In our previous post, we concluded that, in rating agencies’ views, there is no clear consensus on whether the Dodd-Frank Act has eliminated “too-big-to-fail” in the United States. Today, we discuss whether bond market participants share these views.

As we discussed in our post on Monday, the Dodd-Frank Act includes provisions to address whether banks remain “too big to fail.” Title II of the Act creates an orderly liquidation mechanism for the Federal Deposit Insurance Corporation (FDIC) to resolve failed systemically important financial institutions (SIFIs). In December 2013, the FDIC outlined a “single point of entry” (SPOE) strategy for resolving failing SIFIs that, in principle, should obviate bailouts. Under the SPOE, the FDIC will be appointed receiver of the top-tier parent holding company, and losses of a subsidiary bank will be assigned to shareholders and unsecured creditors of the holding company (in a “bail-in” arrangement). The company may be restructured by shrinking businesses, breaking it into smaller entities, liquidating assets, or closing operations to ensure that the resulting entities can be resolved in bankruptcy. Crucially, during this process, the healthy subsidiaries of the company, including any banks, will maintain normal operation, thus avoiding the need for bailouts to prevent systemic instability.

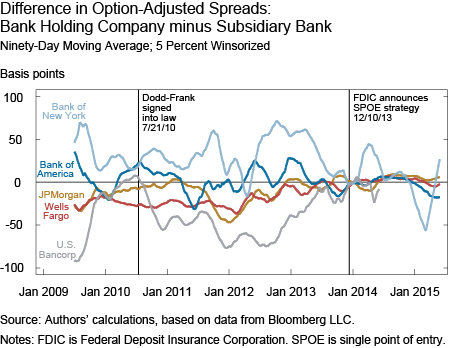

Since the Dodd-Frank Act makes it easier to intervene at the holding company level, we predict that, relative to the pre-Dodd-Frank era, investors’ perceptions of the risk of holding bonds of a parent company would have increased relative to the risk of holding bonds of its subsidiary bank. To test this hypothesis, we compared how bond spreads evolved for a matched pair of bonds—one issued by the parent company and one by its subsidiary bank. This approach lets us isolate any differential effect of the new resolution procedure on the parent company relative to its subsidiary. A downside, though, is that there are only a few cases where both the parent and the subsidiary have the same bonds traded in financial markets.

Contrary to our hypothesis, the difference in option-adjusted spreads to Treasuries of the parent companies and their subsidiary banks, shown in the chart below, has not widened since the Dodd-Frank Act was enacted.

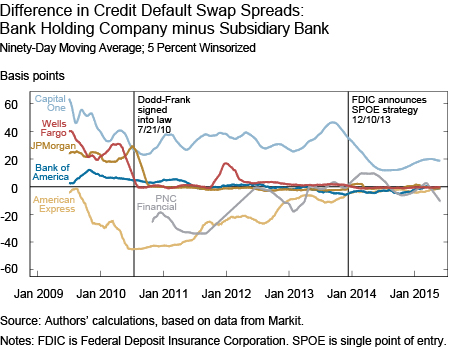

Perhaps the missing effect of the Dodd-Frank Act on relative spreads reflects liquidity issues in the bond market. To address this possibility, we turned to the credit default swap (CDS) market and compared spreads on CDS contracts for parent companies and their bank subsidiaries. The difference in these spreads, shown next, also did not increase following passage of the Dodd-Frank Act or the announcement of the SPOE strategy.

Our previous post demonstrated that rating agencies do not have a unanimous view of the current level of government support of U.S. commercial banks and their holding companies. The results here indicate that market participants’ perceptions of the relative risk have not increased as one would have expected given the new resolution framework introduced by the Dodd-Frank Act. It is possible that these findings (or lack of) apply only to the banking organizations we were limited to in our analysis. However, our sample does include some of the organizations for which the new resolution framework will matter the most.

Together the evidence suggests that rating agencies and market participants may have some doubts about the ability, so far, of the Dodd-Frank Act to deal with “too big to fail.” However, some observers have argued that once all provisions of the Dodd-Frank Act are implemented, any remaining expectations of government support will disappear. Time will tell.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Gara Afonso is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

João A.C. Santos is a vice president in the Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics