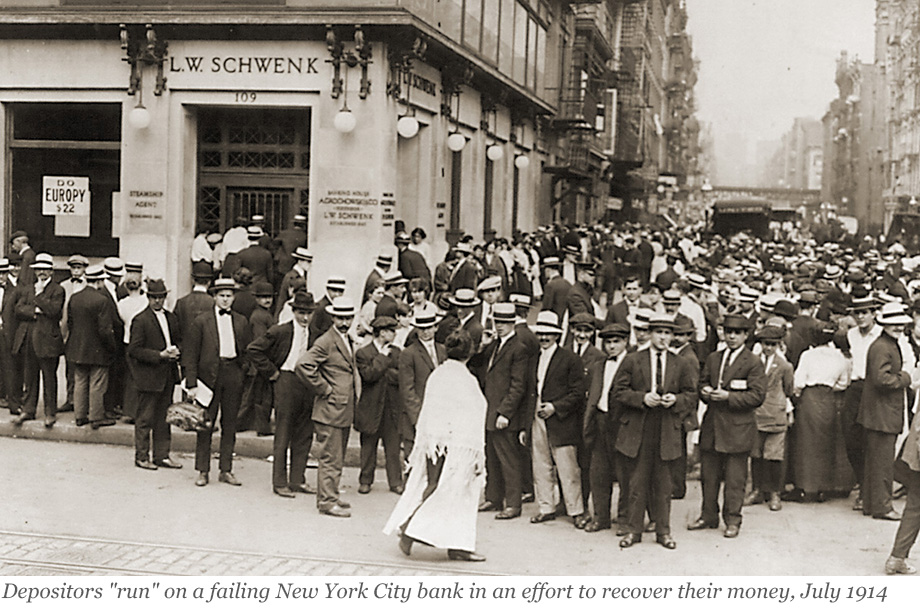

Robust banks are a cornerstone of a healthy financial system. To ensure their stability, it is desirable for banks to hold a diverse portfolio of loans originating from various borrowers and sectors so that idiosyncratic shocks to any one borrower or fluctuations in a particular sector would be unlikely to cause the entire bank to go under. With this long-held wisdom in mind, how diversified are banks in reality?

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics