The Federal Reserve Bank of New York recently decided to revise the composition of the Overnight Bank Funding Rate (OBFR), a reference rate measuring the cost banks face to borrow overnight in unsecured U.S. dollar-denominated money markets. Specifically, in addition to the federal funds and Eurodollar transactions currently comprising the OBFR, the OBFR now also includes overnight, interest-bearing demand deposits (at rates negotiated between the counterparties and excluding deposits payable on demand) booked within banks’ U.S. offices, known as “selected deposits.” In this post, we discuss the change in more detail, the reason for including selected deposits, and the likely impact on the OBFR’s published values.

The Decline in Eurodollar Volume

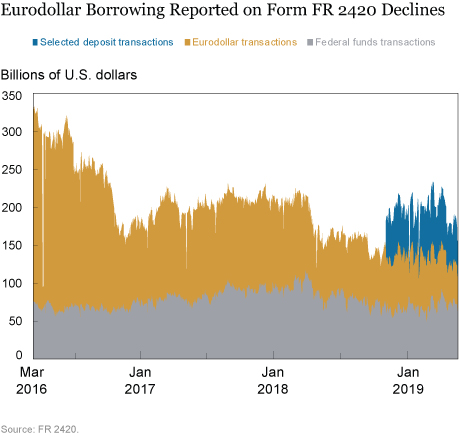

Since its inception, the OBFR has been calculated as the volume-weighted median of the rates on overnight federal funds and Eurodollar borrowings reported by U.S. depository institutions and U.S. branches of foreign banking organizations (FBOs) as collected in the FR 2420 Report of Selected Money Market Rates. However, soon after its initial publication in March 2016, some of the activity underlying the OBFR began to move outside the scope of the collection. Specifically, as shown in the chart below, around June 2016, a few FBOs that had been active Eurodollar borrowers decided to partially or completely move their Eurodollar borrowing booked at their Caribbean branches to deposits booked at their U.S. branches.

Analysts have pointed to various factors to explain this shift, most prominently the simplification of the living wills that banks are required to submit as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Analysts also noted that the change in borrowing behavior was enabled, in part, by the repeal of Regulation Q and by the fact that the increase in reserve requirements caused by booking deposits at U.S. branches instead of Caribbean branches was less binding in an environment with abundant reserves.

Regardless of the cause of this shift, these borrowing transactions booked at U.S. branches are economically similar to the Eurodollar transactions the FR 2420 report was designed to collect. However, until October 2018, these borrowings fell outside the scope of the FR 2420 collection. Consequently, the total transaction volume underlying the OBFR declined.

The OBFR with Selected Deposits

Because of this shift in borrowing activity, in October 2018, the FR 2420 was revised to collect transaction-level information on short-term wholesale unsecured deposits that are economically equivalent to federal funds or Eurodollar transactions; these transactions are reported in FR 2420 under the name “selected deposits.”

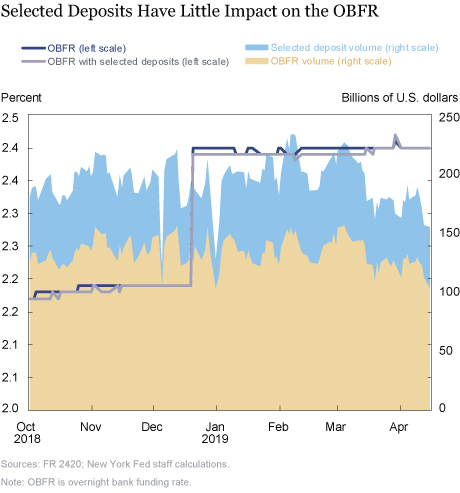

Moreover, following a period of public comment, on April 17, 2019, the New York Fed announced that, beginning on May 2, 2019, the pool of transactions used to calculate the OBFR will, in addition to federal funds and Eurodollar transactions, include selected deposits. This inclusion results in a rate that is more robust and more representative of banks’ cost to borrow overnight in unsecured U.S. dollar-denominated money markets. Since October 2018—when selected deposits started being reported in FR 2420—daily selected deposits transaction volume has averaged roughly $60 billion, which represents approximately one-third of the revised OBFR’s transaction base.

The volume-weighted median of the rates on selected deposit transactions is typically very close to the comparable rate on Eurodollar transactions, consistent with the economic similarity of the two types of transactions. As a result, as the next chart shows, when the selected deposits transactions are incorporated into the OBFR, the change to the OBFR’s daily value is, on most days, zero (note that the OBFR is rounded to the nearest basis point); on those days when there is a difference, the rate is one basis point lower.

Summing Up

The Federal Reserve Bank of New York has incorporated an additional set of transactions into the pool of transactions from which the OBFR is computed. These transactions fell out of the scope of the data collection used to calculate the OBFR when FBOs began moving the booking of some overnight, unsecured borrowing from their Caribbean branches to their U.S. offices. These changes will produce a broader and more robust measure of the costs banks face to borrow overnight in unsecured U.S. dollar-denominated money markets.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Alyssa Cambron is a manager in the Federal Reserve Bank of New York’s Markets Group.

Alyssa Cambron is a manager in the Federal Reserve Bank of New York’s Markets Group.

Marco Cipriani is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joshua Jones is a secondee in the Bank’s Markets Group.

Romen Mookerjee is a senior analyst in the Bank’s Markets Group.

Romen Mookerjee is a senior analyst in the Bank’s Markets Group.

Scott Sherman is an assistant vice president in the Bank’s Markets Group.

Scott Sherman is an assistant vice president in the Bank’s Markets Group.

Brett Solimine is an associate in the Bank’s Markets Group.

Brett Solimine is an associate in the Bank’s Markets Group.

Timothy Wessel is an associate in the Bank’s Markets Group.

Timothy Wessel is an associate in the Bank’s Markets Group.

How to cite this blog post:

Alyssa Cambron, Marco Cipriani, Joshua Jones, Romen Mookerjee, Scott Sherman, Brett Solimine, and Timothy Wessel, “Selected Deposits and the OBFR,” Federal Reserve Bank of New York Liberty Street Economics (blog), https://libertystreeteconomics.newyorkfed.org/2019/05/selected-deposits-and-the-obfr.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics