The Dollar’s Imperial Circle

The importance of the U.S. dollar in the context of the international monetary system has been examined and studied extensively. In this post, we argue that the dollar is not only the dominant global currency but also a key variable affecting global economic conditions. We describe the mechanism through which the dollar acts as a procyclical force, generating what we dub the “Dollar’s Imperial Circle,” where swings in the dollar govern global macro developments.

How Much Can GSCPI Improvements Help Reduce Inflation?

Inflationary pressures—their determinants and evolution—continue to dominate policy discussions. In this post, we provide a simple framework to analyze the determinants of different measures of inflation and use it to lay out a risk-scenario analysis. We find that global supply factors captured by the New York Fed’s Global Supply Chain Pressure Index (GSCPI) are strongly associated with inflationary developments measured by the producer price index (PPI) and by the c0nsumer price index (CPI). Under the assumption that the GSCPI falls back to its historical average over twelve months, our model would project a substantial easing of consumer price inflation over 2023 to below 4.0 percent. The normalization of the GSCPI would then be consistent with a return of inflation to levels consistent with a soft-landing scenario.

How Have Swings in Demand Affected Global Supply Chain Pressures?

In a January 2022 post, we first presented the Global Supply Chain Pressure Index (GSCPI), a parsimonious global measure designed to capture supply chain disruptions using a range of indicators. The spirit of our index was to isolate supply factors, such as shutdowns in response to the pandemic, that put pressure on the global supply chain. In this post, we describe an auxiliary index, the Net GSCPI, which differs from the GSCPI by not filtering out demand factors. This “net” index is meant to capture global supply chain stress from both the supply and demand sides. Our analysis documents that the net index is currently below its historical average, unlike the original index, due to both the easing of supply constraints and a contraction in global demand.

How Much Can the Fed’s Tightening Contract Global Economic Activity?

What types of foreign firms are most affected when the Federal Reserve raises its policy rate? Recent empirical research used cross-country firm level data and information on input-output linkages and finds that the impact on sales and investment spending is largest in sectors with exposure to trade in intermediate goods. The research also finds that financial factors drive differences, with U.S. monetary policy spillovers having a much smaller impact on firms that are less financially constrained.

Global Supply Chain Pressure Index: The China Factor

In a January 2022 post, we first presented the Global Supply Chain Pressure Index (GSCPI), a parsimonious global measure designed to capture supply chain disruptions using a range of indicators. In this post, we review GSCPI readings through December 2022, and then briefly discuss the drivers of recent moves in the index. While supply chain disruptions have significantly diminished over the course of 2022, the reversion of the index toward a normal historical range has paused over the past three months. Our analysis attributes the recent pause largely to the pandemic in China amid an easing of “Zero COVID” policies.

Supply Chains, Student Debt, and Stablecoins—The Top 5 Liberty Street Economics Posts of 2022

“Kitchen table” issues were on the minds of our readers in 2022, though what was labeled as such was perhaps a bit broader than in the past. Supply chains—now firmly placed on the radar of Main Street—were the subject of the year’s top post by number of page views and accounted for three of the top five (we’ll consider them as one for this roundup). Student debt forgiveness and inflation were also in the news, drawing readers to our preview of various possibilities for the (subsequently announced) federal student loan forgiveness program and a quarterly update of a New York Fed economic forecast model. Posts on more technical topics were popular as well, including an update on the Federal Reserve’s balance sheet “runoff” and a discussion of stablecoins. Underscoring their broad appeal, the year’s top two posts rank among the top five in the history of Liberty Street, which dates back to 2011. Read on to see which posts resonated most with readers.

Highlights from the Fifth Bi‑annual Global Research Forum on International Macroeconomics and Finance

The COVID-19 pandemic, geopolitical tensions, and distinct economic conditions bring challenges to economies worldwide. These key themes provided a backdrop for the fifth bi-annual Global Research Forum on International Macroeconomics and Finance, organized by the European Central Bank (ECB), the Federal Reserve Board, and Federal Reserve Bank of New York in New York in November. The papers and discussions framed important issues related to the global economy and financial markets, and explored the implications of policies that central banks and other official sector bodies take to address geopolitical developments and conditions affecting growth, inflation, and financial stability. A distinguished panel of experts shared diverse perspectives on the drivers of and prospects for inflation from a global perspective. In this post, we discuss highlights of the conference. The event page includes links to videos for each session.

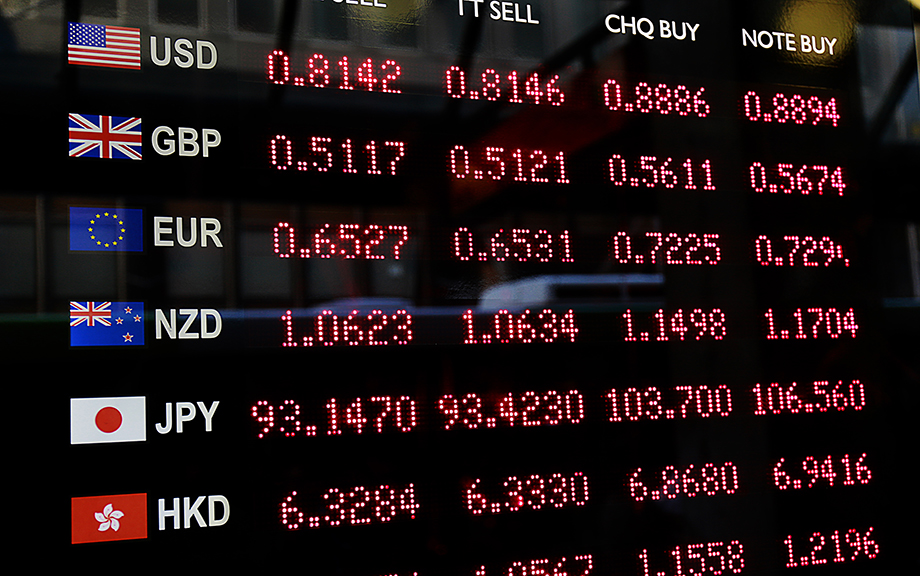

Do Exchange Rates Fully Reflect Currency Pressures?

Currency values are important both for the real economy and the financial sector. When faced with currency market pressures, some central banks and finance ministries turn to foreign exchange intervention (FXI) in an effort to reduce realized currency depreciation, thus diminishing its economic and financial consequences. This post provides insights into how effective these interventions might be in limiting currency depreciation.

A Closer Look at Chinese Overseas Lending

While considerable attention has focused on China’s credit boom and the rise of China’s domestic debt levels, another important development in international finance has been growth in China’s lending abroad. In this post, we summarize what is known about the size and scope of China’s external lending, discuss the incentives that drove this lending, and consider some of the challenges these exposures pose for Chinese lenders and foreign borrowers.

Is China Running Out of Policy Space to Navigate Future Economic Challenges?

After making progress slowing the pace of debt accumulation prior to the pandemic, China saw its debt levels surge in 2020 as the government responded to the severe economic slowdown with credit-led stimulus. With China currently in the midst of another sharp decline in economic activity due to its property slump and zero-COVID strategy, Chinese authorities have responded again by pushing out credit to soften the downturn despite already high levels of debt on corporate, household, and government balance sheets. In this post, we revisit China’s debt buildup and consider the growing constraints on Chinese policymakers’ tools to navigate future economic challenges.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics