodology based on the lessons from March 2023 and assess how the system-level vulnerability has evolved.

Banks Runs and Information

The collapse of Silicon Valley Bank (SVB) and Signature Bank (SB) has raised questions about the fragility of the banking system. One striking aspect of these bank failures is how the runs that preceded them reflect risks and trade-offs that bankers and regulators have grappled with for many years. In this post, we highlight how these banks, with their concentrated and uninsured deposit bases, look quite similar to the small rural banks of the 1930s, before the creation of deposit insurance. We argue that, as with those small banks in the early 1930s, managing the information around SVB and SB’s balance sheets is of first-order importance.

How (Un‑)Informed Are Depositors in a Banking Panic? A Lesson from History

How informed or uninformed are bank depositors in a banking crisis? Can depositors anticipate which banks will fail? Understanding the behavior of depositors in financial crises is key to evaluating the policy measures, such as deposit insurance, designed to prevent them. But this is difficult in modern settings. The fact that bank runs are rare and deposit insurance universal implies that it is rare to be able to observe how depositors would behave in absence of the policy. Hence, as empiricists, we are lacking the counterfactual of depositor behavior during a run that is undistorted by the policy. In this blog post and the staff report on which it is based, we go back in history and study a bank run that took place in Germany in 1931 in the absence of deposit insurance for insight.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics