This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since September 2020.

As usual, we wish to remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and variables discussed here, see our DSGE model Q & A. Note that interactive charts are now available for DSGE model forecasts.

In response to the pandemic, we changed the New York Fed’s DSGE model to reflect the fact that the economic disruptions caused by COVID‑19 are likely different from standard business cycles. The model now includes additional shocks designed to reflect phenomena like lockdowns and social distancing (the model description on the GitHub page describes these changes in some detail). For this round of forecasts two further changes were made to the model. First, the model incorporates an additional COVID-19 demand shock taking place in 2020:Q4 but anticipated in Q3. This shock captures the renewed weakness in demand in the current quarter stemming from the second wave of the pandemic, and its size is disciplined by imposing that the Q3 expectation for real GDP growth in Q4 coincides with the median forecast from the November Philadelphia Fed Survey of Professional Forecasters (henceforth, SPF), namely 4.0 percent, annualized. We also consider a second more pessimistic scenario where we impose that expected real GDP growth in Q4 coincides with the 10th percentile of the cross- sectional distribution of SPF point forecasts (1.2 percent, annualized). The two scenarios are combined using weights (80, and 20 percent, respectively) that are loosely informed by the SPF average probability distribution for 2020 year-over-year real GDP growth.

Second, the model replaces the historical policy reaction function with a new reaction function, flexible average inflation targeting (AIT), reflecting our interpretation of the changes in the FOMC monetary policy strategy announced last August. In our implementation, which we describe in more detail in the model description on the NY Fed DSGE GitHub page, the interest rate reacts to a moving average (MA) of deviations of PCE inflation from the FOMC long run goal of 2 percent, where the MA half-life is ten quarters. It also reacts to an MA of deviations of output growth from its steady state value in light of both the Federal Reserve’s dual mandate and the central bank’s intention to support the recovery from the COVID-19 recession. Finally, the new reaction function features inertia, like the old one. The reaction function parameters were chosen so that the liftoff of interest rates from the effective lower bound would take place in early 2023, and would be very gradual. We should stress that the specific formulation of the rule, as well as the choices for the parameters, in no way reflect the views of the FOMC but simply our way of implementing flexible AIT in the context of the model.

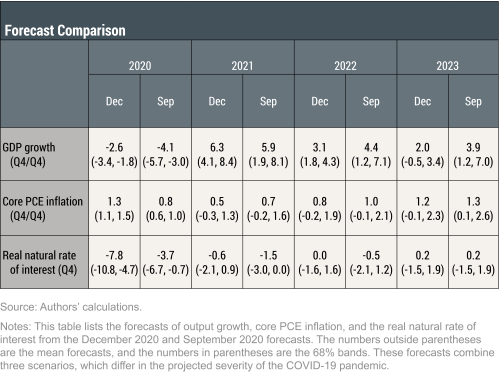

Importantly, the model assumes that the introduction of the new reaction function is only partially incorporated by the agents in forming expectations. Specifically, expectations are formed using a convex combination of forecasts obtained under the old and the new policy reaction functions using weights of 2/3 and 1/3, respectively. This approach reflects the fact that expectation formation by households and firms may adjust slowly to the introduction of the new policy strategy. The December model forecast is summarized in the table below, alongside the September forecast, and in the following charts. The model uses quarterly macroeconomic data released through the third quarter of 2020, financial data available through November 19, 2020, and SPF forecasts for GDP growth as described above.

How do the latest forecasts compare with the September forecasts?

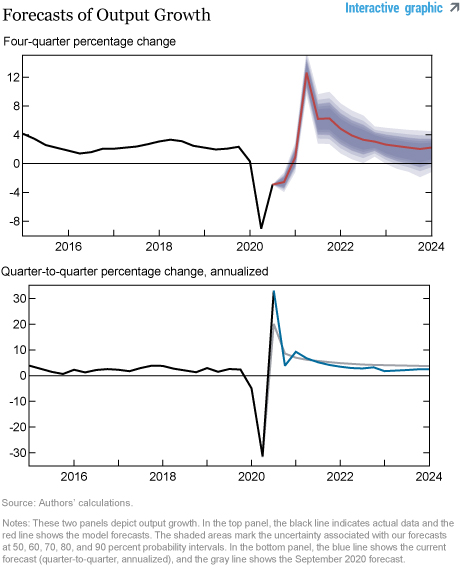

- In the forecast that combines the two scenarios described above, real GDP growth is expected to be -2.6 percent in 2020 on a Q4/Q4 basis, compared with a -4.1 percent projection in September. The introduction of AIT tends to accelerate the recovery so that growth in 2021 is a bit faster than predicted in September (6.3 versus 5.9 percent), but slower in 2022 and 2023 (3.1 versus 4.4 percent).

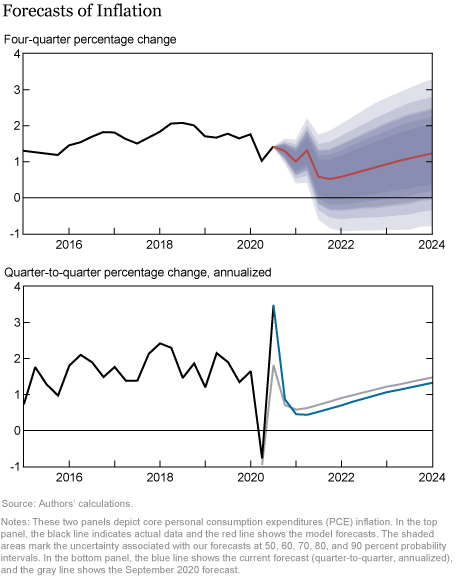

- Core PCE inflation is projected to be 1.3 percent in 2020, above the September forecast of 0.8 percent, but in spite of AIT it is expected to remain subdued throughout the forecast horizon, and below the projections in September. The change in the inflation projections relative to September mostly reflects the fact that the model is now more certain in interpreting the COVID-19 recession as a demand shock, leading to a decline in inflation. Ceteris paribus, AIT lifts the inflation projections by roughly 20 basis points relative to the forecast under the historical reaction function. Nonetheless, the small estimated slope of the Phillips curve implies that AIT has a limited impact on inflation, even if it boosts the recovery.

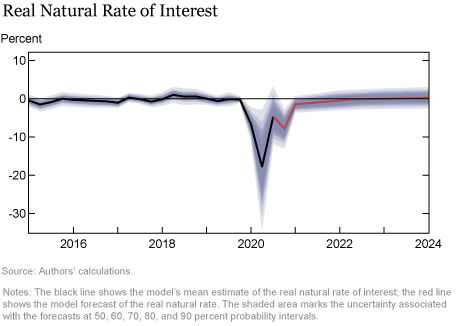

- Partly because of the second wave of the pandemic, the real natural rate falls temporarily by a large amount, -7.8 percent, in 2020:Q4 but it rebounds faster in 2021 than it did in the September projections, reflecting the transitory nature of the shocks.

William Chen is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Del Negro is a vice president in the Bank’s Research and Statistics Group.

Shlok Goyal is a senior research analyst in the Bank’s Research and Statistics Group.

Alissa Johnson is a senior research analyst in the Bank’s Research and Statistics Group.

How to cite this post:

William Chen, Marco Del Negro, Shlok Goyal, and Alissa Johnson, “The New York Fed DSGE Model Forecast—December 2020,” Federal Reserve Bank of New York Liberty Street Economics, December 23, 2020, https://libertystreeteconomics.newyorkfed.org/2020/12/the-new-york-fed-dsge-model-forecastdecember-2020.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics