Why Do Banks Fail? Bank Runs Versus Solvency

Evidence from a 160-year-long panel of U.S. banks suggests that the ultimate cause of bank failures and banking crises is almost always a deterioration of bank fundamentals that leads to insolvency. As described in our previous post, bank failures—including those that involve bank runs—are typically preceded by a slow deterioration of bank fundamentals and are hence remarkably predictable. In this final post of our three-part series, we relate the findings discussed previously to theories of bank failures, and we discuss the policy implications of our findings.

Why Do Banks Fail? The Predictability of Bank Failures

Can bank failures be predicted before they happen? In a previous post, we established three facts about failing banks that indicated that failing banks experience deteriorating fundamentals many years ahead of their failure and across a broad range of institutional settings. In this post, we document that bank failures are remarkably predictable based on simple accounting metrics from publicly available financial statements that measure a bank’s insolvency risk and funding vulnerabilities.

Why Do Banks Fail? Three Facts About Failing Banks

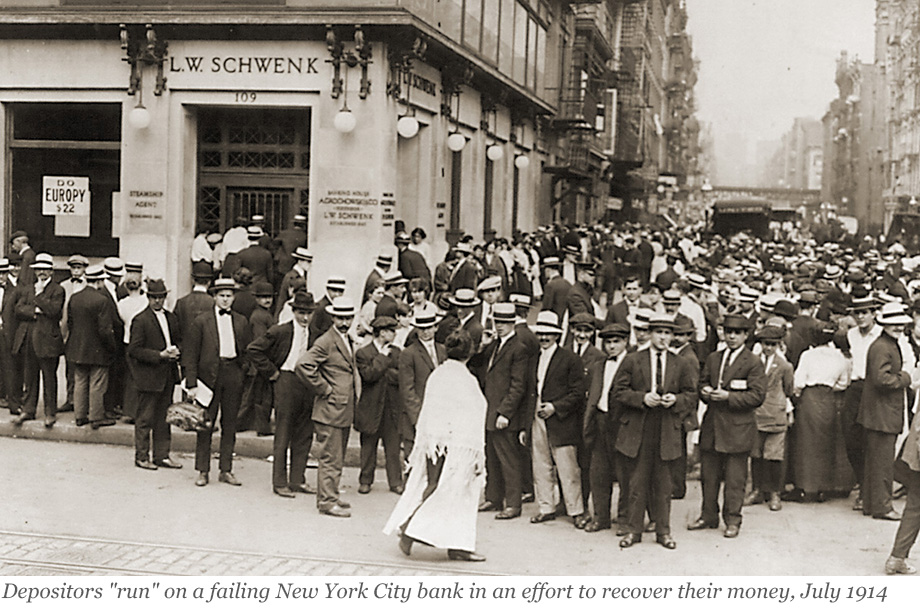

Why do banks fail? In a new working paper, we study more than 5,000 bank failures in the U.S. from 1865 to the present to understand whether failures are primarily caused by bank runs or by deteriorating solvency. In this first of three posts, we document that failing banks are characterized by rising asset losses, deteriorating solvency, and an increasing reliance on expensive noncore funding. Further, we find that problems in failing banks are often the consequence of rapid asset growth in the preceding decade.

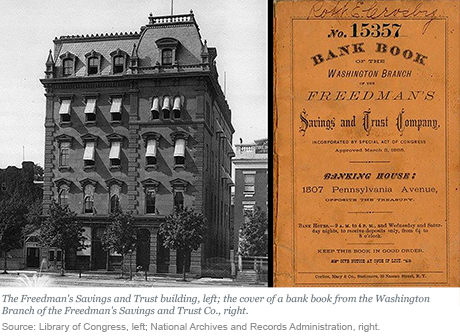

Historical Echoes: The Legacy of Freedman’s Savings and Trust

Freedman’s Savings and Trust Company, often referred to as the Freedman’s Bank, was created specifically for former slaves and African-American soldiers. It was established by legislation signed by Abraham Lincoln on March 3, 1865, only weeks before his assassination. Groundwork for the bank was laid during a meeting in January of that year by abolitionist preacher John Alvord, who met with a number of others to discuss the possibility of founding a system to assist freed African-Americans in their savings, financial development, and integration into American economic society. In the ten years of its existence, the Freedman’s Bank brought hope and then heartbreak to the African-American community.

Depositor Discipline of Risk‑Taking by U.S. Banks

The recent financial crisis caused the largest rise in the number of bank failures since the unprecedented banking crisis of the 1980s and early 1990s.

Parting Reflections on the Series on Large and Complex Banks

The motivation for the Economic Policy Review series was to understand better the behavior of large and complex banks, and we have covered a lot of ground toward that end.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics