Editor’s note: Since this post was first published, the title of the last chart has been corrected. June 26, 2023, 11 a.m.

The Federal Reserve Bank of New York’s 2023 SCE Housing Survey, released in April, reported some novel data about expectations for home prices, interest rates, and mortgage refinancing. While the data showed a sharp drop in home price expectations, some of the most notable findings concern renters. In this post, we take a deeper dive into how renters’ expectations and financial situations have evolved over the past year. We find that both owners and renters expect rents to rise rapidly over the next year, albeit at a slower pace than last year. Furthermore, we also show that eviction expectations rose sharply over the past twelve months, and that this increase was most pronounced for those in the lowest quartile of the income distribution.

Rent Price Expectations Remain Elevated, Putting Pressure on Eviction Expectations

We examine the situation of renters using the SCE Housing Survey, an annual module of the New York Fed’s Survey of Consumer Expectations (SCE). The Housing Survey, which has been fielded every February since 2014, asks questions specific to respondents’ housing market expectations; responses to those questions can then be combined with the standard expectations questions asked in the monthly core SCE. The 2023 survey includes 1,013 respondents, about one-quarter of whom are current renters.

Expectations for Rent Price Growth

We ask all respondents for their views on the outlook for the rental market, particularly the growth rate of housing rents in their zip code over both the next year and the next five years. (In the monthly core survey, we ask the same respondents about rents nationally; those responses display a similar pattern.)

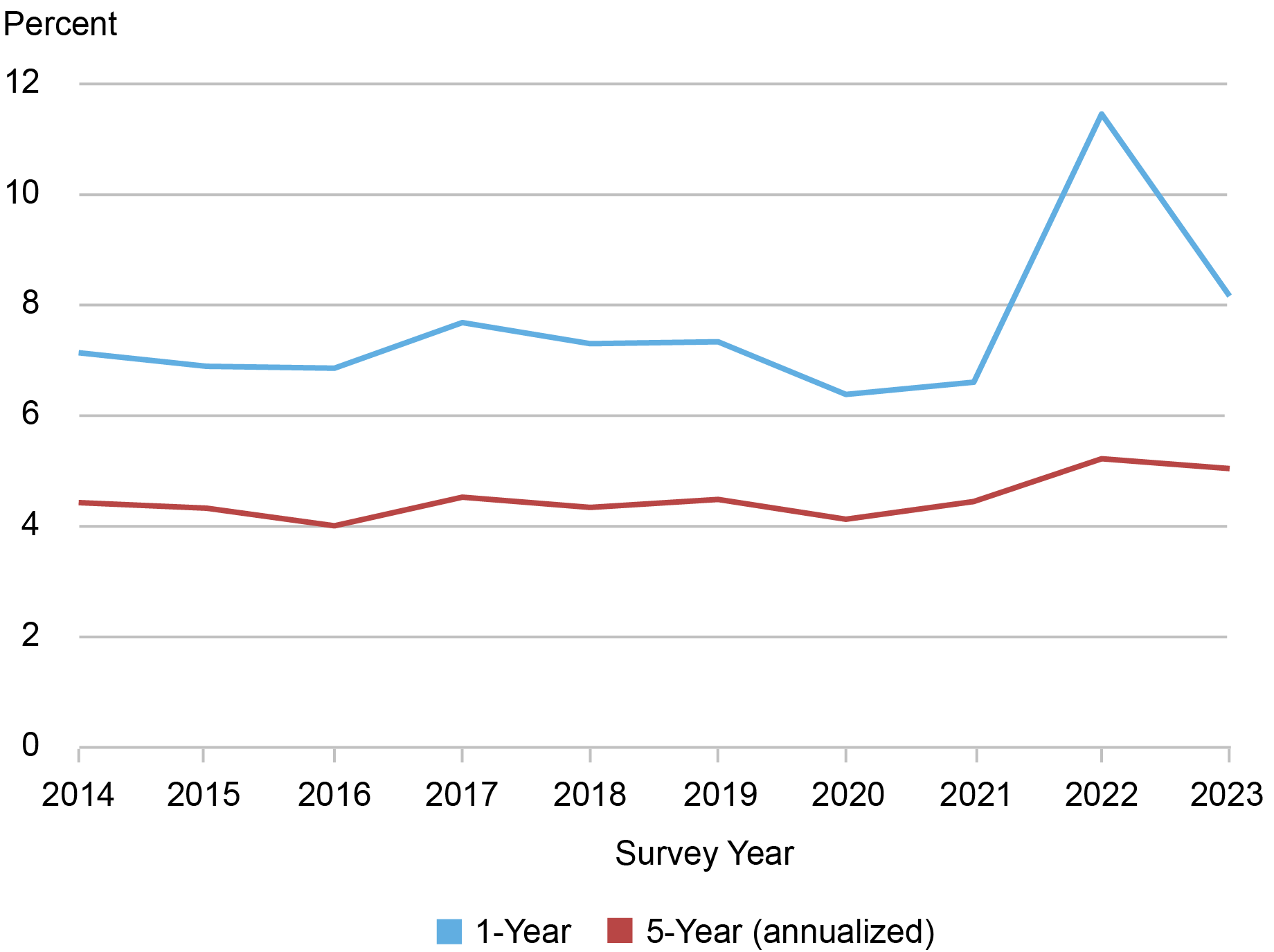

In the chart below, we report the average expectations for the years 2014-23. The responses display a remarkably stable pattern through 2021, with one-year-ahead rent change expectations moving in a narrow range between 6.4 and 7.7 percent. The average expected change in rent over the next five years was similarly flat through 2021, moving in a narrow range between 4.0 percent and 4.5 percent. In 2022, as rents were rising sharply nationwide, respondents reported an expectation that increases would reach 11.5 percent over the year ended in February 2023. In the most recent data, the expected change in rent prices over the next year moderated slightly, with respondents expecting an 8.2 percent increase in rents by February 2024. The average expected change in rent over the next five years also rose to series-high levels in February 2022, and then fell back somewhat; however, these changes were more muted than those at the one-year horizon. While the decline in rental price growth expectations relative to last year was substantial, both series remain elevated relative to their pre-pandemic levels.

Households Expect Slight Moderation in Rent Price Growth in the Short Term

Expectations for future rent increases vary across demographic groups, with less-advantaged (renters, less well-educated, lower income, older) households generally anticipating that rent growth in their zip codes will be higher. While less-advantaged groups’ expectations moderated a lot in 2023 compared to 2022, they remain above those of more advantaged groups. While homeowners and renters share similar rent expectations, renters typically expect slightly higher increases over the next year than do homeowners, and 2022 was no exception as their expectations more than doubled from 5.9 percent to 12.5 percent, compared to 11.0 percent for owners. In 2023, renters’ one-year-ahead rent change expectations declined to 8.4 percent. However, expectations in 2023 are higher for less well-educated, older, and lower income respondents, as well as those that live in the South and Midwest. (Differences in the five-year outlook vary much less by demographics. Interested readers will find time series of responses for these demographic groups here.) Since we ask respondents to report their rent expectations for their own zip codes, we can interpret these persistent differences as reflecting, at least in part, differences in housing market conditions across neighborhood types.

One perhaps surprising detail is that the moderation in rent expectations was most prominently felt among households making less than $30,000 in annual income, and households with the largest rent-to-income ratios. However, as we further explore below, this decline could also reflect a correction relative to the previous year, which saw the majority of eviction moratoria lifted, and were likely correlated with record-high rent price growth expectations that year.

Evictions

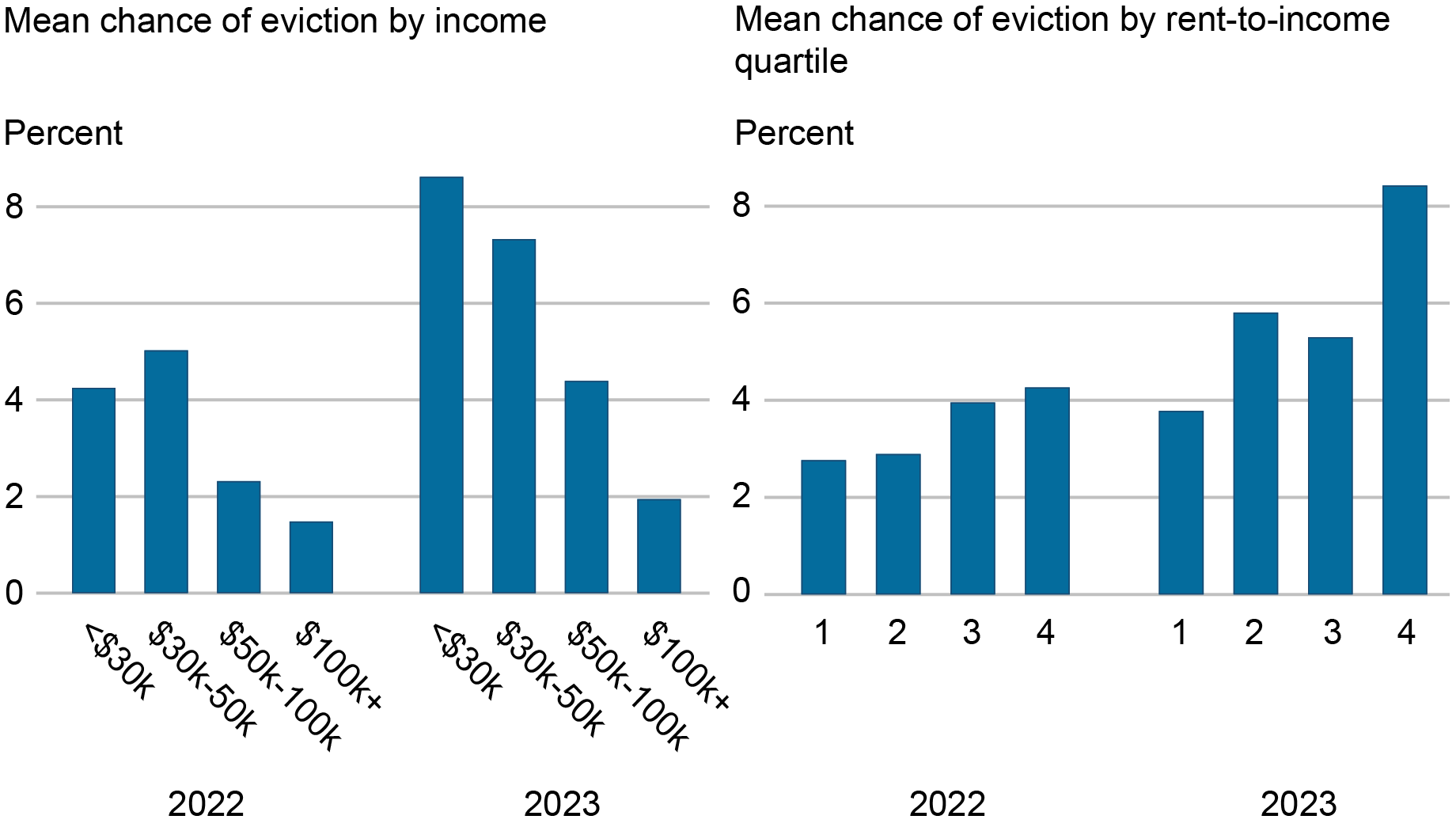

Despite expecting less pronounced rental price increases over the next twelve months, renters anticipate an increase in evictions in 2023. When renters were asked about the chance that they would be evicted in the next twelve months, the overall eviction likelihood rose from 4.1 percent in 2022 to 6.1 percent in 2023, where the eviction probability more than doubled—to 10.1 percent—among those in the top quartile of the rent-to-income distribution (indicated by group number 4 in the chart below, which corresponds to renters that put more than 47 percent of their income toward rent).

Renters See Higher Risk of Eviction in 2023

At first blush, the sharp rise in eviction expectations among the most vulnerable groups of renters is puzzling, given that they simultaneously anticipate a big reduction in the rate of rent increases. But this apparent puzzle is consistent with the view that rent increases are not the primary driver of eviction expectations—a conclusion we came to in our analysis of the 2022 eviction expectations data. In that work, we found that renters’ previous experience—specifically a previous experience with eviction—was the most important predictor of their expectations of eviction in the future. In this year’s data, we find that payment history (including missed rent) and expectations for future payments are more important determinants of eviction expectations.

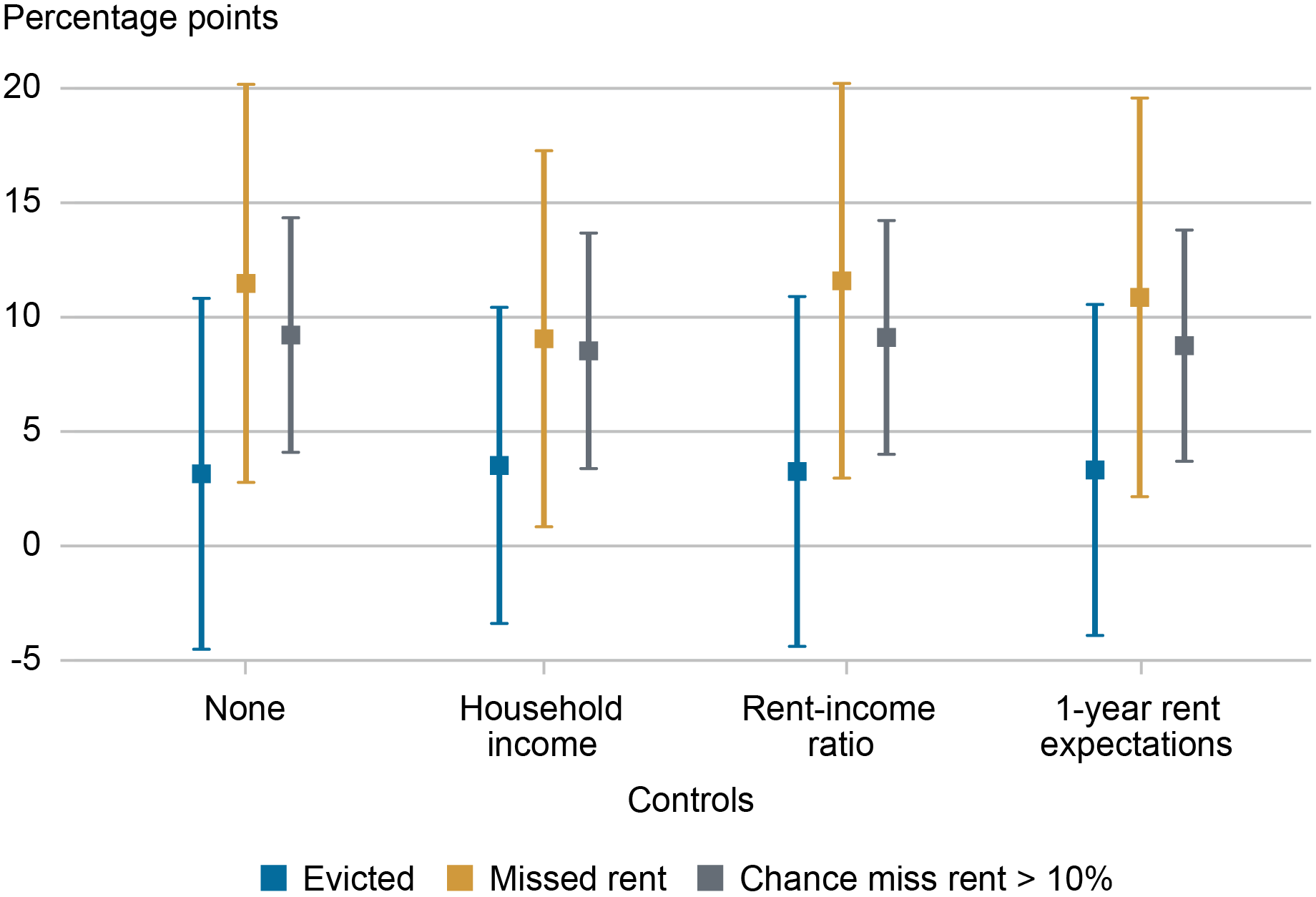

In the chart below, we report the effects on eviction expectations of three variables:

- A previous experience with eviction (the blue series);

- having missed at least one rental payment in the last year (gold); and

- expressing a greater than 10 percent chance of missing a rental payment in the next year (gray).

The squares show the estimated effect size and the lines show the 95 percent confidence intervals for the estimates. Having missed a previous payment and expecting to miss one in the next year raise the reported chance of eviction by around 10 percentage points; these results hold even when we control for household income (the second set of lines), the rent-to-income ratio (the third set), and year-ahead rent growth expectations (the last set). Any past experience of eviction still has a positive effect on eviction expectations, but the effect is smaller and less precisely estimated (the 95 percent confidence intervals are wide and include 0) than in our analysis of the 2022 eviction expectations data.

Estimated Risk of Eviction within Next Year: Marginal Effects of Past Eviction and Rent Delinquency

Taken together, these results suggest that the chance of eviction has become more salient, which is consistent with the expiration of eviction moratoria and the fact that evictions were on the rise in many parts of the U.S. in 2022. Those who have recently missed rental payments, or expect to miss them in the coming year, are indeed vulnerable to eviction in this new environment and appear to be increasingly aware of that vulnerability. The fact that these expectations don’t seem particularly closely related to rent increases is perhaps evidence that renters’ current situation is difficult—rent at its current levels is enough to make the risk of eviction salient.

As might be expected in an environment where they anticipate high and increasing home prices coupled with rising mortgage rate expectations, tightening lending standards, and evictions among the most vulnerable populations, renters remain pessimistic about their buying prospects in the future. In 2023, renters reported a 44.4 percent chance of owning at some point in the future, close to the series low reading of 43.3 percent in 2022. These readings are down from estimates in the range of 50-55 percent from 2015 to 2021, which further reinforces the view that significant headwinds remain for renters in the current economic environment.

Andrew F. Haughwout is director of Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ben Hyman is a research economist in Urban and Regional Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ben Lahey is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Devon Lall is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Somerville is a research economist in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Andrew Haughwout, Ben Hyman, Ben Lahey, Devon Lall, and Jason Somerville, “Elevated Rent Expectations Continue to Pressure Low‑Income Households,” Federal Reserve Bank of New York Liberty Street Economics, June 22, 2023, https://libertystreeteconomics.newyorkfed.org/2023/06/elevated-rent-expectations-continue-to-pressure-low-income-households/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics