The Anatomy of Export Controls

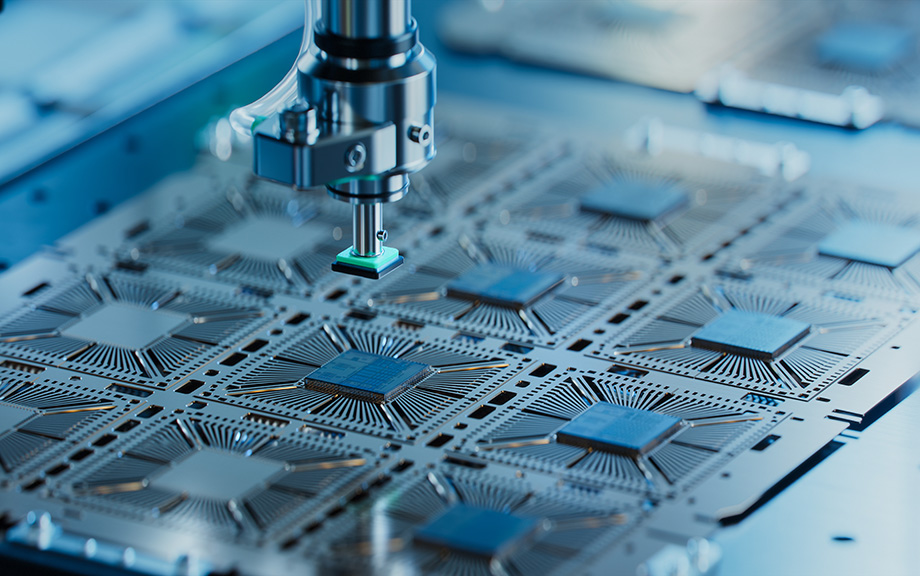

Governments increasingly use export controls to limit the spread of domestic cutting-edge technologies to other countries. The sectors that are currently involved in this geopolitical race include semiconductors, telecommunications, and artificial intelligence. Despite their growing adoption, little is known about the effect of export controls on supply chains and the productive sector at large. Do export controls induce a selective decoupling of the targeted goods and sectors? How do global customer-supplier relations react to export controls? What are their effects on the productive sector? In this post, which is based on a related staff report, we analyze the supply chain reconfiguration and associated financial and real effects following the imposition of export controls by the U.S. government.

Do Economic Crises in Europe Affect the U.S.? Some Lessons from the Past Three Decades

In this post we summarize the main results of our contribution to a recent e-book, “The Making of the European Monetary Union: 30 years since the ERM crisis,” on the economic and financial crises in Europe since 1992-93, and focus on the spillovers of those crises onto the United States and the global economy. We find that the answer to the question in the title of this post is a (moderate) yes.

Highlights from the Fifth Bi‑annual Global Research Forum on International Macroeconomics and Finance

The COVID-19 pandemic, geopolitical tensions, and distinct economic conditions bring challenges to economies worldwide. These key themes provided a backdrop for the fifth bi-annual Global Research Forum on International Macroeconomics and Finance, organized by the European Central Bank (ECB), the Federal Reserve Board, and Federal Reserve Bank of New York in New York in November. The papers and discussions framed important issues related to the global economy and financial markets, and explored the implications of policies that central banks and other official sector bodies take to address geopolitical developments and conditions affecting growth, inflation, and financial stability. A distinguished panel of experts shared diverse perspectives on the drivers of and prospects for inflation from a global perspective. In this post, we discuss highlights of the conference. The event page includes links to videos for each session.

Will the U.S. Dollar Continue to Dominate World Trade?

There are around 180 currencies in the world, but only a very small number of them play an outsized role in international trade, finance, and central bank foreign exchange reserves. In the modern era, the U.S. dollar has a dominant international presence, followed to a lesser extent by the euro and a handful of other currencies. Although the use of specific currencies is remarkably stable over time, with the status of dominant currencies remaining unchanged over decades, there have been decisive shifts in the international monetary system over long horizons. For example, the British pound only lost its dominant currency status in the 1930s, well after Britain stopped being the leading world economy. In a new study, we show that the currency that is used in international trade transactions is an active firm-level decision rather than something that is just fixed. This finding raises the question of what factors could augment or reduce the U.S. dollar’s dominance in world trade.

When Will U.S. Exports Take Off?

The economic recovery from the COVID-19 pandemic has been uneven across countries and sectors. While U.S. imports have rebounded to surpass their level before the collapse in 2020, U.S. exports remain far below their pre-pandemic level. This asymmetry in part reflects the different sectoral compositions of imports and exports. U.S. imports are driven by goods trade, while exports rely more heavily on services trade. A key component of services exports is foreign travel to the United States, which has dried up due to the suspension of nonessential travel imposed in March 2020. However, U.S. exports may now be at a turning point given the reopening of U.S. borders to all vaccinated travelers on November 8. We analyze the trajectory of U.S. services and how the lifting of the travel ban might contribute to the rebound of U.S. services exports.

An Update on the U.S.–China Phase One Trade Deal

A Liberty Street Economics post from last summer by Matthew Higgins and Thomas Klitgaard contained an assessment of the Phase One trade agreement between the United States and China. The authors of that note found that, depending on how successfully the deal was implemented, the impact on U.S. economic growth could have been substantially larger than originally foreseen by many of its critics, as a result of the fact that the pandemic had depressed the U.S. economy far below its potential growth path. Here we take another look at these considerations with the benefit of an additional year’s worth of trade data and a much different economic environment in the United States.

The International Spillover of U.S. Monetary Policy via Global Production Linkages

Julian di Giovanni describes work with Galina Hale that employs an empirical framework to quantify the role of the global production network in transmitting U.S. monetary policy across international stock markets.

COVID‑19 Has Temporarily Supercharged China’s Export Machine

Are U.S. Tariffs Turning Vietnam into an Export Powerhouse?

The imposition of Section 301 tariffs on about half of China’s exports to the United States has coincided with a fall in imports from China and gains for other countries. The U.S.-China trade conflict also appears to be accelerating an ongoing shift in foreign direct investment (FDI) from China to other emerging markets, particularly in Asia. Within the region, Vietnam is often cited as a clear beneficiary of these trends, a rising economy that could displace China, to some extent, in global supply chains. In this note, we examine the data and conclude that Vietnam is indeed gaining market share, but is too small to replace China anytime soon.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics