Will the Moderation in Wage Growth Continue?

Wage growth has moderated notably following its post-pandemic surge, but it remains strong compared to the wage growth prevailing during the low-inflation pre-COVID years. Will the moderation continue, or will it stall? And what does it say about the current state of the labor market? In this post, we use our own measure of wage growth persistence – called Trend Wage Inflation (TWIn in short) – to look at these questions. Our main finding is that, after a rapid decline from 7 percent at its peak in late 2021 to around 5 percent in early 2023, TWin has changed little in recent months, indicating that the moderation in nominal wage growth may have stalled. We also show that our measure of trend wage inflation and labor market tightness comove very closely. Hence, the recent behavior of TWIn is consistent with a still-tight labor market.

Expectations and the Final Mile of Disinflation

In the aftermath of the COVID-19 pandemic, the U.S. economy experienced a swift recovery accompanied by a sharp rise in inflation. Inflation has been gradually declining since 2022 without a notable slowdown in the labor market. Nonetheless, inflation remains above the Federal Reserve’s 2 percent target and the path of the so-called final mile remains uncertain, as emphasized by Chair Powell during his press conference in January. In this post, we examine the unemployment-inflation trade-off over the past few years through the lens of a New Keynesian Phillips curve, based on our recent paper. We also provide model-based forecasts for 2024 and 2025 under various labor market scenarios.

Global Supply Chains and U.S. Import Price Inflation

Inflation around the world increased dramatically with the reopening of economies following COVID-19. After reaching a peak of 11 percent in the second quarter of 2021, world trade prices dropped by more than five percentage points by the middle of 2023. U.S. import prices followed a similar pattern, albeit with a lower peak and a deeper trough. In a new study, we investigate what drove these price movements by using information on the prices charged for products shipped from fifty-two exporters to fifty-two importers, comprising more than twenty-five million trade flows. We uncover several patterns in the data: (i) From 2021:Q1 to 2022:Q2, almost all of the growth in U.S. import prices can be attributed to global factors, that is, trends present in most countries; (ii) at the end of 2022, U.S. import price inflation started to be driven by U.S. demand factors; (iii) in 2023, foreign suppliers to the U.S. market caught up with demand and account for the decline in import price inflation, with a significant role played by China.

Businesses See Inflationary Pressures Moderating

Shortly after the recovery from the pandemic recession began, the U.S. economy entered a period of high inflation as surging demand, severe supply disruptions, and worker shortages combined to create large imbalances and inflationary pressures in the economy. More recently, however, inflationary pressures have been moderating. Indeed, the inflation rate as measured by the consumer price index (CPI) has come down from its recent peak of 9.1 percent in the summer of 2022 to 3.1 percent at the start of 2024. Have inflationary pressures also moderated for local businesses in the New York–Northern New Jersey region? The New York Fed’s February business surveys asked firms about increases in their costs and prices. Results indicate that the pace of increase in costs, wages, and prices have all slowed considerably over the past year. Moreover, firms in the region expect cost and price increases, as well as the overall inflation rate, to moderate further in the year ahead.

Auto Loan Delinquency Revs Up as Car Prices Stress Budgets

The New York Fed’s Center for Microeconomic Data released the Quarterly Report on Household Debt and Credit for the fourth quarter of 2023 this morning. Household debt balances grew by $212 billion over the last quarter. Although there was growth across most loan types, it was moderate compared to the fourth-quarter changes seen in the past few years. Mortgage balances grew by $112 billion and home equity line of credit (HELOC) balances saw an $11 billion bump as borrowers tapped home equity in lieu of refinancing first mortgages. Credit card balances, which typically see substantial increases in the fourth quarter coinciding with holiday spending, grew by $50 billion, and are now 14.5 percent higher than in the fourth quarter of 2022. Auto loan balances saw a $12 billion increase from the previous quarter, continuing the steady growth that has been in place since 2011. In this post, we revisit our analysis on credit cards and examine which groups are struggling with their auto loan payments. The Quarterly Report and this analysis are based on the New York Fed Consumer Credit Panel (CCP), a panel which is drawn from Equifax credit reports.

Measuring Price Inflation and Growth in Economic Well‑Being with Income‑Dependent Preferences

How can we accurately measure changes in living standards over time in the presence of price inflation? In this post, I discuss a novel and simple methodology that uses the cross-sectional relationship between income and household-level inflation to construct accurate measures of changes in living standards that account for the dependence of consumption preferences on income. Applying this method to data from the U.S. suggests potentially substantial mismeasurements in our available proxies of average growth in consumer welfare in the U.S.

How Large Are Inflation Revisions? The Difficulty of Monitoring Prices in Real Time

With prices quickly going up after the COVID-19 pandemic, inflation releases have rarely been as present in the public debate as in recent years. However, since inflation estimates are frequently revised, how precise are the real-time data releases? In this Liberty Street Economics post, we investigate the size and nature of revisions to inflation. We find that inflation estimates for a given month can change substantially as subsequent data vintages are released. As an example, consider March 2009. With the economy contracting amid the Global Financial Crisis, the twelve-month inflation rate for personal consumption expenditures (PCE) excluding food and energy dropped from an initial estimate of 1.8 percent to 0.8 percent in the current series. The difference is dramatic and points to the difficulty of monitoring inflation in real time. Our results suggest that there is significant uncertainty in measuring inflation, and the key features of the recent spike and subsequent moderation of inflation may look quite different in hindsight once further revisions have taken place.

Consumers’ Perspectives on the Recent Movements in Inflation

Editors Note: The title of this post has been changed from the original. August 17, 2023, 10:35 a.m.

Inflation in the U.S. has experienced unusually large movements in the last few years, starting with a steep rise between the spring of 2021 and June 2022, followed by a relatively rapid decline over the past twelve months. This marks a stark departure from an extended period of low and stable inflation. Economists and policymakers have expressed differing views about which factors contributed to these large movements (as reported in the media here, here, here, and here), leading to fierce debates in policy circles, academic journals, and the press. We know little, however, about the consumer’s perspective on what caused these sudden movements in inflation. In this post, we explore this question using a special module of the Federal Reserve Bank of New York’s Survey of Consumer Expectations (SCE) in which consumers were asked what they think contributed to the recent movements in inflation. We find that consumers think supply-side issues were the most important factor behind the 2021-22 inflation surge, while they regard Federal Reserve policies as the most important factor behind the recent and expected future decline in inflation.

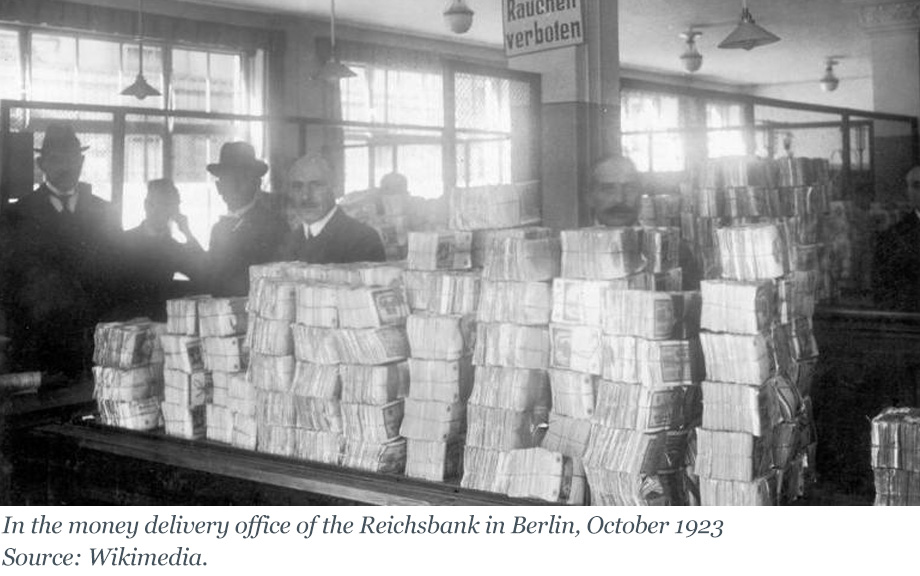

Inflating Away the Debt: The Debt‑Inflation Channel of German Hyperinflation

The recent rise in price pressures around the world has reignited interest in understanding how inflation transmits to the real economy. Economists have long recognized that unexpected surges of inflation can redistribute wealth from creditors to debtors when debt contracts are written in nominal terms (see, for example, Fisher 1933). If debtors are financially constrained, this redistribution can affect real economic activity by relaxing financing constraints. This mechanism, which we call the debt-inflation channel, is well understood theoretically (for example, Gomes, Jermann, and Schmid 2016), but there is limited empirical evidence to substantiate it. In this post, we discuss new insights from one of the key events in monetary history: the Great German Inflation of 1919-23. Because this case of inflation was both surprising and extremely high, Germany’s experience helps shed light on how high inflation impacts firms’ economic activity through the erosion of their nominal debt burdens. These insights are based on a recently released research paper.

Where Is Inflation Persistence Coming From?

Elevated inflation continues to be a top-of-mind preoccupation for households, businesses, and policymakers. Why has the post-pandemic inflation proved so persistent? In a Liberty Street Economics post early in 2022, we introduced a measure designed to dissect the buildup of the inflationary pressures that emerged in mid-2021 and to understand where the sources of its persistence are. This measure, that we labeled Multivariate Core Trend (MCT) inflation analyzes whether inflation is short-lived or persistent, and whether it is concentrated in particular economic sectors or broad-based.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics