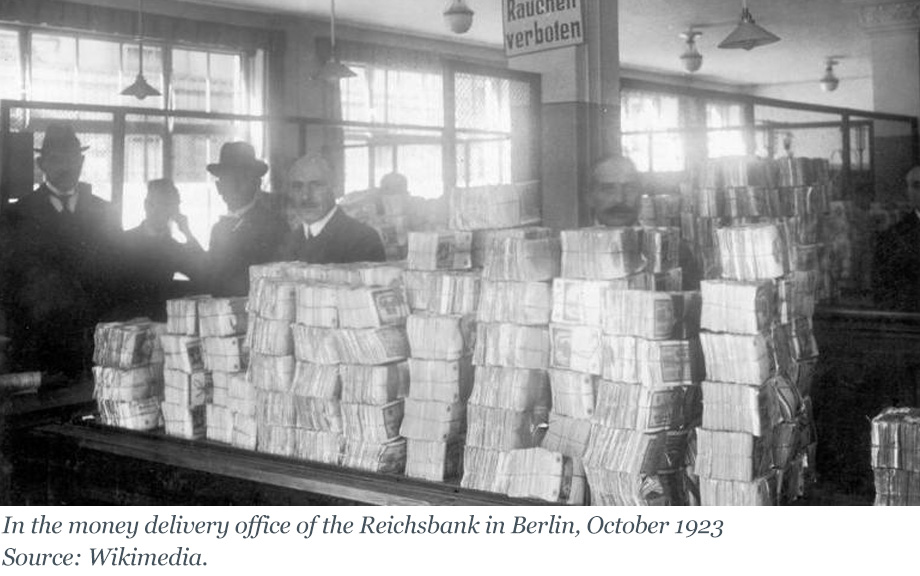

Inflating Away the Debt: The Debt‑Inflation Channel of German Hyperinflation

The recent rise in price pressures around the world has reignited interest in understanding how inflation transmits to the real economy. Economists have long recognized that unexpected surges of inflation can redistribute wealth from creditors to debtors when debt contracts are written in nominal terms (see, for example, Fisher 1933). If debtors are financially constrained, this redistribution can affect real economic activity by relaxing financing constraints. This mechanism, which we call the debt-inflation channel, is well understood theoretically (for example, Gomes, Jermann, and Schmid 2016), but there is limited empirical evidence to substantiate it. In this post, we discuss new insights from one of the key events in monetary history: the Great German Inflation of 1919-23. Because this case of inflation was both surprising and extremely high, Germany’s experience helps shed light on how high inflation impacts firms’ economic activity through the erosion of their nominal debt burdens. These insights are based on a recently released research paper.

Financial Fragility without Banks

Proponents of narrow banking have argued that lender of last resort policies by central banks, along with deposit insurance and other government interventions in the money markets, are the primary causes of financial instability. However, as we show in this post, non-bank financial institutions (NBFIs) triggered a financial crisis in 1772 even though the financial system at that time had few banks and deposits were not insured. NBFIs profited from funding risky, longer-dated assets using cheap short-term wholesale funding and, when they eventually failed, authorities felt compelled to rescue the financial system.

Insights from Newly Digitized Banking Data, 1867‑1904

Call reports—regulatory filings in which commercial banks report their assets, liabilities, income, and other information—are one of the most-used data sources in banking and finance. Though call reports were collected as far back as 1867, the underlying data are only easily accessible for the recent past: the mid-1980s onward in the case of the FDIC’s FFIEC call reports. To help researchers look farther back in time, we’ve begun creating a complete digital record of this “missing” call report data; this data release covers 1867 through 1904, the bulk of the National Banking Era. Here, we describe the digitization process and highlight some of the interesting features of that era from a research perspective.

The First Global Credit Crisis

June 2022 marks the 250th anniversary of the outbreak of the 1772-3 credit crisis. Although not widely known today, this was arguably the first “modern” global financial crisis in terms of the role that private-sector credit and financial products played in it, in the paths of financial contagion that propagated the initial shock, and in the way authorities intervened to stabilize markets. In this post, we describe these developments and note the parallels with modern financial crises.

Reasonable Seasonals? Seasonal Echoes in Economic Data after COVID‑19

Seasonal adjustment is a key statistical procedure underlying the creation of many economic series. Large economic shocks, such as the 2007-09 downturn, can generate lasting seasonal echoes in subsequent data. In this Liberty Street Economics post, we discuss the prospects for these echo effects after last year’s sharp economic contraction by focusing on the payroll employment series published by the U.S. Bureau of Labor Statistics (BLS). We note that seasonal echoes may lead the official numbers to overstate actual changes in payroll employment modestly between March and July of this year after which distortions flip the other way.

How the Fed Managed the Treasury Yield Curve in the 1940s

The coronavirus pandemic has prompted the Federal Reserve to pledge to purchase Treasury securities and agency mortgage-backed securities in the amount needed to support the smooth market functioning and effective transmission of monetary policy to the economy. But some market participants have questioned whether something more might not be required, including possibly some form of direct yield curve control. In the first half of the 1940s the Federal Open Market Committee (FOMC) sought to manage the level and shape of the Treasury yield curve. In this post, we examine what can be learned from the FOMC’s efforts of seventy-five years ago.

The Value of Opacity in a Banking Crisis

During crisis periods, we often observe regulators limiting access to bank‑level information with the goal of restoring the public’s confidence in banks. Thus, information management often plays a central role in ending financial crises. Despite the perceived importance of managing information about individual banks during a financial crisis, we are not aware of any empirical work that quantifies the effect of such policies. In this blog post, we highlight results from our recent working paper, demonstrating that in a crisis, a policy of suppressing information about banks’ balance sheets has a significant and positive effect on deposits.

Fight the Pandemic, Save the Economy: Lessons from the 1918 Flu

The COVID-19 outbreak has sparked urgent questions about the impact of pandemics, and the associated countermeasures, on the real economy. Policymakers are in uncharted territory, with little guidance on what the expected economic fallout will be and how the crisis should be managed. In this blog post, we use insights from a recent research paper to discuss two sets of questions. First, what are the real economic effects of a pandemic—and are these effects temporary or persistent? Second, how does the local public health response affect the economic severity of the pandemic? In particular, do non-pharmaceutical interventions (NPIs) such as social distancing have economic costs, or do policies that slow the spread of the pandemic also reduce its economic severity?

Once Upon a Time in the Banking Sector: Historical Insights into Banking Competition

How does competition among banks affect credit growth and real economic growth? In addition, how does it affect financial stability? In this blog post, we derive insights into this important set of questions from novel data on the U.S. banking system during the nineteenth century.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics