This post presents an updated estimate of inflation persistence, following the release of personal consumption expenditure (PCE) price data for March 2023. The estimates are obtained by the Multivariate Core Trend (MCT), a model we introduced on Liberty Street Economics last year and covered most recently in a March post. The MCT is a dynamic factor model estimated on monthly data for the seventeen major sectors of the PCE price index. It decomposes each sector’s inflation as the sum of a common trend, a sector-specific trend, a common transitory shock, and a sector-specific transitory shock. The trend in PCE inflation is constructed as the sum of the common and the sector-specific trends weighted by the expenditure shares.

MCT Declined in March

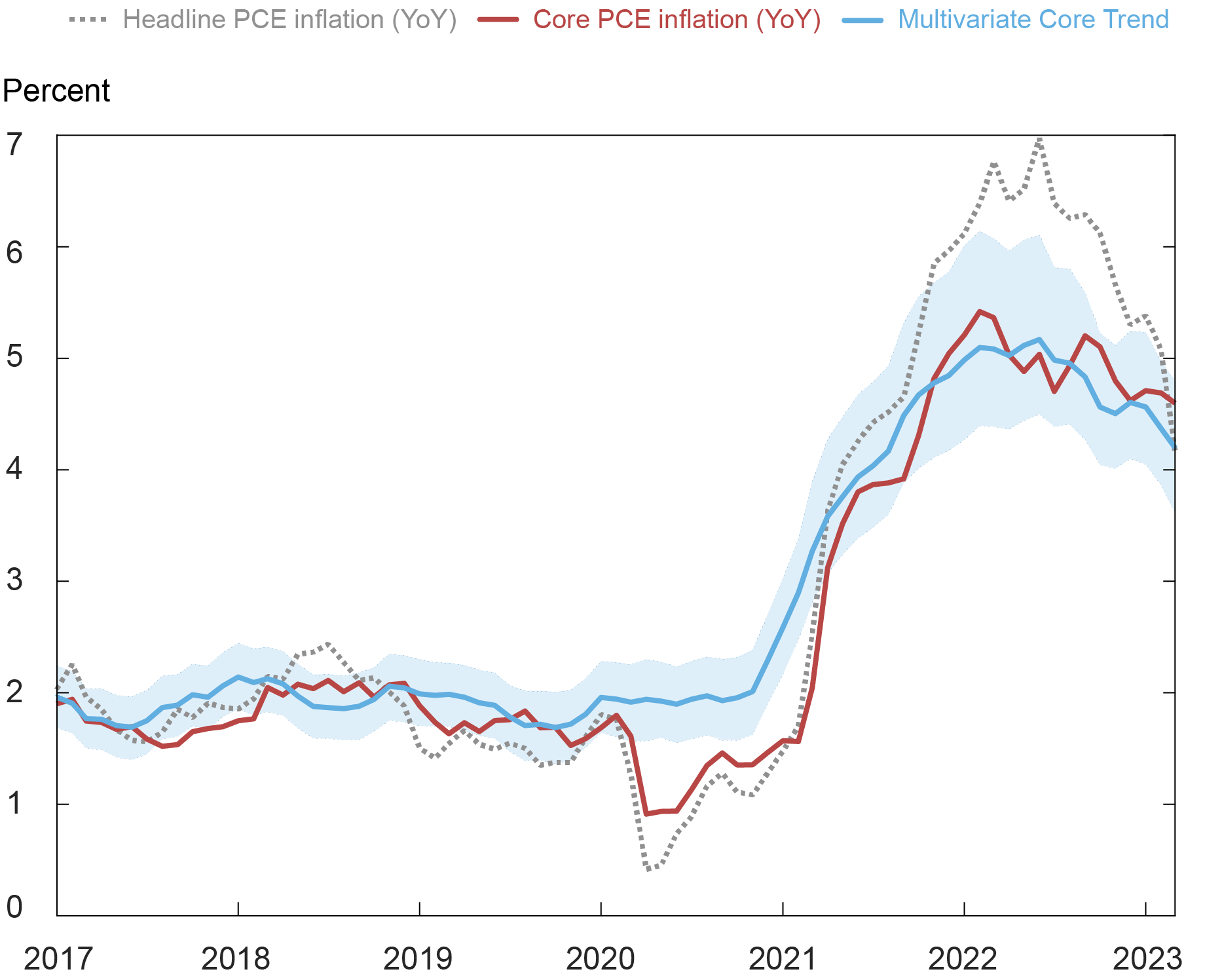

The MCT declined to 4.2 percent in March from 4.4 percent in February (the value for February was itself revised down from 4.5 percent), as illustrated in the chart below. Uncertainty is high as reflected in the 68 percent probability band (shaded area) of (3.6, 4.8) percent. By comparison, the standard twelve-month core PCE measure declined from 4.7 percent in February to 4.6 percent in March following monthly readings of 0.6 percent in January and 0.3 percent in February.

PCE and Multivariate Core Trend

Notes: PCE is personal consumption expenditure. The shaded area is a 68 percent probability band.

According to our latest estimates, the trend as measured by the MCT has held steady at a level below 5 percent since October 2022 after exceeding 5 percent during most of 2022. The sectoral composition shows that the decline in the trend since October 2022 is explained in equal parts by core goods and non-housing services while the decline in housing contributed only slightly to the overall trend.

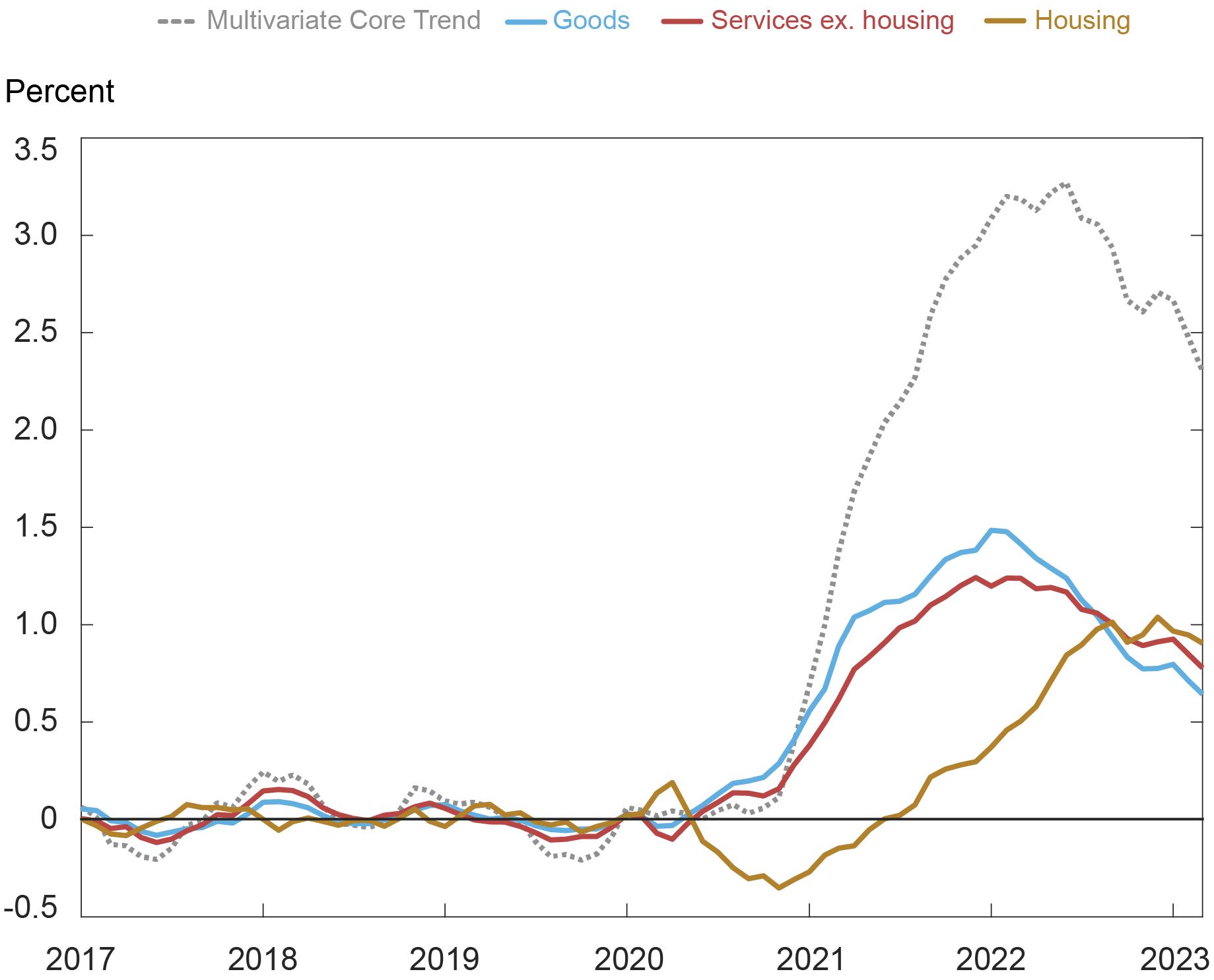

To be more precise about the sectoral details, the trend in housing inflation declined to 8.5 percent in March from the 8.8 percent recorded in February as the data showed monthly housing inflation decreasing to 0.5 percent in March from 0.8 percent on average between July 2022 and February 2023. The trends in goods and services continued to decline over the month. The contribution of housing inflation to the increase in the persistent component of inflation from the onset of the pandemic, at about 0.9 percentage point (ppt), is comparable to the cumulative contribution of services ex-housing (0.8 ppt) and above that of goods (0.6 ppt), as shown in the following chart.

Inflation Trend Decomposition: Sector Aggregates

Note: The base for the calculations of the contributions to the change in the Multivariate Core Trend is the average over the period January 2017-December 2019.

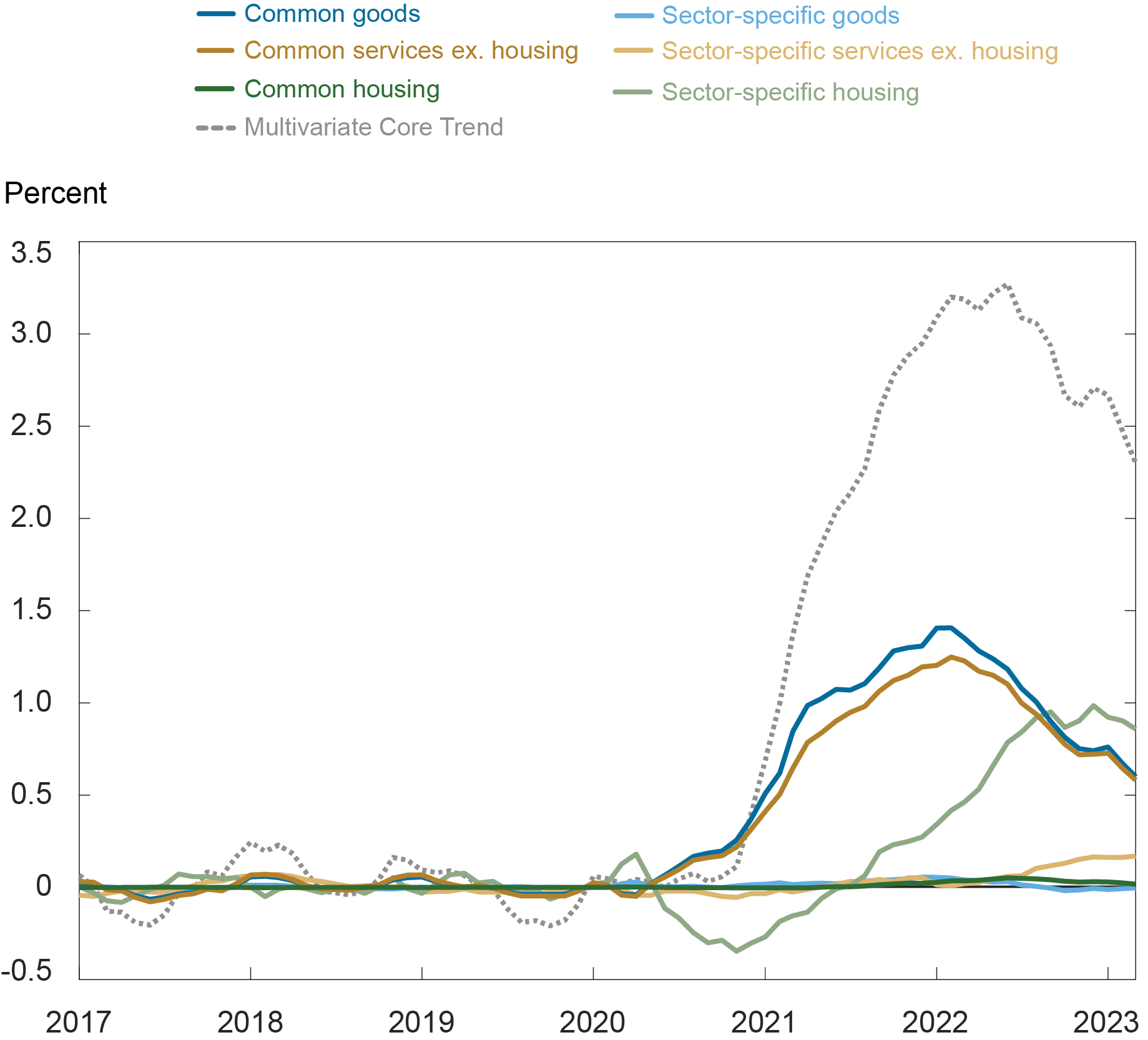

As we documented in our previous posts, an important difference across sectors is the source of the persistence: in the housing sector, the persistence has a strong sector-specific component, while core goods and services ex-housing are dominated by their common component, as seen in the next chart showing a finer decomposition using the MCT model.

Finer Inflation Trend Decomposition

Note: The base for the calculations of the contributions to the change in the Multivariate Core Trend is the average over the period January 2017-December 2019.

We will provide a new update of the MCT and its sectoral insights after the release of April PCE data.

Martín Almuzara is a research economist in Macroeconomic and Monetary Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Babur Kocaoglu is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Argia Sbordone is the head of Macroeconomic and Monetary Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Martin Almuzara, Babur Kocaoglu, and Argia Sbordone, “MCT Update: Inflation Persistence Continued to Decline in March,” Federal Reserve Bank of New York Liberty Street Economics, May 5, 2023, https://libertystreeteconomics.newyorkfed.org/2023/05/mct-update-inflation-persistence-continued-to-decline-in-march/

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics