Federal government actions in response to the pandemic have taken many forms. One set of policies is intended to reduce the risk that the pandemic will result in a housing market crash and a wave of foreclosures like the one that accompanied the Great Financial Crisis. An important and novel tool employed as part of these policies is mortgage forbearance, which provides borrowers the option to pause or reduce debt service payments during periods of hardship, without marking the loan delinquent on the borrower’s credit report. Widespread take-up of forbearance over the past year has significantly changed the housing finance system in the United States, in different ways for different borrowers. This post is the first of four focusing attention on the effects of mortgage forbearance and the outlook for the mortgage market. Here we use data from the New York Fed’s Consumer Credit Panel (CCP) to examine the effects of these changes on households during the pandemic.

Background: Who Qualifies for COVID-19 Mortgage Forbearance?

Initially, under the CARES Act, borrowers with federally backed mortgages could request up to twelve months of forbearance, made up of two 180-day periods, if they experienced financial hardship because of COVID-19. Several agencies have subsequently granted extensions. Specifically, borrowers with mortgages backed by the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac can request up to two additional three-month extensions (for a maximum of eighteen months of total forbearance) if they were in an active forbearance plan as of February 28, 2021, while borrowers with mortgages backed by the Department of Housing and Urban Development/Federal Housing Administration (HUD/FHA), the U.S. Department of Agriculture (USDA), or the Department of Veterans Affairs (VA) can enroll in forbearance until June 30, 2021, and receive up to eighteen months of total forbearance. At the same time, the CARES Act (section 4013) eased the accounting treatment of pandemic-related modifications for loans in bank portfolios, and the federal banking agencies released guidance to that effect in early April 2020.

How Does Forbearance Work?

Widespread forbearance is a new policy, although similar programs have previously been rolled out on a smaller scale in the wake of natural disasters. Typically, the missed payments will be added to the end of the loan; for a borrower in the first year of a thirty-year mortgage, a forbearance thus amounts to a twenty-nine-year interest-free loan of the forborne amount. These forbearances are safe loans in part because they are incentive-compatible: in order to preserve their housing equity, borrowers must resume payments when they are able. (Note that renters, with no equity in their property, do not have strong incentives to pay back forborne rent payments, making the provision of relief to renters more difficult than to owners.)

Who Entered Forbearance?

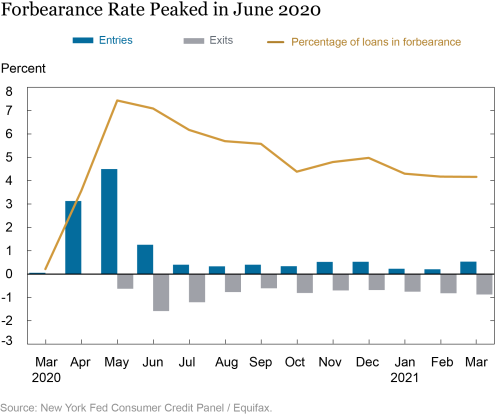

As we reported back in November, large numbers of mortgage forbearances began to appear on credit reports in April 2020, and by May 2020, 7 percent of mortgage accounts were in forbearance. By June, however, exits from forbearance began to outweigh entries, and the number of mortgages in forbearance began a slow decline. The following chart shows that by March 2021, the overall forbearance rate had fallen to 4.2 percent, accompanied by reductions in both entries and exits, suggesting a relatively stable group of borrowers in forbearance for a relatively long period of time. In fact, of the 2.2 million mortgages still in forbearance in March 2021, 1.2 million entered forbearance in June 2020 or earlier. (In March, the inflows into forbearance are likely affected by additional payment relief offered in Texas as a response to the effects of the winter storm there.)

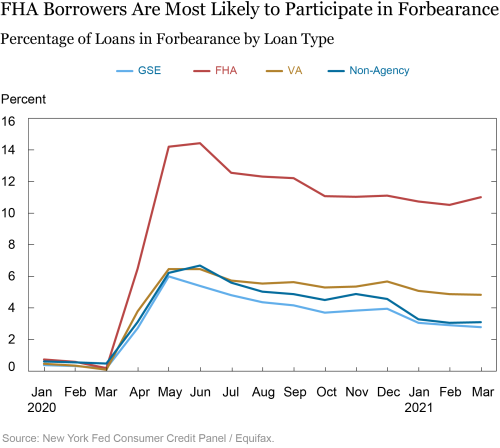

These dynamics—a sharp rise in April and May, followed by a slow decline through the summer and fall—are common across most types of mortgages, but FHA borrowers were considerably more likely to take up mortgage forbearance initially, and have remained in the program longer. As of March 2021, more than 11 percent of FHA borrowers remain in forbearance, as shown below.

What accounts for the higher forbearance rates for FHA borrowers? FHA borrowers are much more likely to be first-time home buyers and to live in lower-income areas. About 41 percent of FHA borrowers live in neighborhoods with average annual household income below $50,000, compared to 22 percent for GSE borrowers.

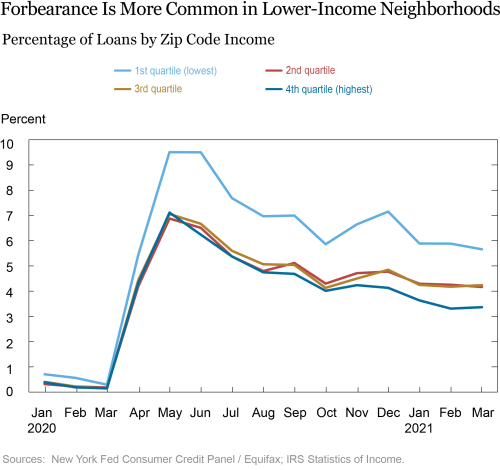

With this context, it’s perhaps not surprising to find that forbearance rates rose most, and were most persistent, in lower average income zip codes. As shown in the next chart, forbearance rates in the poorest quartile of zip codes approached 10 percent in May and June 2020 and remain above 5.5 percent at the end of March 2021.

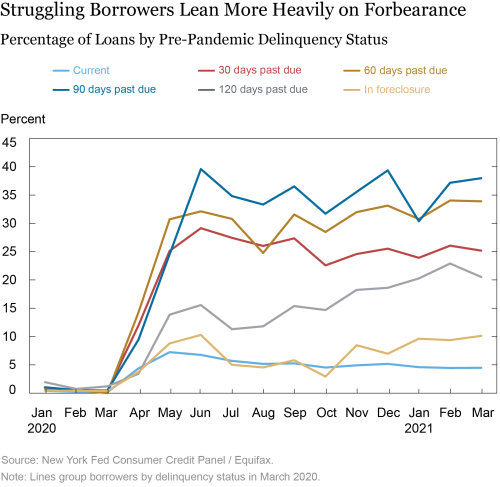

The likelihood of forbearance falls steadily as borrower credit score (measured at the date of mortgage origination) rises, and it is far higher for loans that were delinquent in March 2020; see the next chart. Indeed, forbearance rates remain near 40 percent for borrowers who were delinquent on their mortgages pre-pandemic. The higher rates of mortgage forbearance in poorer areas and among FHA borrowers is consistent with the uneven impact that COVID-19 and the accompanying recession have had on different segments of the population. Mortgage forbearance has been an important policy tool to mitigate the impact of these challenges faced by less-advantaged households.

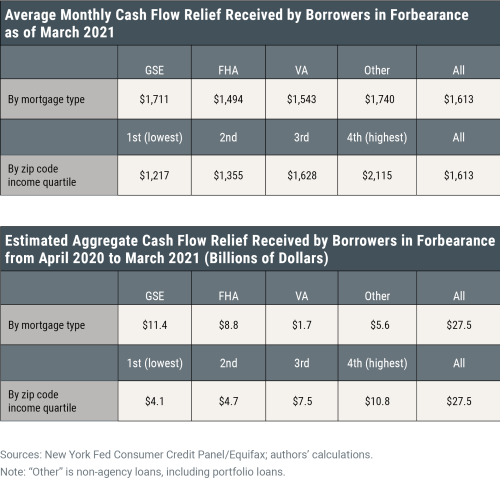

Since housing costs are typically one of the largest household expenses, it isn’t surprising that mortgage forbearance offers very substantial cash flow relief to the households that take it up. The table below provides details on the payment relief that different forbearance participants received. (As we show in a companion post, being enrolled in forbearance isn’t quite the same as receiving cash flow relief.) We estimate this relief using the average payment that was due prior to enrolling in forbearance for those who were enrolled in forbearance as of March 2021. (These figures have been very stable since March 2020, so we don’t show the changes over time here.)

As the table shows, the average monthly cash flow relief associated with a mortgage forbearance is somewhat different across different mortgage types and grows sharply as neighborhood income rises. Indeed, aggregate cumulative payments skipped by borrowers from the poorest 25 percent of neighborhoods are about 38 percent of those skipped in top-quartile neighborhoods.

All told, in absolute dollar terms, mortgage forbearance has brought the most benefit to the highest-income areas. This is due to a combination of high homeownership and relatively expensive mortgage payments in these areas, which more than offsets the considerably higher incidence of forbearance in lower-income areas. Still, the high rates of forbearance take-up on FHA loans and in poorer zip codes makes clear that these programs have been an important lifeline to less-advantaged households.

Conclusion

We find that mortgage forbearance has been an important policy tool to mitigate the impact of the pandemic and has become a fairly common phenomenon since it became widely available last year. After an initial rapid rise to over 7 percent, the share of mortgages in forbearance has slowly declined and stood at just over 4 percent in late March 2021. Forbearance has been more common for FHA borrowers and mortgagors from poorer neighborhoods, as well as those who were already delinquent in March 2020. In a separate post, we look at how being in forbearance affects borrowers, and continue to look at the distribution of those effects.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is a senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Andrew F. Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Keeping Borrowers Current in a Pandemic,” Federal Reserve Bank of New York Liberty Street Economics, May 19, 2021, https://libertystreeteconomics.newyorkfed.org/2021/05/keeping-borrowers-current-in-a-pandemic-.html.

Additional Posts in This Series

What Happens during Mortgage Forbearance?

Small Business Owners Turn to Personal Credit

What’s Next for Forborne Borrowers?

Press Briefing

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics