In our first post in this series we showed that mortgage provisions under the CARES ACT and its subsequent extensions resulted in a rapid take-up of mortgage forbearances, under which borrowers had the option to pause or reduce debt service payments without inducing a delinquency notation on their credit reports. Here we examine the forbearance take-up rate of a group of mortgage borrowers we expect to have been particularly hard hit by the pandemic recession: small business owners. Relatively little is known about how small business owners have fared over the past year in terms of their personal finances. Were they able to continue making mortgage payments on their homes? Did they draw on home equity to help fund their business operations?

A Unique Data Set

To examine these questions, we draw on a unique merger between individual-level data from the New York Fed’s Consumer Credit Panel (CCP) and business owner identifiers derived from a random anonymous sample of businesses drawn from Equifax’s Commercial database. The latter is a comprehensive database of all active businesses operating in the United States. To identify business owners, we draw on information reported as part of a business’s Secretary of State filing. More specifically, we identify as business owners those individual(s) listed as owner or principal under “business contacts” in Secretary of State filings in 2019 or later. In approximately 60 percent of these filings the owners can be matched with characteristics of their firms, such as industry or firm size.

Forbearance Take-up and Performance among Small Business Owners

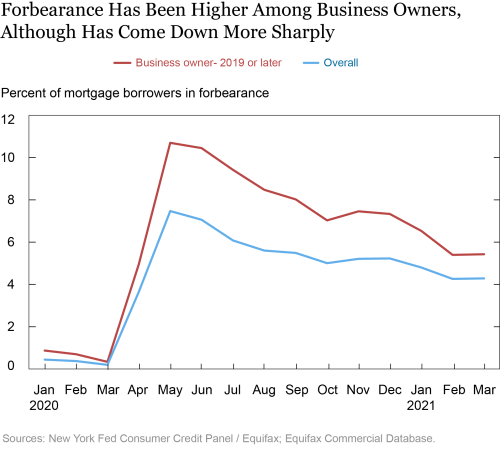

We have described the general trends on forbearances in the first and second posts in this series: By May 2020 some 7 percent of mortgage accounts were in forbearance, after which the share declined gradually to 4.2 percent in March 2021. Borrowers living in the lowest-income zip codes (with average income belonging to the bottom 25 percent) had a take-up rate that peaked at around 10 percent in May, considerably higher than the 7 percent rate for those in zip codes with average incomes in the top 25 percent. In contrast, given their much higher homeownership rates and outstanding mortgage balances, the cash flow relief obtained through forbearance was considerably higher for those in higher-income areas.

But business owners differ from the general population of mortgagors in some important ways. It is important to consider how this group of borrowers compares to mortgagors overall before describing mortgage forbearance take-up by business owners. Consistent with other findings from the New York Fed, we find that business owners generally tend to be somewhat older, have higher credit scores, and are more likely to have credit products of all types (excluding student loans). They also have higher balances on their accounts, on average, and are more likely to live in higher-income areas. For example, some 39 percent of business owners in our matched sample reside in the wealthiest areas with the highest average incomes in their zip codes (based on 2017 IRS data).

We next turn to forbearance take-up among mortgage borrowers, and in the chart below, we compare the rates for those identified as business owners as well as for mortgagors overall. We find a considerably higher take-up rate among business owners, reaching 11 percent in May, after which the share exiting forbearance began to outweigh the share entering, with the rate gradually declining to about 5 percent in March 2021. Overall, 17 percent of small business owners with personal mortgages participated in a forbearance program at some point since February 2020.

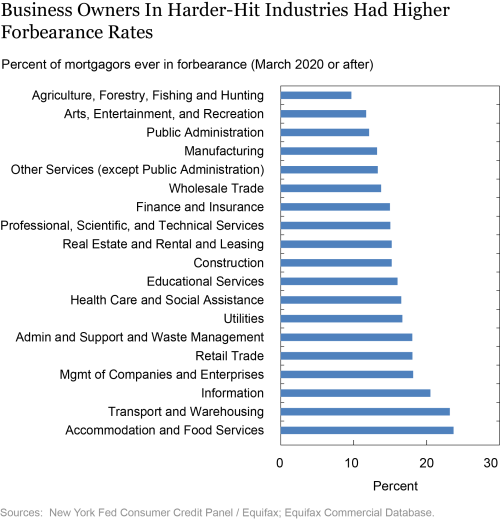

Data on business closures and consumer spending indicate that some segments of the economy, and in particular the services sector, were more severely affected by the pandemic. The chart below shows these hardships clearly reflected on business owner’s credit reports, with business owners in harder-hit industries having much higher forbearance rates on their mortgages. Note that these firmographic descriptions are based on a somewhat smaller sample for which we have industry codes, so they may not be generalizable to the full population of firms. Nonetheless, the results are consistent with spending and employment data, with some 23 percent of business owners in the hard hit accommodation and food services, and transport and warehousing sectors entering forbearance on their mortgage at some point over the past year, while fewer than 10 percent did so in agriculture. We also examined how the forbearance take-up rate varied with firm size. Perhaps somewhat surprisingly, we found relatively little variation.

Personal Credit Use and Performance

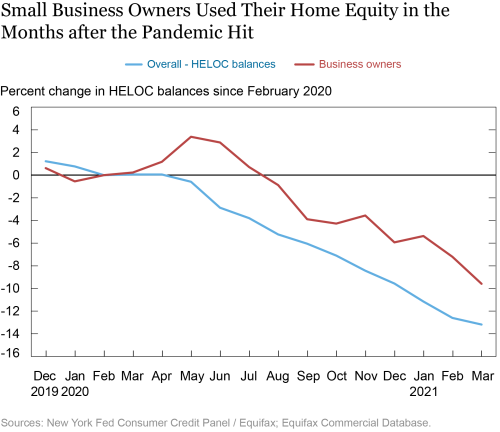

In addition to a high mortgage forbearance take-up rate, business owners were more likely to borrow against their home equity after the onset of the pandemic. First, small business owners are more likely to have a HELOC and also on average carry larger HELOC balances. In the chart below showing HELOC balance changes relative to their February 2020 levels, we find that the average HELOC balances of small business owners had jumped up 3.4 percent between February and May 2020, while those of overall individuals declined 0.6 percent over the same period. The increase seen among business owners is remarkable considering that overall HELOC balances have seen steady quarterly declines for many years and has not seen such substantial growth in a three-month period since the Great Recession. This gap persisted over time, with the general population out-pacing business owners in HELOC paydown by about 4 percentage points through March of 2021.

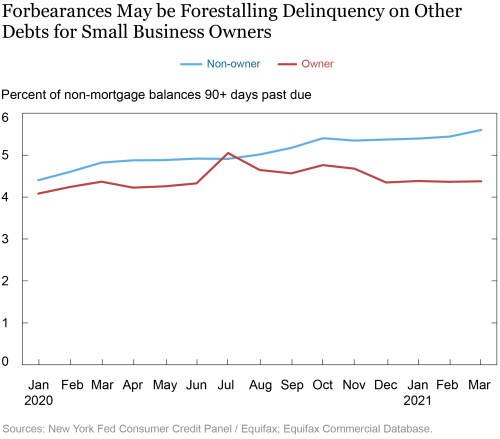

In the final chart below, we show non-mortgage delinquency rates among forbearance participants for both business owners and the general population. We showed the blue line earlier in this series—the non-mortgage delinquency rate for forbearance participants has crept up in the general population. But for business owners, the delinquency rate has remained relatively flat after a brief uptick in July.

Summary

We find evidence consistent with disproportionate financial hardship experienced by business owners. Although the CARES Act provisions were intended to target households, these household-supporting provisions also provided relief for troubled small business owners through the personal credit channel, complementing better known means of small business support like PPP and other business lending programs. Small business owners were more likely to enter forbearance on their personal mortgage, a difference especially pronounced in harder hit industries. Business owners were also more likely to borrow against their home equity during the first phase of the pandemic. These coping strategies have likely helped businesses preserve cash flow and avoid delinquency and bankruptcy for their business and themselves personally. Whether these forbearances are simply forestalling future trouble for strained business owners, or if the post-pandemic economy will support the owners to catch up the lost months remains to be seen.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Andrew F. Haughwout is a senior vice president in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Donghoon Lee is an officer in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is an senior vice president in the Bank’s Research and Statistics Group.

Wilbert van der Klaauw is an senior vice president in the Bank’s Research and Statistics Group.

How to cite this post:

Andrew F. Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Small Business Owners Turn to Personal Credit,” Federal Reserve Bank of New York Liberty Street Economics, May, 19, 2021, https://libertystreeteconomics.newyorkfed.org/2021/05/small-business-owners-turn-to-personal-credit-.html.

Additional Posts in This Series

Keeping Borrowers Current in a Pandemic

What Happens during Mortgage Forbearance?

What’s Next for Forborne Borrowers?

Press Briefing

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics