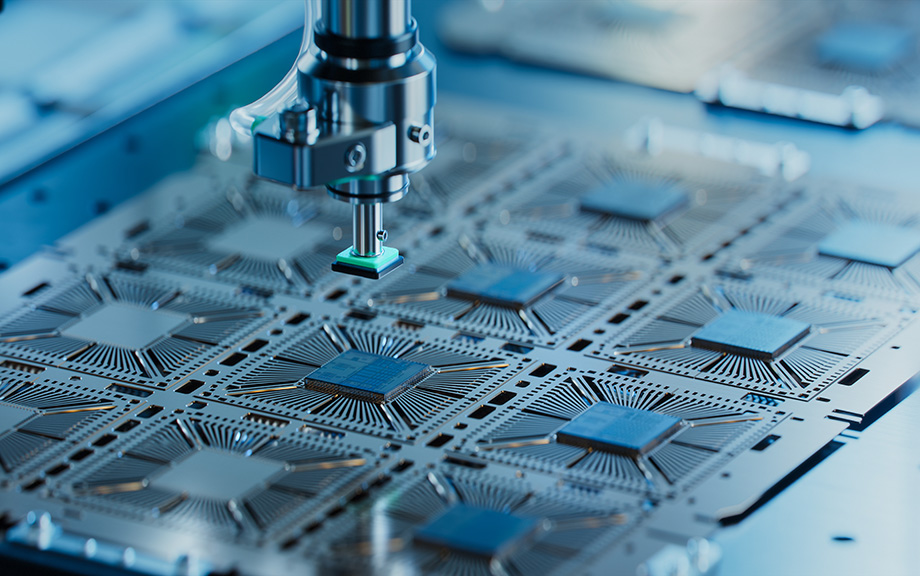

The Anatomy of Export Controls

Editor's note: We corrected the first chart in this post to include missing data for the number of affected U.S. suppliers in 2016 in the histogram. Chart data is available for download via link at the foot of the post. (June 12)

Governments increasingly use export controls to limit the spread of domestic cutting-edge technologies to other countries. The sectors that are currently involved in this geopolitical race include semiconductors, telecommunications, and artificial intelligence. Despite their growing adoption, little is known about the effect of export controls on supply chains and the productive sector at large. Do export controls induce a selective decoupling of the targeted goods and sectors? How do global customer-supplier relations react to export controls? What are their effects on the productive sector? In this post, which is based on a related staff report, we analyze the supply chain reconfiguration and associated financial and real effects following the imposition of export controls by the U.S. government.

An Overlooked Factor in Banks’ Lending to Minorities

In the second quarter of 2022, the homeownership rate for white households was 75 percent, compared to 45 percent for Black households and 48 percent for Hispanic households. One reason for these differences, virtually unchanged in the last few decades, is uneven access to credit. Studies have documented that minorities are more likely to be denied credit, pay higher rates, be charged higher fees, and face longer turnaround times compared to similar non-minority borrowers. In this post, which is based on a related Staff Report, we show that banks vary substantially in their lending to minorities, and we document an overlooked factor in this difference—the inequality aversion of banks’ stakeholders.

Banking System Vulnerability: 2022 Update

To assess the vulnerability of the U.S. financial system, it is important to monitor leverage and funding risks—both individually and in tandem. In this post, we provide an update of four analytical models aimed at capturing different aspects of banking system vulnerability with data through 2022:Q2, assessing how these vulnerabilities have changed since last year. The four models were introduced in a Liberty Street Economics post in 2018 and have been updated annually since then.

Banking System Vulnerability through the COVID‑19 Pandemic

More than a year into the COVID-19 pandemic, the U.S. banking system has remained stable and seems to have weathered the crisis well, in part because of effects of the policy actions undertaken during the early stages of the pandemic. In this post, we provide an update of four analytical models that aim to capture different aspects of banking system vulnerability and discuss their perspective on the COVID pandemic. The four models, introduced in a Liberty Street Economics post in November 2018 and updated annually since then, monitor vulnerabilities of U.S. banking firms and the way in which these vulnerabilities interact to amplify negative shocks.

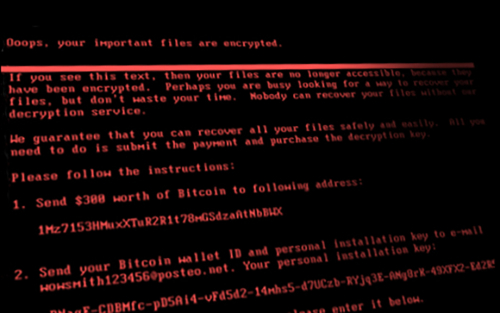

Cyberattacks and Supply Chain Disruptions

Cybercrime is one of the most pressing concerns for firms. Hackers perpetrate frequent but isolated ransomware attacks mostly for financial gains, while state-actors use more sophisticated techniques to obtain strategic information such as intellectual property and, in more extreme cases, to disrupt the operations of critical organizations. Thus, they can damage firms’ productive capacity, thereby potentially affecting their customers and suppliers. In this post, which is based on a related Staff Report, we study a particularly severe cyberattack that inadvertently spread beyond its original target and disrupted the operations of several firms around the world. More recent examples of disruptive cyberattacks include the ransomware attacks on Colonial Pipeline, the largest pipeline system for refined oil products in the U.S., and JBS, a global beef processing company. In both cases, operations halted for several days, causing protracted supply chain bottlenecks.

How Does Zombie Credit Affect Inflation? Lessons from Europe

Even after the unprecedented stimulus by central banks in Europe following the global financial crisis, Europe’s economic growth and inflation have remained depressed, consistently undershooting projections. In a striking resemblance to Japan’s “lost decades,” the European economy has been recently characterized by persistently low interest rates and the provision of cheap bank credit to impaired firms, or “zombie credit.” In this post, based on a recent staff report, we propose a “zombie credit channel” that links the rise of zombie credit to dis-inflationary pressures.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics