The New York Fed’s Center for Microeconomic Data released results today from its April 2020 SCE Public Policy Survey, which provides information on consumers’ expectations regarding future changes to a wide range of fiscal and social insurance policies and the potential impact of these changes on their households. These data have been collected every four months since October 2015 as part of our Survey of Consumer Expectations (SCE). Given the ongoing COVID-19 pandemic, households face significant uncertainty about their personal situations and the general economic environment when forming plans and making decisions. Tracking individuals’ subjective beliefs about future government policy changes is important for understanding and predicting their behavior in terms of spending and labor supply, which will be crucial in forecasting the economic recovery in the months ahead.

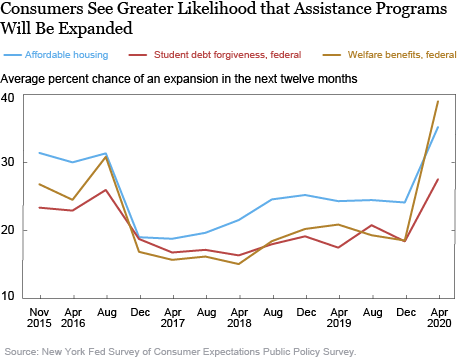

The April SCE Public Policy Survey, which was fielded between April 2 and 30, shows large movements in consumers’ expectations regarding future changes in several assistance and social insurance programs as well as in taxes and fees. Starting with assistance programs, the chart below shows the average percent chance that respondents assign to an expansion over the next twelve months in affordable housing, federal student loan forgiveness, and the generosity of federal welfare benefits. All three series reached new highs in April, but the average likelihood of an increase in federal welfare benefits logged the biggest jump—around 20 percentage points—since December 2019. The large increases in the expected expansions for federal student loan forgiveness and welfare programs were broad-based across demographic groups. Interestingly, the change in expectations for a year-ahead expansion in affordable housing from December 2019 to April 2020 was much more muted for lower-income (less than $60,000) households at 4.9 percentage points, compared to higher-income households at 15.8 percentage points.

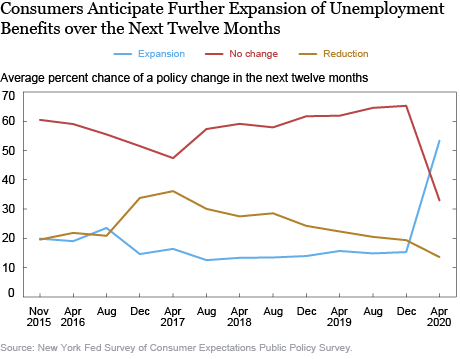

Turning to social insurance programs, we observe a sharp increase in the average likelihood of a year-ahead increase in unemployment benefits, from 15.3 percent in December 2019 to 53.4 percent in April 2020, coupled with a decline in the average likelihood of a year-ahead decrease in unemployment benefits, from 19.4 percent in December 2019 to 13.6 percent in April 2020. The expectations for a year-ahead change in unemployment benefits were comparable across age, gender, income, and education groups. To the extent that respondents were aware that the CARES Act, signed into law on March 27, already included a federal top-up to the unemployment benefits and a thirteen-week extension among its provisions, responses from the April 2020 SCE Public Policy Survey indicate that consumers expect a further expansion of unemployment benefits. This anticipation might be influential in how households use the unemployment benefits and Economic Impact Payments they receive, in terms of saving, spending, and paying down debts.

Regarding expected changes in tax policy, the April data show a 5.5 percentage point jump in the average likelihood of a year-ahead decline in gasoline tax and, similarly, a 6 percentage point increase in the average likelihood of a decline in the payroll tax over the next twelve months from December 2019 to April 2020. There was also a 6.8 percentage point increase in the average likelihood of an increase in the income tax rate for the highest income bracket over the next twelve months. At 29.8 percent, that reading is now at its highest level since August 2016. Regarding fees, we observe increases of around 4 percentage points in the average probabilities of year-ahead declines in public college tuition (in each respondent’s state) as well as in the cost of public transport. The size of these changes was greater among respondents with a college degree.

The SCE Public Policy Survey also collects information on what respondents think the household impact of various policy changes over the next twelve months would be. Unsurprisingly, given the COVID-19 outbreak and the business closures necessitated by social distancing measures, April data show a broad-based rise in the share of respondents that associate a positive impact with an increase in unemployment benefits—16.3 percent in April 2020, up from 5.6 percent in December 2019. Similarly, we see a reduction in the share of respondents who expect to be negatively affected by an increase in welfare benefits, from 19.9 percent to 11.0 percent. Finally, the share of respondents who expect to be positively affected by a decrease in the payroll tax rate increased from 47.0 percent to 52.6 percent.

The timing and strength of the economic recovery from the COVID-19 pandemic will largely depend on households’ economic decisions regarding spending, saving, and working. These decisions, in turn, are affected by the current and future policy environment. The results from the April 2020 SCE Public Policy Survey show that households increasingly anticipate further fiscal expansions in government support, with consumers assigning higher likelihoods to expansions in affordable housing, federal student loan forgiveness, and in the generosity of unemployment and welfare benefits. We will continue to monitor households’ public policy expectations as the pandemic and the policy responses to it evolve.

Gizem Koşar is an economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Kyle Smith is a senior research analyst in the Bank’s Research and Statistics Group.

Kyle Smith is a senior research analyst in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Gizem Koşar, Kyle Smith, and Wilbert van der Klaauw, “Consumers Increasingly Expect Additional Government Support amid COVID-19 Pandemic,” Federal Reserve Bank of New York Liberty Street Economics, May 26, 2020, https://libertystreeteconomics.newyorkfed.org/2020/05/consumers-increasingly-expect-additional-government-support-amid-covid-19-pandemic.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics