At the New York Fed: The Appropriate Government Role in U.S. Mortgage Markets

While the U.S. mortgage finance system was at the center of the recent financial crisis, it remains largely untouched by legislative reforms. At the center of these conversations are Fannie Mae and Freddie Mac—both of which were placed into federal conservatorship in September 2008.

Financial Crises and the Desirability of Macroprudential Policy

The global financial crisis has put financial stability risks—and the potential role of macroprudential policies in addressing them—at the forefront of policy debates. The challenge for macroeconomists is to develop new models that are consistent with the data while being able to capture the highly nonlinear nature of crisis episodes. In this post, we evaluate the impact of a macroprudential policy that has the government tilt incentives for banks to encourage them to build up their equity positions. The government has a role since individual banks do not internalize the systemic benefit of having more bank equity. Our model allows for an evaluation of the tradeoff between the size of such incentives and the probability of a future financial crisis

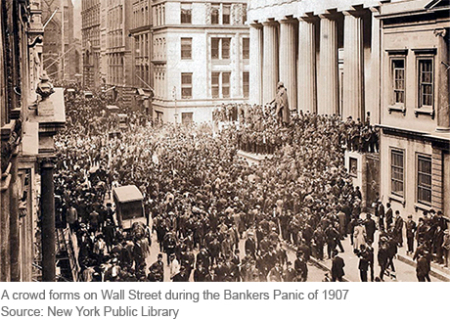

The Final Crisis Chronicle: The Panic of 1907 and the Birth of the Fed

The panic of 1907 was among the most severe we’ve covered in our series and also the most transformative, as it led to the creation of the Federal Reserve System. Also known as the “Knickerbocker Crisis,” the panic of 1907 shares features with the 2007-08 crisis, including “shadow banks” in the form high-flying, less-regulated trusts operating beyond the safety net of the time, and a pivotal “Lehman moment” when Knickerbocker Trust, the second-largest trust in the country, was allowed to fail after J.P. Morgan refused to save it.

Monetary Policy Transmission before and after the Crisis

Banking Deserts, Branch Closings, and Soft Information

U.S. banks have shuttered nearly 5,000 branches since the financial crisis, raising concerns that more low-income and minority neighborhoods may be devolving into “banking deserts” with inadequate, or no, mainstream financial services.

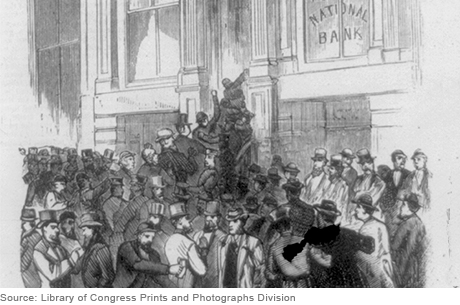

Crisis Chronicles: The Long Depression and the Panic of 1873

It always seemed to come down to railroads in the 1800s. Railroads fueled much of the economic growth in the United States at that time, but they required that a great deal of upfront capital be devoted to risky projects. The panics of 1837 and 1857 can both be pinned on railroad investments that went awry, creating enough doubt about the banking system to cause pervasive bank runs. The fatal spark for the Panic of 1873 was also tied to railroad investments—a major bank financing a railroad venture announced that it would suspend withdrawals. As other banks started failing, consumers and businesses pulled back and America entered what is recorded as the country’s longest depression.

Crisis Chronicles: The Cotton Famine of 1862‑63 and the U.S. One‑Dollar Note

When the U.S. Civil War broke out in 1861, cotton was king. The southern United States produced and exported much of the world’s cotton, England was a major textile producer, and cotton textiles were exported from England around the world.

Evaluating the Rescue of Fannie Mae and Freddie Mac

In September 2008, the U.S. government engineered a dramatic rescue of Fannie Mae and Freddie Mac, placing the two firms into conservatorship and committing billions of taxpayer dollars to stabilize their financial position.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics