The 2012 Nobel Prize in economics was awarded to Alvin E. Roth and Lloyd S. Shapley for their work on matching problems. Two-sided matching problems, like assigning jobs to workers or dorm rooms to students, can be complicated enough. But sometimes the matching problem can be even more difficult. It may be that an item supplied by Alice is useful to Bob, but Bob has nothing of value to give to Alice. If, however, the item supplied by Bob is valuable to Charlie, then there is the potential for a matching chain. Charlie gives something to Alice, Alice gives something to Bob, and Bob gives something to Charlie. Such chains can by themselves be very complicated, and work must be done to identify chains that provide the most benefit. The first Nobel laureate mentioned above has done considerable work designing matching mechanisms used in kidney exchange. But why is all of this necessary? Why isn’t there simply a market with prices?

The answer in the case of kidneys is quite simple. In most developed countries, the sale of kidneys and other human organs is illegal. This means Alice cannot pay Charlie for a kidney. Rather, the two must find a chain of exchanges. In some cases a chain will exist, but in other instances there will be no solution to the matching problem. Even though Charlie might be willing to sell Alice a kidney, society prohibits it.

Society prevents the occurrence of transactions that it deems to be repugnant by imposing penalties or jail time on violators. Al Roth wrote an elegant essay on the topic entitled, “Repugnance as a Constraint on Markets.” In the essay, he presents numerous examples of repugnant activities that society prohibits. He makes it clear that laws prohibiting these activities are not designed to protect participants. For instance, eating horse meat is prohibited in California even though killing horses is legal. Repugnance laws go above and beyond existing laws to enforce the desire by members of society to prohibit certain types of behavior that otherwise would be legal. In short, such laws are justified on the grounds that allowing repugnant actions imposes a negative externality on everyone (not just the parties involved) and lowers the public good.

But who decides what is repugnant? In democratic societies, these decisions are ultimately made by the lawmakers, who are influenced by their constituents. Of course, it’s possible that an influential minority could exert undue influence on this process, but let us, for the sake of argument, say that the process is perfectly democratic, so that acts deemed repugnant actually reflect the majority’s wishes. What this basically means is that, in a democratic society, classifying things as repugnant, or declassifying them, requires some form of public debate and consensus formation.

Or does it? Instead of relying on laws that punish repugnant behavior, it is conceivable that individuals or institutions might intervene directly, by preventing the payments from occurring in the first place. For the most part, existing payment platforms do not impose restrictions on the types of transactions that they facilitate beyond the requirement that the transactions be legal. However, it is worth noting that in addition to requiring that transactions be legal, credit card companies also reserve the right to limit activity that they, at their own discretion, deem potentially harmful to their brands (see rules documents from Visa, Section 1.3.3.4, and MasterCard, Section 5.9.7).

In the last few years, a new type of payment system has emerged: the distributed public ledger. This new technology facilitates payments in terms of virtual currencies, most notably Bitcoin. The Bitcoin protocol uses a “proof-of-work” process that decentralizes clearing and settlement. Agents, known as miners, compete to win the right to validate transactions. Without delving into details, the important aspects are that (1) a miner’s probability of winning the right to process transactions is proportional to how much computing power he or she assigns to the task and (2) miners can choose which transactions to validate. This means that a miner can avoid validating transactions that he or she considers repugnant and that, if a majority of miners agreed, such transactions can be significantly delayed or even prevented.

Virtual currencies like Bitcoin create a new opportunity for expressing views on repugnance that allows individuals to impede or even prevent transactions that they deem repugnant. I can think of several ways this could manifest itself. One avenue is political contributions. Last year, the campaigns of two political candidates in Texas, Steve Stockman, who ran for the U.S. Senate, and Greg Abbott, who was elected governor, accepted bitcoins. A miner who objected to either candidate could have excluded transactions directed to their public address.

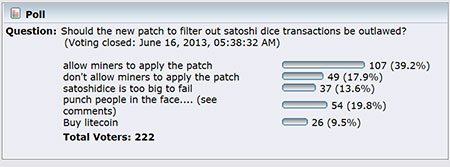

There is at least one example where something like this has already occurred. Satoshi Dice is an online gaming site that uses bitcoin as its primary form of payment. In the spring of 2013, members of the Bitcoin community started to complain about these transactions and reportedly started excluding them from the transaction blocks that they were processing. The following poll was taken from an online chat room on whether patches that excluded these transactions should be allowed.

While the results were in no way binding, the winning response was to allow miners to exclude the transactions. Fortunately, “punch people in the face” was a minority view.

To be fair, the online commentary suggested that the objection to Satoshi Dice was not the gambling, but that the activity involves a large number of small payments that bog down the system (there are limits to how many payments can be processed per block). Nevertheless, the point is that this appears to be a new avenue for constraining markets that does not come from a central authority or rule maker. It is, in essence, a distributed version of repugnance as a constraint on markets.

I will close with an observation about Ripple. Ripple is a distributed payment protocol that uses a procedure to validate transactions that is different from Bitcoin. Ripple uses a consensus approach, where transactions are only validated if a sufficient percentage of participants in the system agree. Ripple sets the threshold high (80 percent) to provide adequate protection from double spending. But by doing so, it gives a submajority the ability to block transactions that they perceive to be repugnant.

Disclaimer

The views expressed in this post are those of the author and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author.

Rod Garratt is a vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

Excellent article. Best one I’ve read by Liberty Economics in a while. Thank you, Celan