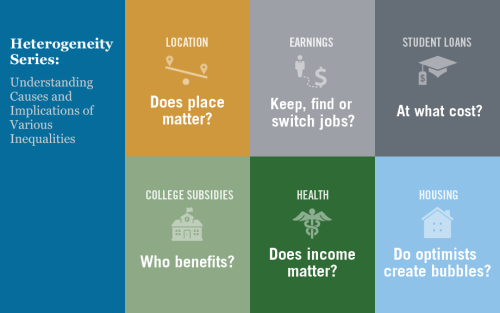

Introduction to Heterogeneity Series: Understanding Causes and Implications of Various Inequalities

Economic analysis is often geared toward understanding the average effects of a given policy or program. Likewise, economic policies frequently target the average person or firm. While averages are undoubtedly useful reference points for researchers and policymakers, they don’t tell the whole story: it is vital to understand how the effects of economic trends and government policies vary across geographic, demographic, and socioeconomic boundaries. It is also important to assess the underlying causes of the various inequalities we observe around us, be they related to income, health, or any other set of indicators. Starting today, we are running a series of six blog posts (apart from this introductory post), each of which focuses on an interesting case of heterogeneity in the United States today.

U.S. Virgin Islands Struggle While Puerto Rico Rebounds

Almost two years after hurricanes Irma and Maria wreaked havoc on Puerto Rico and the U.S. Virgin Islands, the two territories’ economies have moved in very different directions. When the hurricanes struck, both were already in long economic slumps and had significant fiscal problems. As of mid-2019, however, Puerto Rico’s economy was showing considerable signs of improvement since the hurricanes, while the Virgin Islands’ economy remained mired in a deep slump through the end of 2018, though signs of a nascent recovery began emerging in early 2019. In this post, we assess the contrasting trends of these two economies since the hurricanes and attempt to explain the forces driving these trends.

Minimum Wage Impacts along the New York‑Pennsylvania Border

Just Released: Transitions to Unemployment Tick Up in Latest SCE Labor Market Survey

The Federal Reserve Bank of New York’s July 2019 SCE Labor Market Survey shows a year-over-year rise in employer-to-employer transitions as well as an increase in transitions into unemployment. Satisfaction with promotion opportunities and wage compensation were largely unchanged, while satisfaction with non-wage benefits retreated. Regarding expectations, the average expected wage offer (conditional on receiving one) and the average reservation wage—the lowest wage at which respondents would be willing to accept a new job—both increased. Expectations regarding job transitions were largely stable.

Did the Value of a College Degree Decline during the Great Recession?

In an earlier post, we studied how educational attainment affects labor market outcomes and earnings inequality. In this post, we investigate whether these labor market effects were preserved across the last business cycle: Did students with certain types of educational attainment weather the recession better?

Just Released: New Regional Employment Data Now Available

Regional employment data provided by the U.S. Bureau of Labor Statistics (BLS) are a critically important tool used to track and assess local economic conditions on a timely basis. However, the primary data used for this purpose are monthly survey-based estimates that are revised once per year, and these revisions can sometimes be substantial and surprising. As a result, initial readings of these data can lead to conclusions about employment trends that may later change. It is possible to anticipate these revisions in advance of their release using a second publicly available data set released by the BLS. Like some of our colleagues at other Federal Reserve Banks, the Federal Reserve Bank of New York is now performing an “early benchmark” of initial monthly employment releases throughout the year and making these benchmarked data available to the public on a monthly basis. Our early benchmarked estimates tend to more closely track revised data than the initial releases do, and can help policymakers and the public better monitor regional economic conditions on a timely basis.

The Cost of College Continues to Climb

College is much more expensive than it used to be. Tuition for a bachelor’s degree has more than tripled from an (inflation-adjusted) average of about $5,000 per year in the 1970s to around $18,000 today. For many parents and prospective students, this high and rising tuition has raised concerns about whether getting a college degree is still worth it—a question we addressed in a 2014 study. In this post, we update that study, estimating the cost of college in terms of both out-of-pocket expenses, like tuition, and opportunity costs, the wages one gives up to attend school. We find that the cost of college has increased sharply over the past several years, though tuition increases are not the primary driver. Rather, opportunity costs have increased substantially as the wages of those without a college degree have climbed due to a strong labor market. In a follow-up post, we will consider whether college is still “worth it” by weighing the benefits relative to the costs to estimate the return to a college degree.

How Has Germany’s Economy Been Affected by the Recent Surge in Immigration?

Germany emerged as a leading destination for immigration around 2011, as the country’s labor market improved while unemployment climbed elsewhere in the European Union. A second wave began in 2015, with refugees from the Middle East adding to already heavy inflows from Eastern Europe. The demographic consequences of the surge in immigration include a renewed rise in Germany’s population and the stabilization of the country’s median age. The macroeconomic consequences are hard to measure but look promising, since per capita income growth has held up and unemployment has declined. Data on labor-market outcomes specific to immigrants are similarly favorable through 2015, but challenges are evident in how well the economy is adjusting to the second immigration wave.

Just Released: The New York Fed’s New Regional Economy Website

Jaison R. Abel, Jason Bram, Richard Deitz, and Jonathan Hastings The New York Fed today unveiled a newly designed website on the regional economy that offers convenient access to a wide array of regional data, analysis, and research that the Bank makes available to the public. Focusing specifically on the Federal Reserve’s Second District, which […]

Expecting the Unexpected: Job Losses and Household Spending

Unemployment risk constitutes one of the most significant sources of uncertainty facing workers in the United States. A large body of work has carefully documented that job loss may have long-term effects on one’s career, depressing earnings by as much as 20 percent after fifteen to twenty years. Given the severity of a job loss for earnings, an important question is how much such an event affects one’s standard of living during a spell of unemployment. This blog post explores how unemployment and expectations of job loss interact to affect household spending.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics