In our previous post, we considered balance sheet mechanics related to the Federal Reserve’s purchase and redemption of Treasury securities. These mechanics are fairly straightforward and help to illustrate the basic relationships among actors in the financial system. Here, we turn to transactions involving agency mortgage-backed securities (MBS), which are somewhat more complicated. We focus particularly on what happens when households pay down their mortgages, either through regular monthly amortizations or a large payment covering some or all of the outstanding balance, as might occur with a refinancing.

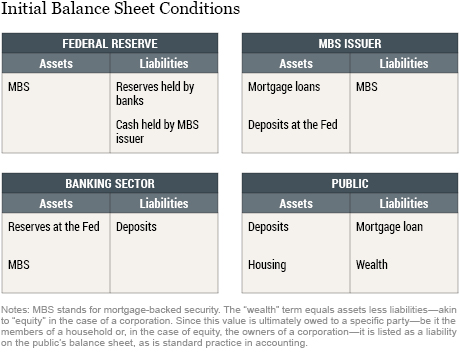

As we did in our previous post, we start with a set of simplified balance sheets, shown in the next exhibit. Three of the balance sheets are for the same actors as before: the Fed, the banking sector, and the public.

We replace the balance sheet of the Treasury, which we won’t need to look at, with the balance sheet of an issuer of MBS. The MBS issuer could be one of two government-sponsored enterprises—Fannie Mae and Freddie Mac—or the government corporation Ginnie Mae. All three are agencies that guarantee the MBS into which individual mortgages are pooled. For simplicity, we will refer to these institutions as “MBS issuers” in this post.

We also focus on somewhat different balance sheet items. On the asset side of the Fed’s balance sheet, we now highlight agency MBS, while on the liability side we have cash held by the MBS issuer, instead of cash held by the Treasury. The MBS issuer holds mortgage loans and deposits at the Fed on the asset side of its balance sheet and MBS on the liability side. Turning to the banking sector, the only change is that MBS have replaced Treasury securities on the asset side. On the asset side of the public’s balance sheet, we have added the stock of housing and on the liability side, we have added mortgage loans.

Key Differences between Treasury Securities and Agency MBS

The mechanics of the Fed’s MBS purchases are exactly the same as those for Treasury securities, which we described in our previous post; thus, we can simply replace Treasury securities with MBS on the relevant balance sheets. But the characteristics of Treasury securities and agency MBS differ in some important ways:

- Treasury securities have a predictable schedule of interest and principal payments. Most coupon securities, for example, pay a pre-specified, fixed amount of interest at specific dates and the full principal at maturity. Agency MBS are more complicated, in part because these securities are backed by the mortgages of households. The payment of principal and interest on MBS depends on the payments made by households on the underlying mortgages; these payments are passed through the mortgage agency, ultimately reaching the MBS investor (the payment would also pass through the mortgage servicer—an entity that is not represented in our exhibits).

- In contrast to Treasury securities, most mortgages are amortized over time. This means that regular monthly payments by households incrementally reduce the principal of the MBS.

- Households also have the right to prepay their mortgages at any time—for example, when a family sells its house or refinances a mortgage to take advantage of lower interest rates. This option means that the payment patterns associated with MBS are less predictable than the payment patterns of Treasury securities.

MBS Transactions and the Fed’s Reinvestment Policy

To understand the effects of the Fed’s reinvestment policy in this context, we need to describe the effects of households’ mortgage payments (principal and interest) on the balance sheets of all actors.

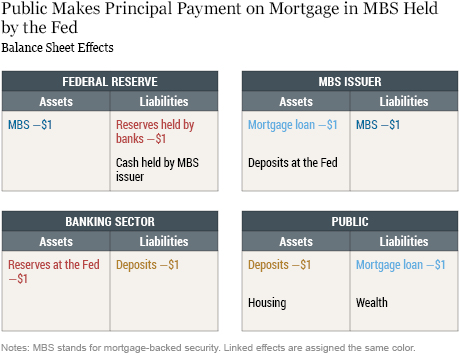

We start by considering the case of a principal payment of $1 on a mortgage, assuming the Fed holds the MBS associated with that mortgage. The next exhibit shows the end result of such a sequence of transactions.

- First, to make the payment, the household could write a check or ask its bank to wire funds to the MBS issuer. Either way, this would result in a $1 decrease in the amount of deposits the public holds at the bank. The mortgage payment, which we assume pays down a share of principal on the loan, also increases the household’s equity in the home, the difference between the value of housing and the amount of the mortgage loan.

- The bank would then send a dollar from its Fed account to the Fed account of the MBS issuer.

- The MBS issuer’s account at the Fed would decrease by a dollar as it pays the MBS investors, leaving the issuer’s account at the Fed unchanged. (We assume here a simultaneous sequence of events, but in actuality, there may be a buildup of balances in an MBS issuer’s accounts before the disbursements are made to MBS investors.)

- Since the MBS is held by the Fed, the principal amount of the Fed’s MBS decreases by $1.

If the Fed did reinvest the proceeds it received from the MBS, its holdings of MBS would go back up and banks’ holdings of reserves would go up as well. Overall, as our previous post showed with respect to the reinvestment of Treasury securities, the Fed’s balance sheet would be unchanged. That said, there could be a lag between the time the Fed receives cash from an MBS paydown and the time it purchases a replacement, owing to the way MBS trade and settle. There could be some temporary ups and downs in the Fed’s balance sheet numbers as a result.

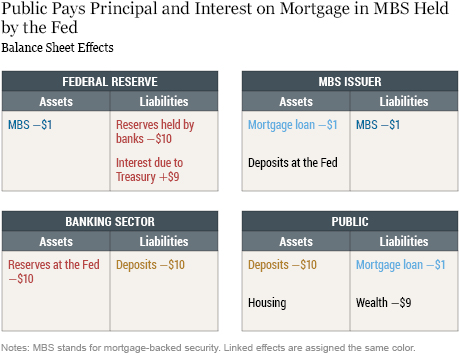

The next exhibit considers a payment from the public of $10 that represents a combination of principal paydown ($1) and payment of interest ($9).

- Again, the public will ask the bank to send the payment amount to the MBS issuer, reducing the deposit held at the bank by $10. However, since the principal payment is only part of the payment, the mortgage loan balance held by the public only decreases by $1. The remainder of the payment decreases the wealth of the public.

- As was the case in the previous exhibit, the bank makes the payment by transferring reserves from its Fed account to the MBS issuer’s Fed account.

- The MBS issuer makes the payment to the MBS holder by decreasing its Fed account.

- In this case, however, the principal paydown is only part of the payment, so the asset side of the Fed’s balance sheet only decreased by $1. The remainder of the payment, the interest, represents interest income for the Fed—funds that are eventually remitted to the Treasury, as is all the Fed’s income, net of costs. Part of the decrease in reserves held by banks may be temporary. As the Fed’s income is remitted to the Treasury and the Treasury pays out the balances to cover expenses, the interest portion due to the Treasury would eventually find its way back into the banking system.

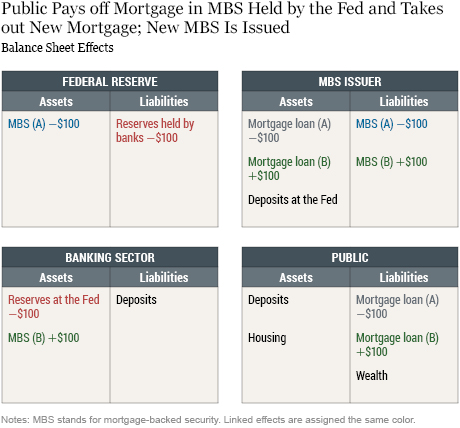

In our previous post, we assumed that whenever the Treasury redeemed a security, it would issue a new security to keep its debt at a constant level. A similar assumption can be made in the case of MBS issuers. While some households pay down their mortgages, other households take out new mortgages. In the next exhibit, we look at what happens in such a case.

Suppose a family relocates to a new city, selling its house and purchasing a new one. We assume that the original $100 mortgage was part of an MBS held by the Fed and that the new mortgage, also for $100, is put into a new MBS. If the Fed no longer reinvests the proceeds it receives, the new MBS will be purchased by someone else, in this case a bank. For simplicity, we assume that the value of the new MBS is equal to that of the old MBS.

From the perspective of the public, nothing has changed, other than the fact that one loan has been replaced by another of equal value. Similarly, for the MBS issuer, one loan replaces another on the asset side, and one MBS replaces another on the liability side. The banking sector has replaced reserves with the new MBS on the asset side of its balance sheet. Finally, from the Fed’s perspective, the paydown of the MBS is accompanied by a decrease in the amount of reserves as the size of the Fed’s balance sheet decreases.

In this blog post, we have described the mechanics of balance sheets related to purchases and redemptions of agency MBS. Compared to the case of Treasury securities, which we discussed in our previous post, the key difference is related to the fact that the timing of repayment of MBS is not predictable and depends on the behavior of homeowners. Despite these differences, the ultimate effect on the Fed’s balance sheet is very similar for MBS and Treasury securities. When these securities mature or are paid down, the size of the Fed’s balance sheet and the supply of reserves both decrease.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Deborah Leonard is a vice president in the Federal Reserve Bank of New York’s Markets Group.

Antoine Martin is a senior vice president in the Bank’s Research and Statistics Group.

Antoine Martin is a senior vice president in the Bank’s Research and Statistics Group.

Simon M. Potter is an executive vice president and head of the Bank’s Markets Group.

Simon M. Potter is an executive vice president and head of the Bank’s Markets Group.

Brett Rose is an assistant vice president of the Bank’s Markets Group.

Brett Rose is an assistant vice president of the Bank’s Markets Group.

How to cite this blog post:

Deborah Leonard, Antoine Martin, Simon M. Potter, and Brett Rose, “How the Fed Changes the Size of Its Balance Sheet: The Case of Mortgage-Backed Securities,” Federal Reserve Bank of New York Liberty Street Economics (blog), July 11, 2017, http://libertystreeteconomics.newyorkfed.org/2017/07/how-the-fed-changes-the-size-of-its-balance-sheet-the-case-of-mortgage-backed-securities.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics

FOMC ought to be selling $50-100bn per month of MBS given current market conditions. Demand for MBS is high and unlikely to change. Also, the drop in agency issuance since Q4 2016 has caused a precipitous surge in pricing for 1-4 whole loans in the secondary market. Lenders are seeing record low profits selling into the conforming markets for MBS. Large aggregators are bidding very aggressively. If anything, there is a striking shortage of DURATION in the markets.