The New York Fed’s Center for Microeconomic Data today released the Quarterly Report on Household Debt and Credit for the first quarter of 2019. Total household debt grew by $124 billion over the quarter, boosted by increases in mortgage, auto, and student loan balances. Over the past twenty years, the prevalence of each type of credit has waxed and waned, shifts linked to the housing boom, the Great Recession, and the subsequent economic recovery. In this blog post, we draw on the New York Fed’s Consumer Credit Panel—a nationally representative sample of Equifax credit report data and the basis of our Quarterly Report—to explore those longer-term trends in credit market participation.

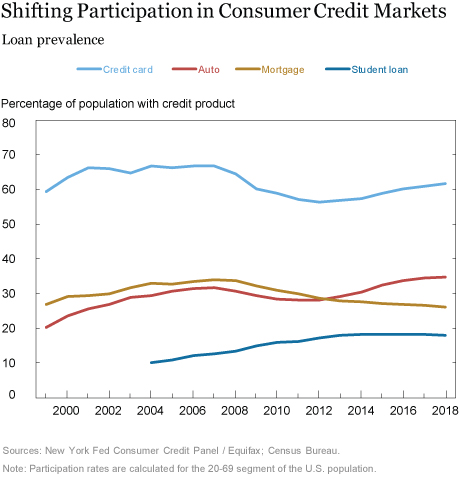

The chart below depicts the prevalence of loan types over time, which we calculate as the percentage of individuals aged 20-69 with a respective loan type on their credit report. The prevalence of products followed very different paths during and after the Great Recession.

Mortgage participation tracked the housing cycle; mortgage prevalence swelled from 27 percent in 1999 to 34 percent in 2006, and has been declining ever since. At the end of 2018, about 26 percent of Americans between 20 and 69 had a mortgage, the lowest point reached in the twenty years of available data.

Auto loans, on the other hand, have seen their aggregate balance increase steadily since 2013. The chart below shows that one key reason for this is an increase in prevalence—more than one-third of Americans now have auto loans, up from only 20 percent in 1999.

Student loans, which we’ve written about extensively on this blog, have completely broken with the business cycle; the prevalence of student loans grew steadily between 2004 and 2016, with very rapid growth in both participation and balances seen during the depths of the Great Recession, when college enrollment increased. Since 2016, about 18 percent of the population has held student loans, up from only 10 percent in 2004.

Credit cards are the most popular and common form of credit used by consumers, with over 60 percent of the population having at least one credit card account, including individuals with zero balance on open accounts. Tightening during the recession, paired with the Card Act of 2009, caused a steep contraction in the number of open card accounts and noticeably reduced Americans’ credit card participation rate. There has been some recovery in credit card prevalence in recent years, consistent with increased issuance in card accounts.

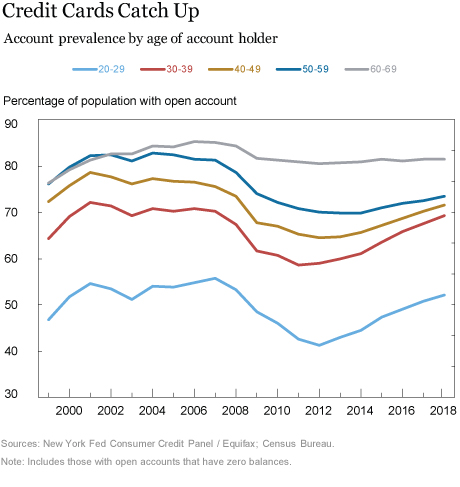

Credit Card Participation by Age

Card participation data reveal interesting trends when disaggregated by age group, as shown in the chart below. The prevalence of credit card accounts declined steeply for young borrowers between 2008 and 2012, partly because the Card Act limited issuance to the youngest borrowers. Older borrowers are far more likely to have a credit card, and their participation rates experienced a much smaller contraction. The youngest borrowers saw a 14 percentage point decline in their participation rate, and by 2012 only 41 percent of those in their twenties had a credit card. This trend has reversed, however, and now more than half (52 percent) of those in their twenties have credit cards.

Credit card delinquency rates have been trending upward in the past few years—likely reflecting, in part, the increased presence of younger borrowers in the credit card market. However, despite this recent deterioration, credit card performance remains better than it was during the pre-Great Recession years of 2000-06.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Andrew F. Haughwout is a senior vice president in the Bank’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and StatisticsGroup.

Joelle Scally is the administrator of the Center for Microeconomic Data in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this blog post:

Andrew F. Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Just Released: Shifts in Credit Market Participation over Two Decades,” Federal Reserve Bank of New York Liberty Street Economics (blog), May 14, 2019, https://libertystreeteconomics.newyorkfed.org/2019/05/just-released-shifts-in-credit-market-participation-over-two-decades.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics