Job Seekers’ Beliefs and the Causes of Long‑Term Unemployment

In addition to its terrible human toll, the COVID-19 pandemic has also caused massive disruption in labor markets. In the United States alone, more than 25 million people lost their jobs during the first wave of the pandemic. While many have returned to work since then, a large number have remained unemployed for a prolonged period of time. The number of long-term unemployed (defined as those jobless for twenty-seven weeks or longer) has surged from 1.1 million to almost 4 million. An important concern is that the long-term unemployed face worse employment prospects, but prior work has provided no consensus on what drives this decline in employment prospects. This post discusses new findings using data on elicited beliefs of unemployed job seekers to uncover the forces driving long-term unemployment.

The Regional Economy during the Pandemic

The New York-Northern New Jersey region experienced an unprecedented downturn earlier this year, one more severe than that of the nation, and the region is still struggling to make up the ground that was lost. That is the key takeaway at an economic press briefing held today by the New York Fed examining economic conditions during the pandemic in the Federal Reserve’s Second District. Despite the substantial recovery so far, business activity, consumer spending, and employment are all still well below pre-pandemic levels in much of the region, and fiscal pressures are mounting for state and local governments. Importantly, job losses among lower-income workers and people of color have been particularly consequential. The pace of recovery was already slowing in the region before the most recent surge in coronavirus cases, and we are now seeing signs of renewed weakening as we enter the winter.

Delaying College During the Pandemic Can Be Costly

Many students are reconsidering their decision to go to college in the fall due to the coronavirus pandemic. Indeed, college enrollment is expected to be down sharply as a growing number of would-be college students consider taking a gap year. In part, this pullback reflects concerns about health and safety if colleges resume in-person classes, or missing out on the “college experience” if classes are held online. In addition, poor labor market prospects due to staggeringly high unemployment may be leading some to conclude that college is no longer worth it in this economic environment. In this post, we provide an economic perspective on going to college during the pandemic. Perhaps surprisingly, we find that the return to college actually increases, largely because the opportunity cost of attending school has declined. Furthermore, we show there are sizeable hidden costs to delaying college that erode the value of a college degree, even in the current economic environment. In fact, we estimate that taking a gap year reduces the return to college by a quarter and can cost tens of thousands of dollars in lost lifetime earnings.

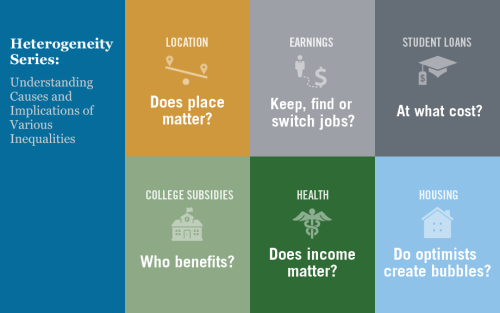

Introduction to Heterogeneity Series: Understanding Causes and Implications of Various Inequalities

Economic analysis is often geared toward understanding the average effects of a given policy or program. Likewise, economic policies frequently target the average person or firm. While averages are undoubtedly useful reference points for researchers and policymakers, they don’t tell the whole story: it is vital to understand how the effects of economic trends and government policies vary across geographic, demographic, and socioeconomic boundaries. It is also important to assess the underlying causes of the various inequalities we observe around us, be they related to income, health, or any other set of indicators. Starting today, we are running a series of six blog posts (apart from this introductory post), each of which focuses on an interesting case of heterogeneity in the United States today.

Just Released: Transitions to Unemployment Tick Up in Latest SCE Labor Market Survey

The Federal Reserve Bank of New York’s July 2019 SCE Labor Market Survey shows a year-over-year rise in employer-to-employer transitions as well as an increase in transitions into unemployment. Satisfaction with promotion opportunities and wage compensation were largely unchanged, while satisfaction with non-wage benefits retreated. Regarding expectations, the average expected wage offer (conditional on receiving one) and the average reservation wage—the lowest wage at which respondents would be willing to accept a new job—both increased. Expectations regarding job transitions were largely stable.

Just Released: Labor Markets in the Region Are Exceptionally Tight

At today’s economic press briefing, we examined labor market conditions across our District, which includes New York State, Northern New Jersey, and Fairfield County, Connecticut, as well as Puerto Rico and the U.S. Virgin Islands. As the island economies continue to recover and rebuild from the destruction caused by last year’s hurricanes, employment has edged up in Puerto Rico and stabilized in the U.S. Virgin Islands. Meanwhile, as has been true throughout the expansion, New York City remains an engine of job growth, while employment gains have been more moderate in Northern New Jersey and fairly sluggish across most of upstate New York. Nonetheless, it has become more difficult for firms to find workers throughout the New York-Northern New Jersey region. It may not be terribly surprising that labor markets have tightened in and around New York City, where job growth has been strong, but labor markets have also tightened in parts of upstate New York, even in places where there has been little or no job growth. This is because labor markets are tightening as a result of changes in both labor demand and labor supply. In upstate New York, a decline in the labor force has reduced the pool of available workers.

Just Released: Are Employer‑to‑Employer Transitions Yielding Wage Growth? It Depends on the Worker’s Level of Education

The rate of employer-to-employer transitions and the average wage of full-time offers rose compared with a year ago, according to the Federal Reserve Bank of New York’s July 2018 SCE Labor Market Survey. Workers’ satisfaction with their promotion opportunities improved since July 2017, while their satisfaction with wage compensation retreated slightly. Regarding expectations, the average expected wage offer (conditional on receiving one) and the reservation wage—the lowest wage at which respondents would be willing to accept a new job—both increased. The expected likelihood of moving into unemployment over the next four months showed a small uptick, which was most pronounced for female respondents.

Just Released: Economic Press Briefing Focuses on Regional Wage Inequality

The New York-Northern New Jersey region is home to some of the most and least unequal places in the nation, based on research presented today at our economic press briefing examining wage inequality in the region. Wage inequality—meaning the disparity in earnings between workers—has increased significantly in the United States since the early 1980s, though some places have much more wage inequality than others. Fairfield, Conn., for example, ranks as the most unequal metropolitan area in the country, and the New York–Northern New Jersey metropolitan area ranks in the top ten. On the other hand, most of the metropolitan areas in upstate New York are among the least unequal places in the country.

Hey, Economist! Is Now a Good Time to Be Graduating from College?

A Conversation with Jaison R. Abel and Richard Deitz With the 2017 college graduation season in full swing, we thought it would be helpful to take stock of the job prospects for recent college graduates. Is now a good time to be graduating from college? Publications editor Trevor Delaney caught up with Jaison Abel and […]

What Caused the Decline in Interstate Migration in the United States?

Geographic mobility is thought to be important both for economic mobility and for the efficiency of a labor market in allocating the right people to the right jobs. Accordingly, the willingness of the U.S. workforce to move is a factor behind the greater dynamism of the U.S. labor market compared to Europe. While Europeans tend to be more reluctant to move to distant places within their respective countries, the idea of moving across state borders for a job has been woven into the fabric of the American Dream. However, the image of the United States as a mobile nation has changed substantially over recent decades. This post investigates the role that demographic shifts—in particular, the nation’s aging population—have played in the recent decline in interstate migration.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics