Once Upon a Time in the Banking Sector: Historical Insights into Banking Competition

How does competition among banks affect credit growth and real economic growth? In addition, how does it affect financial stability? In this blog post, we derive insights into this important set of questions from novel data on the U.S. banking system during the nineteenth century.

“Skin in the Game,” Depositor Discipline, and Bank Risk Taking

In a previous post, we argued that double liability for bank owners might not limit their risk taking, despite the extra “skin in the game,” if it also weakens depositor discipline of banks. This post, drawing on our recent working paper, looks at the interplay of those opposing forces in the late 1920s when bank liability differed across states. We find that double liability may have reduced the outflow of deposits during the crisis, but wasn’t successful in mitigating bank risk during the boom.

Does More “Skin in the Game” Mitigate Bank Risk‑Taking?

It is widely said that a lack of “skin in the game” would distort lenders’ incentives and cause a moral hazard problem, that is, excessive risk-taking. If so, does more skin in the game—in the form of extended liability—reduce bankers’ risk-taking? In order to examine this question, we investigate historical data prior to the Great Depression, when bank owners’ liability for losses in the event of bank failure differed by state and primary regulator. This post describes our preliminary findings.

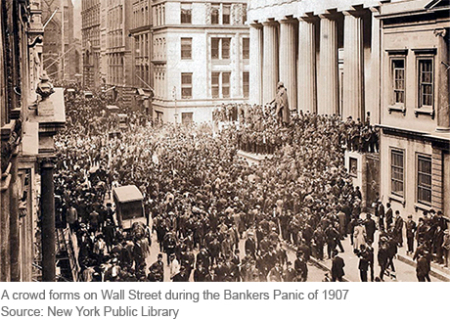

The Final Crisis Chronicle: The Panic of 1907 and the Birth of the Fed

The panic of 1907 was among the most severe we’ve covered in our series and also the most transformative, as it led to the creation of the Federal Reserve System. Also known as the “Knickerbocker Crisis,” the panic of 1907 shares features with the 2007-08 crisis, including “shadow banks” in the form high-flying, less-regulated trusts operating beyond the safety net of the time, and a pivotal “Lehman moment” when Knickerbocker Trust, the second-largest trust in the country, was allowed to fail after J.P. Morgan refused to save it.

Hey, Economist! Why—and When—Did the Treasury Embrace Regular and Predictable Issuance?

Few people know the Treasury market from as many angles as Ken Garbade, a senior vice president in the Money and Payments Studies area of the New York Fed’s Research Group. Ken taught financial markets at NYU’s graduate school of business for many years before heading to Wall Street to assume a position in the research department of the primary dealer division of Bankers Trust Company. At Bankers, Ken conducted relative-value research on the Treasury market, assessing how return varies relative to risk for particular Treasury securities. For a time, he also traded single-payment Treasury obligations known as STRIPS—although not especially successfully, he notes.

Did Third Avenue’s Liquidation Reduce Corporate Bond Market Liquidity?

Tobias Adrian, Michael J. Fleming, Erik Vogt, and Zachary Wojtowicz The announced liquidation of Third Avenue’s high-yield Focused Credit Fund (FCF) on December 9, 2015, drew widespread attention and reportedly sent ripples through asset markets. Events of this kind have the potential to increase the demand for market liquidity, as investors revise expectations, reassess risk […]

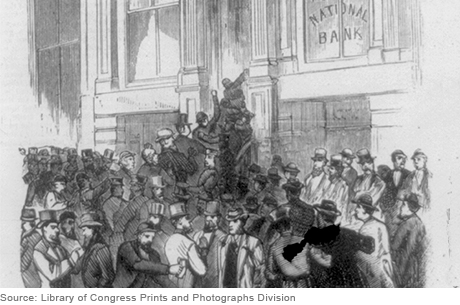

Crisis Chronicles: The Long Depression and the Panic of 1873

It always seemed to come down to railroads in the 1800s. Railroads fueled much of the economic growth in the United States at that time, but they required that a great deal of upfront capital be devoted to risky projects. The panics of 1837 and 1857 can both be pinned on railroad investments that went awry, creating enough doubt about the banking system to cause pervasive bank runs. The fatal spark for the Panic of 1873 was also tied to railroad investments—a major bank financing a railroad venture announced that it would suspend withdrawals. As other banks started failing, consumers and businesses pulled back and America entered what is recorded as the country’s longest depression.

Crisis Chronicles: The Cotton Famine of 1862‑63 and the U.S. One‑Dollar Note

When the U.S. Civil War broke out in 1861, cotton was king. The southern United States produced and exported much of the world’s cotton, England was a major textile producer, and cotton textiles were exported from England around the world.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics