The pandemic struck the New York-Northern New Jersey region early and hard, and the economy is still struggling to recover nearly two years later. Indeed, employment fell by 20 percent in New York City as the pandemic took hold, a significantly sharper decline than for the nation as a whole, and the rest of the region wasn’t far behind, creating a much larger hole to dig out of than other parts of the country. While the region saw significant growth as the economy began to heal, growth has slowed noticeably, and job shortfalls—that is, the amount by which employment remains below pre-pandemic levels—are some of the largest in the nation. Among major metro areas, job shortfalls in New York City, Buffalo, and Syracuse rank among the five worst in the country. Thus, despite much progress, the region is struggling to recover from the pandemic recession. By contrast, employment has rebounded above pre-pandemic levels in Puerto Rico, reaching a five-year high.

Large Job Shortfalls Remain in the Region

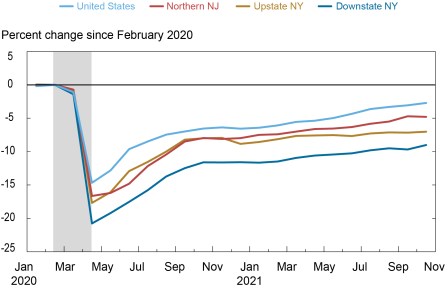

The New York-Northern New Jersey region saw particularly sharp job losses during the pandemic recession (February to April 2020), and the region has not yet caught up to the rest of the nation during the recovery. The chart below shows employment trends through the pandemic, indexed to pre-pandemic (February 2020) levels. With New York City emerging as the epicenter of the pandemic early on, the initial job loss of more than 20 percent in the downstate New York region greatly exceeded the national decline of 15 percent. Similarly, job losses in Northern New Jersey, Fairfield County, and upstate New York were greater than for the nation, at around 17-18 percent.

As the economy began to recover last spring, job growth in the region generally matched or even exceeded that of the nation. But for the region to catch up, job growth needed to be well above average for a sustained period—a difficult feat in the midst of a pandemic with the labor market in turmoil and workers hard to find. In fact, the opposite pattern began to occur in 2021: after a brief slowdown in late 2020, job growth resumed throughout the region but lagged the nationwide pace, especially in upstate New York. This was likely the result of the renewed spread of the virus at the end of last year, as people pulled back on many activities and restrictions were implemented in the region. The result of these two forces—a larger initial job loss and a slower pace of job gains for much of this year—has led to job shortfalls that significantly exceed the nation’s. As of October 2021, our early benchmark estimates indicate that payroll employment is still 9 percent below pre-pandemic levels in downstate New York, 7 percent below in upstate New York, and 5 percent below in Northern New Jersey, compared to less than 3 percent nationally (these and other data are available in our new Regional Employment Trends web interactive).

Large Job Shortfalls Remain in Much of the Region

Notes: Shading indicates a period designed a recession by the NBER. Data are early benchmarked by New York Fed staff.

Looking at local areas, the region is home to some of the largest job shortfalls in the country. The table below shows the initial employment decline and remaining job shortfalls for metro areas in the tri-state region. Job shortfalls in Buffalo, New York City, and Syracuse rank second, third, and fourth, respectively, among the nation’s largest 100 metropolitan areas (the complete list is available in the data file at the end of this post). In addition, Albany, Rochester, Long Island, and Newark all fall within the top 20. Many of the other metro areas in the region that are not among the 100 largest have job shortfalls well in excess of the national rate.

The New York-Northern New Jersey Region Is Home to Some of the Country’s Largest Job Shortfalls

Percent change in employment since February 2020

| Initial Decline, February 2020 to April 2020 | Remaining Shortfall as of October 2021 | Shortfall Rank (Largest 100 Metros) | |

|---|---|---|---|

| United States | -14.7 | -2.7 | – |

Largest Metros in the Region | |||

| Buffalo, NY MSA | -21.3 | -8.7 | 2 |

| New York City Metro Division | -19.6 | -8.3 | 3 |

| Syracuse, NY MSA | -17.1 | -8.1 | 4 |

| Albany, NY MSA | -15.4 | -6.0 | 11 |

| Rochester, NY MSA | -17.2 | -5.7 | 13 |

| Long Island | -23.4 | -5.6 | 14 |

| Newark Metro Division | -15.7 | -5.6 | 15 |

| Fairfield County, CT | -17.9 | -3.7 | 42 |

Smaller Metros in the Region | |||

| Ithaca, NY MSA | -10.1 | -9.8 | – |

| Dutchess-Putnam Counties, NY | -18.8 | -9.2 | – |

| Kingston, NY MSA | -21.3 | -8.6 | – |

| Binghamton, NY MSA | -18.0 | -7.7 | – |

| Elmira, NY MSA | -16.3 | -6.7 | – |

| Utica-Rome, NY MSA | -17.0 | -6.5 | – |

| Glens Falls, NY MSA | -19.8 | -6.2 | – |

| Watertown, NY MSA | -17.2 | -1.2 | – |

Notes: Data are early benchmarked by New York Fed staff. MSA refers to “metropolitan statistical area.”

With a job shortfall exceeding 10 percent, New York City (defined here as the five boroughs, not the larger metro shown in the table above) stands out as having a particularly large hole, while the surrounding areas—Long Island, Northern New Jersey, and Fairfield County—have fared a bit better, though shortfalls in all of these places are still above the national average.

Which Sectors Account for Such Large Shortfalls?

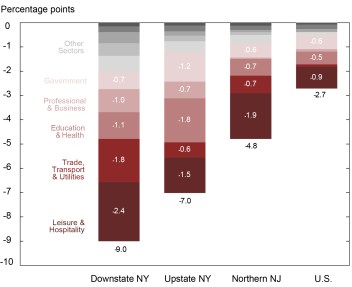

To better understand which parts of the regional economy are contributing most to outsized job shortfalls, we decompose job shortfalls into industry contributions for broad geographic aggregates in the region. Here’s how to interpret the chart: nationwide, the total job shortfall is 2.7 percent, shown by the full length of the stacked bar on the right. Each segment within the bar represents an industry’s contribution to that 2.7 percent. About 0.9 percentage points—or roughly a third of the shortfall—comes from the leisure & hospitality industry; 0.5 percentage points is attributable to education & health services; and another 0.6 points comes from the government sector. Indeed, these three sectors alone account for the vast majority of the job shortfall in the United States.

Industry Contributions to Job Shortfalls as of October 2021

Note: Data are early benchmarked by New York Fed staff.

Shortfalls are larger in the region than in the nation in nearly all industries, but some differences are particularly striking. Two consumer service-oriented sectors—leisure & hospitality and trade—have had an outsized impact on job shortfalls in the region. In downstate New York, the contribution of these two sectors alone to job shortfalls are significantly larger than the entire job shortfall in the nation. The outsized shortfalls in leisure & hospitality and trade downstate reflect the much more significant spread of the virus in and around New York City early in the pandemic, as well as restrictions on activities like air travel and dining out that were in place during much of the pandemic. Indeed, these consumer service-oriented sectors in New York City rely heavily on office workers, business travelers, and tourists—all of which have been sparse during the pandemic. Within New York City, the lion’s share of the job shortfall accrues to Manhattan, its central business district, while surrounding areas performed noticeably better. In effect, much of the money previously spent at Manhattan bars, restaurants, gyms, nail salons, and retail stores has gone to the outlying areas, which have benefitted from local residents working from home. The closing of the Canadian border also likely depressed tourism and some cross-border business activity in parts of upstate New York.

The education & health and government sectors are also more significant contributors to job shortfalls in the region than is the case nationally. The contribution from education & health is more than three times as large in upstate New York as nationwide, a result of the region having an above average share of workers in these sectors and of a more significant and persistent decline in health care workers across New York State, from hospitals to nursing homes. The pandemic also led to significant declines in teachers in the region as schools intermittently closed and went to online classes at various times, reflected by large shortfalls in the education sector, as well as the government sector (which includes public school teachers).

Finally, while the professional & business services sector has recouped nearly all its job losses in the nation and in Northern New Jersey, it remains a significant contributor to shortfalls in upstate and downstate New York, as those core business services have not recovered as well in these areas.

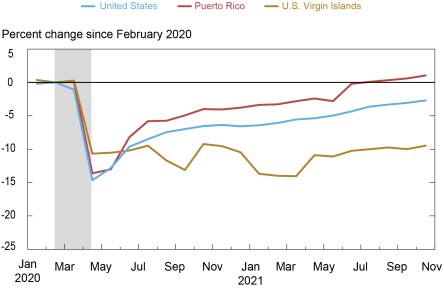

Puerto Rico Is Bucking the Trend

Puerto Rico and the U.S. Virgin Islands—both of which are in the Federal Reserve’s Second District—have traced very different paths. The chart below shows employment trends through the pandemic for Puerto Rico and the U.S. Virgin Islands compared to the U.S. mainland. While initial job losses were not as severe as on the mainland in either place, the path of recovery has diverged considerably through the pandemic. Indeed, employment is now 1 percent above pre-pandemic levels in Puerto Rico, reaching a five-year high. This is a striking feat, given that Puerto Rico’s economy had significantly lagged the mainland for decades. By contrast, with a job shortfall of nearly 10 percent, the U.S. Virgin Islands has recovered only a handful of the jobs that were lost.

Diverging Employment Patterns in Puerto Rico and

U.S. Virgin Islands

Note: Shading indicates a recession, as designated by the NBER.

Puerto Rico’s favorable job performance is due to a some unique factors. First, the spread of the virus was more contained on the island than on the mainland—likely helped by limited entry points, intermittent curfews, and a milder climate—resulting in fewer disruptions to economic activity and the labor force. Second, the medical manufacturing industry is a key economic driver in Puerto Rico, and this sector has seen fairly strong job growth during the pandemic. By contrast, the Virgin Islands are more highly dependent on tourism, particularly cruise-ship stop-overs, which has waned considerably.

An Uncertain Path Forward

While the employment data we analyze cover trends through October, our business surveys indicate that business activity in the region’s service sector has slowed to a moderate pace since then, while manufacturing activity has continued to grow at a solid clip. Local businesses report that activity is being impeded by a combination of a renewed surge in the virus, severe supply chain disruptions, and widespread worker shortages. While businesses and households generally remain optimistic that conditions will improve over the next six months, the regional economy faces a number of headwinds. As in much of the rest of the country, growth is likely to be hampered until the virus comes under control and there is meaningful progress toward relieving shortages of both workers and supplies. We will continue to monitor economic conditions in the region, providing timely updates as additional data and information become available. You can visit our Regional Economy website to stay up to date on the progress of the region’s recovery from the pandemic recession.

The data underlying the charts in this blog post and other supplemental materials, including information for local areas in the Second District, are available in the link below.

Chart data ![]()

Jaison R. Abel is an assistant vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Bram is a research officer in the Bank’s Research and Statistics Group.

Richard Deitz is an assistant vice president in the Bank’s Research and Statistics Group.

Jonathan Hastings is a research associate in the Bank’s Research and Statistics Group.

How to cite:

Jaison R. Abel, Jason Bram, Richard Deitz, and Jonathan Hastings, “The Region Is Struggling to Recover from the Pandemic Recession,” Federal Reserve Bank of New York Liberty Street Economics, December 17, 2021, https://libertystreeteconomics.newyorkfed.org/2021/12/the-region-is-struggling-to-recover-from-the-pandemic-recession.html.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York, the Federal Reserve Board, or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics